Finite Math Practice Exam for Chapter 5 (Solutions)

advertisement

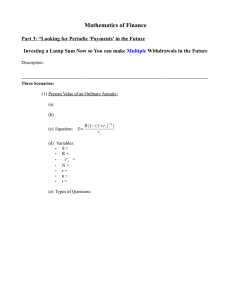

Finite Math Practice Exam for Chapter 5 (Solutions) Name: Instructions: Show work whenever possible. Identify which formula from Chapter 5 is appropriate for each question, and identify the appropriate inputs for that formula. Use the TVM-Solver on the TI-83 only to check your work. Unjustified answers will not receive credit. Partial credit is only possible with some written indication of your thoughts. Calculators may not be shared. Please put a box around your final answer. 1. Find the accumulated amount after 8 years if $12,000 is invested at 5% annual interest compounded annually. Solution: A P(1 i)n 12000(1 0.05)8 $17,729.47 2. Find the future value of an ordinary annuity of $120 per month for 10 years at 9% annual interest compounded monthly. (1 i)n 1 (1 0.09 /12)120 1 Solution: S R 120 $23, 221.71 i 0.09 /12 3. The manager of a money market fund has invested $4.2 million in certificates of deposit that pay interest at the rate of 5.4% per year compounded quarterly over a period of 5 years. How much will the investment be worth at the end of 5 years? Solution: A P(1 i)n 4200000(1 0.054 / 4)20 $5, 491,921.88 4. Peggy made a down payment of $400 toward the purchase of new furniture. To pay the balance of the purchase price, she has secured a loan from her bank at 12%/year compounded monthly. Under the terms of her finance agreement, she is required to make payments of $75.32 at the end of each month for 24 months. What was the purchase price of the furniture? Solution: Amount borrowed is present value of annuity. 1 (1 i) n 1 (1 0.01) 24 So P R 75.32 $1, 600.05 i 0.01 Purchase price is this amount plus down payment, or $2,000.05 5. Kim invested a sum of money 4 years ago in a savings account that has since paid interest at the rate of 6.5% per year compounded monthly. Her investment is now worth $19,440.31. How much did she originally invest? Solution: A P(1 i)n , so 19440.31 P(1 0.065 /12) 48 , so P $15,000 6. Find the effective rate of interest corresponding to a nominal rate of 9% per year compounded semiannually. In your own words, carefully explain what is meant by “effective rate of interest”. Solution: reff (1 r / m)m 1 (1 0.09 / 2)2 1 0.092025 So the effective rate of interest is 9.2025%. Even though the nominal rate is stated as 9%, this is the true rate by which the amount increases annually. 7. Jennifer was awarded damages of $150,000 in a successful lawsuit she brought against her employer 5 years ago. Simple interest on the judgment accrues at the rate of 12% per year from the date of filing. If the case were settled today, how much would Jennifer receive in the final judgment? Solution: A P(1 rt ) 150000(1 0.12 5) $240, 000 8. Mai Lee has contributed $200 at the end of each month into her company’s employee retirement account for the past 10 years. Her employer has matched her contribution each month. If the account has earned interest at the rate of 8% per year compounded monthly over the 10-year period, determine how much Mai Lee now has in her retirement account. (1 i)n 1 (1 0.08 /12)120 1 Solution: S R 400 $73,178.41 i 0.08 /12 9. Find the present value of an ordinary annuity of 60 payments of $5000 each made quarterly and earning interest at 8% per year compounded quarterly. 1 (1 i) n 1 (1 0.08 / 4) 60 Solution: P R 5000 $173,804.43 i 0.08 / 4 10. The Turners have purchased a home for $150,000. They made an initial down payment of $30,000 and secured a mortgage with interest charged at the rate of 9% per year on the unpaid balance. (Interest computations are made at the end of each month.) Assume the loan is amortized over a 30-year period. What monthly payment will the Turners be required to make? What will be their total interest payment? Pi 120000(0.09 /12) $965.55 n 1 (1 i) 1 (1 0.09 /12) 360 Total of payments is 360 times $965.55, or $347,598, on $120,000 borrowed. So total interest is $347,598 - $120,000 = $227,598. Solution: R

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)