Time Value of Money

advertisement

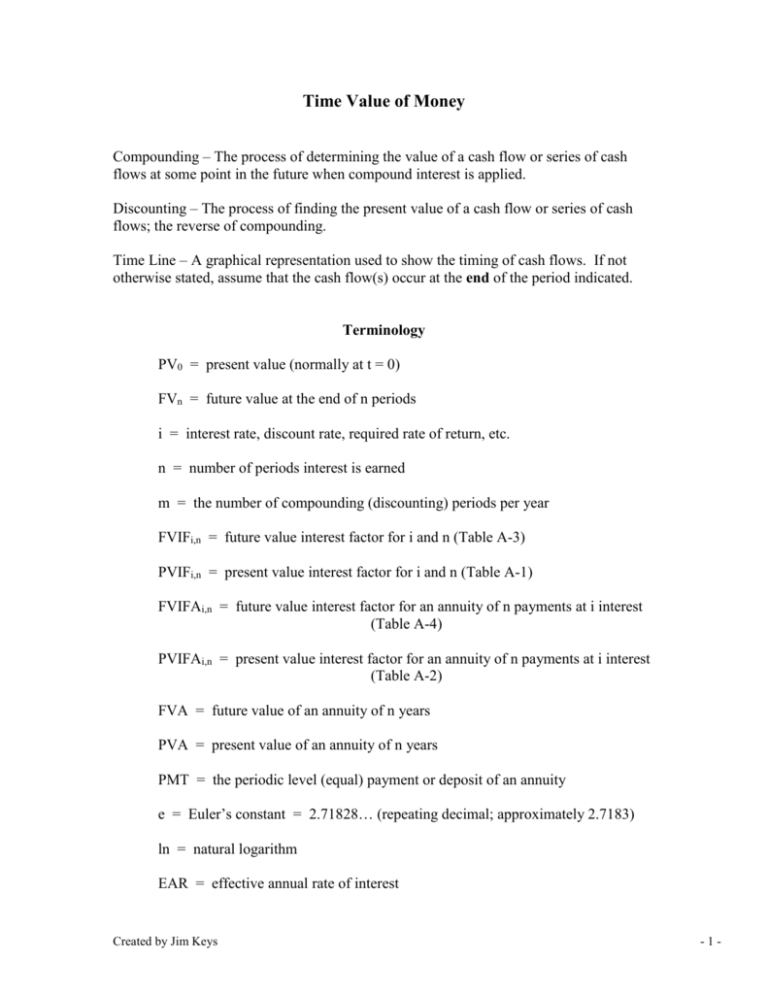

Time Value of Money Compounding – The process of determining the value of a cash flow or series of cash flows at some point in the future when compound interest is applied. Discounting – The process of finding the present value of a cash flow or series of cash flows; the reverse of compounding. Time Line – A graphical representation used to show the timing of cash flows. If not otherwise stated, assume that the cash flow(s) occur at the end of the period indicated. Terminology PV0 = present value (normally at t = 0) FVn = future value at the end of n periods i = interest rate, discount rate, required rate of return, etc. n = number of periods interest is earned m = the number of compounding (discounting) periods per year FVIFi,n = future value interest factor for i and n (Table A-3) PVIFi,n = present value interest factor for i and n (Table A-1) FVIFAi,n = future value interest factor for an annuity of n payments at i interest (Table A-4) PVIFAi,n = present value interest factor for an annuity of n payments at i interest (Table A-2) FVA = future value of an annuity of n years PVA = present value of an annuity of n years PMT = the periodic level (equal) payment or deposit of an annuity e = Euler’s constant = 2.71828… (repeating decimal; approximately 2.7183) ln = natural logarithm EAR = effective annual rate of interest Created by Jim Keys -1- Solving for the Future Value and Present Value of Lump Sums Future value of a lump sum (annual compounding) equation 1(a) on formula sheet Future value of a lump sum (non-annual compounding) equation 1(b) on formula sheet Future value of a lump sum (continuous compounding) equation 1(c) on formula sheet Present value of a lump sum (annual discounting) equation 2(a) on formula sheet Present value of a lump sum (non-annual discounting) equation 2(b) on formula sheet Present value of a lump sum (continuous discounting) equation 2(c) on formula sheet Created by Jim Keys -2- Solving for Time and Interest Rates in Lump Sum Situations Solving for n (annual compounding) equation 7(a) on formula sheet Solving for n (non-annual compounding) equation 7(b) on formula sheet Solving for i (annual compounding) equation 8(a) on formula sheet Solving for i (non-annual compounding) equation 8(b) on formula sheet Future Value of an Annuity Future value of an annuity (annual payments or deposits) equation 3(a) on formula sheet Future value of an annuity (non-annual payments or deposits) equation 3(b) on formula sheet Created by Jim Keys -3- Present Value of an Annuity Present value of an annuity (annual payments or deposits) equation 4(a) on formula sheet Present value of an annuity (non-annual payments or deposits) equation 4(b) on formula sheet Solving for Time and Interest Rates in Annuities Use Tables A-2 and A-4 to estimate the unknown variable. Financial calculator is required to obtain exact answers. Solving for the Payment in Annuities Solve equations 3 and 4 on the formula sheet for the PMT. Perpetuities A series of equal payments/deposits occurring at equal intervals that continue forever It only makes sense to find the present value of a perpetuity Preferred stocks are valued as perpetuities Uneven Cash Flow Streams Find future value and present value of uneven cash flow streams Embedded annuities Combine annuity and lump sum calculations FVA formula gives us the future value of the annuity as of the last period’s payment PVA formula gives us the present value of the annuity one period before first payment Created by Jim Keys -4- Solving for i with Uneven Cash Flow Streams Trial and error procedure or financial calculator (IRR function) Effective Annual Rate (EAR) Considers the compounding of interest equation 5 on formula sheet Amortized Loans A loan which is repaid in equal installments over its life The payment is determined by using the PVA formula and solving for the payment In an amortized loan, the periodic payment remains the same, the amount of interest declines, and the amount of each payment that is applied to principle increases as the loan approaches maturity PROBLEMS (answers on pages 12-13) 1. Compute the future value of $1,580 if the appropriate rate is 5.4% and you invest the money for four years? What is the future value if you invest for eight years? 2. Your uncle plans to buy a piano and can afford to set aside $1,930 toward the purchase today. If the annual interest rate is 14.8%, how much can he spend in four years on the purchase? If the interest rate is 7.4%, how much can he spend? Created by Jim Keys -5- 3. You plan to buy a lawn tractor and can afford to set aside $1,470 toward the purchase today. If the annual interest rate is 5.5% compounded every quarter, how much can you spend in two and half years on the purchase? If you invest for five years, how much can you spend? 4. Joe plans to buy an antique lamp set and can afford to set aside $980 toward the purchase today. If the annual interest rate is 11.7% compounded every week, how much can Joe spend in half a year on the purchase? How much can he spend if the interest rate is compounded daily? 5. You deposit $10,000 in a five-year Certificate of Deposit that offers a 6.5% rate of interest compounded continuously. What will your CD be worth at maturity? 6. If the discount rate is 14.1%, find the present value of $1,768 received after three years. What is the present value if the cash flow is ten years in the future? 7. Compute the present value of $895 received after one and a half years if the appropriate annual rate is 12.7% compounded every week. What is the present value if the interest rate is compounded daily? Created by Jim Keys -6- 8. Mr. Jones proposes to invest $1,880 today and expects to accumulate $2,537 in three years. What is the underlying rate of return on the investment? What is the return if it takes five years to accumulate $2,537? 9. Calculate the compound annual rate of return if an investment of $1,380 compounded every quarter yields $1,858 after four years. What is the rate of return if the investment is compounded monthly? 10. Some companies offer "single premium" policies. One company advertises that if you give them $60,000 today, they will pay you $1,000,000 in 35 years. What rate of return is this company offering? 11. How long does it take to double your money if you can earn 15% per year? How long will it take for $2,000 to grow to $50,000 at an interest rate of 11% per year? 12. How long does it take to double your money if you can earn 15% per year if the interest rate is compounded quarterly? How long will it take for $2,000 to grow to $50,000 at an interest rate of 11% per year if the interest rate is compounded monthly? Created by Jim Keys -7- 13. If the interest rate is 9.6%, find the future value of $12,000 invested every year for 15 years with the first payment made one year from now. What is the future value of $2,000 invested every year for 40 years if the interest rate is 10%? 14. What is the future value of $1,060 invested every month for the next 20 years starting one month from now at 9.2%? How much would you accumulate in your retirement account after 40 years if you deposited $500 each quarter in a mutual fund earning a 10% rate of return? 15. You have just won the lottery and will receive an annual payment of $150,000 every year for the next 20 years starting one year from today. If the annual interest rate is 6.65%, what is the present value of your winnings? If the annual interest rate is 7.50%, what is the present value of your winnings? 16. What is the present value of an annuity of $880 invested every month for the next 19 years starting one month from now at 11.4% compounded monthly? You have just won the lottery and will receive quarterly payments of $37,500 for the next 20 years. If the annual interest rate is 6.65%, what is the present value of your winnings? Created by Jim Keys -8- 17. If you repay a 15-year, $85,000 loan by making payments of $10,000 every year, what is the interest rate on the loan? If the interest rate on the loan is 12%, how long would it take you to repay the loan if the payments remain the same? 18. What payment made every year starting one year from now would be required to repay a $78,218 loan in 20 years if the interest rate is 9.7%? What payment would be required if the interest rate were 7.5%? 19. Wally has just bought a house by taking a 30-year, $127,500 mortgage from the bank. The interest rate is 8.25%. The mortgage is to be retired by payments made every month starting next month. How much does Wally have to pay each month to repay the mortgage? What would the monthly payments be if Wally opts for a 15-year mortgage at the same interest rate? 20. If the discount rate were 12.0%, what would you be willing to pay to receive a payment of $588 every year forever starting one year from now? What would you be willing to pay if the payments did not begin until five years from now? 21. Year 1 2 3 4 5 6 7 8 9 10 Cash Stream 1 $ 500 700 700 700 700 900 0 0 0 0 Created by Jim Keys Cash Stream 2 $ 0 0 0 800 600 600 600 600 600 400 Cash Stream 3 $ 300 300 300 300 300 400 400 400 400 400 -9- What is the present value of each cash flow stream at time zero if the appropriate interest rate is 8%? 10%? What is the future value of each cash flow stream at the end of year ten if the appropriate interest rate is 6%? 15%? What is the future value of each cash flow stream at the end of year fifteen if the appropriate interest rate is 5%? 12%? 22. You are considering a one-year CD for your tuition money and have surveyed three local banks. If you wish to maximize your yield (EAR), in which of the following banks would you open up a CD? BANK A B C Created by Jim Keys QUOTED RATE 6.05% 6.00% 5.95% COMPOUNDING METHOD Monthly Daily Continuously EAR - 10 - 23. Create an amortization schedule for the following loan: Amount Borrowed: Interest Rate: Payment Frequency: Loan Term: $25,000 8% Yearly 5 years (Hint: Determine the yearly payment by using the PVA formula and solving for the payment) Year Beginning Balance Payment Interest Repayment of Principal Ending Balance 1 2 3 4 5 24. If you save $2,000 per year for 40 years in a mutual fund that earns a rate of 11%, how much will you have in your retirement fund? If you earn 10%, what will your investment be worth after 40 years? 25. Reconsider problem #24, assuming that you invest for only 30 years instead of 40. Created by Jim Keys - 11 - ANSWERS TO PROBLEMS 1) $1,949.93; $2,406.48 2) $3,352.16; $2,567.88 3) $1,685.10; $1,931.68 4) $1,038.97; $1,039.03 5) $13,840.31 6) $1,190.21; $472.74 7) $739.93; $739.78 8) 10.5064%; 6.1775% 9) 7.505%; 7.4585% 10) 8.3702% 11) 4.9595 years; 30.844 years 12) 4.7071 years; 29.3964 years 13) $369,388.46; $885,185.11 14) $726,216.19; $1,019,557.36 15) $1,633,263.70; $1,529,173.70 16) $81,903.61; $1,652,514.85 17) 8.1144%; The loan would never be repaid since the interest exceeds the payment. 18) $9,000.05; $7,672.58 19) $957.86; $1,236.93 20) $4,900.00; $3,114.04 Created by Jim Keys - 12 - 21) Cash Stream 1: $3,176.86; $2,979.76 $6,078.92; $10,363.47 $7,300.68; $15,330.03 Cash Stream 2: $2,534.16; $2,254.12 $5,120.01; $6,902.69 $6,321.71; $11,011.41 Cash Stream 3: $2,284.76; $2,078.75 $4,517.95; $6,765.35 $5,521.11; $10,397.65 22) Bank A: 6.2206% Bank B: 6.1831% Bank C: 6.1306% 23) Year Beginning Balance Payment 1 2 3 4 5 $25,000.00 20,738.59 16,136.27 11,165.76 5,797.61 Totals Interest Repayment of Principal Ending Balance $6,261.41 6,261.41 6,261.41 6,261.41 6,261.41 $2,000.00 1,659.09 1,290.90 893.26 463.80 $4,261.41 4,602.32 4,970.51 5,368.15 5,797.60 $20,738.59 16,136.27 11,165.76 5,797.61 0.00* $31,307.05 $6,307.05 $25,000.00 * $0.01 rounding error for year 5 numbers 24) $1,163,652.13; $885,185.11 25) $398,041.76; $328,988.05 Created by Jim Keys - 13 -