values sum

advertisement

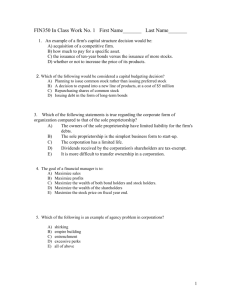

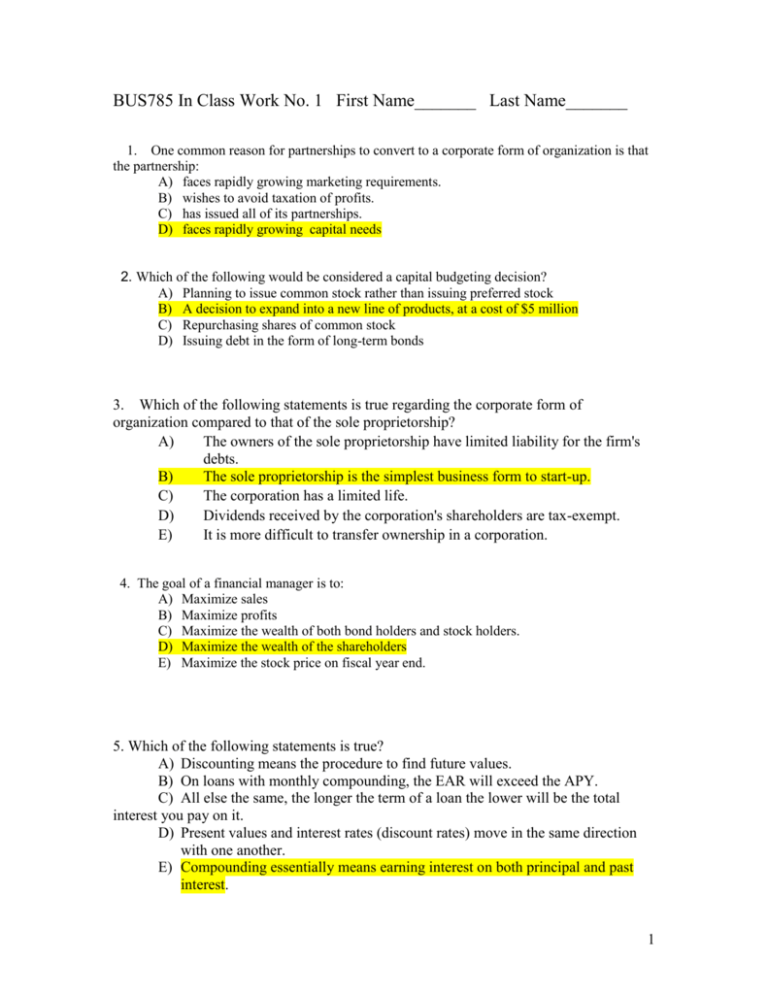

BUS785 In Class Work No. 1 First Name_______ Last Name_______ 1. One common reason for partnerships to convert to a corporate form of organization is that the partnership: A) faces rapidly growing marketing requirements. B) wishes to avoid taxation of profits. C) has issued all of its partnerships. D) faces rapidly growing capital needs 2. Which of the following would be considered a capital budgeting decision? A) Planning to issue common stock rather than issuing preferred stock B) A decision to expand into a new line of products, at a cost of $5 million C) Repurchasing shares of common stock D) Issuing debt in the form of long-term bonds 3. Which of the following statements is true regarding the corporate form of organization compared to that of the sole proprietorship? A) The owners of the sole proprietorship have limited liability for the firm's debts. B) The sole proprietorship is the simplest business form to start-up. C) The corporation has a limited life. D) Dividends received by the corporation's shareholders are tax-exempt. E) It is more difficult to transfer ownership in a corporation. 4. The goal of a financial manager is to: A) Maximize sales B) Maximize profits C) Maximize the wealth of both bond holders and stock holders. D) Maximize the wealth of the shareholders E) Maximize the stock price on fiscal year end. 5. Which of the following statements is true? A) Discounting means the procedure to find future values. B) On loans with monthly compounding, the EAR will exceed the APY. C) All else the same, the longer the term of a loan the lower will be the total interest you pay on it. D) Present values and interest rates (discount rates) move in the same direction with one another. E) Compounding essentially means earning interest on both principal and past interest. 1 6. Suppose a U.S. government bond will pay $1,000 three years from now. If the going interest rate on 3-year government bonds is 4%, how much is the bond worth today? a. b. c. d. e. 7. $943.46 $991.43 $889.00 $907.91 $968.40 You want to go to grad school 4 years from now, and you can save $5,000 per year, beginning one year from today. You plan to deposit the funds in a mutual fund which you expect to return 9% per year. Under these conditions, how much will you have just after you make the 4th deposit, 4 years from now? a. b. c. d. e. $22,865.65 $20,199.47 $21,513.78 $17,976.84 $19,390.50 8. You need $4,500 to buy a new stereo for your car. If now you have $1,800 to invest at 6% compounded daily, how long will you have to wait to buy the stereo? A) 15.28 years B) 18.42 years C) 8.60 years D) 14.58 years E) 15.73 years 9. What’s the present value of a 6-year ordinary annuity of $1,000 per year plus an additional $1,500 at the end of Year 6 if the interest rate is 6%? a. b. c. d. e. $5,324.89 $5,591.45 $5,974.77 $6,011.87 $4,854.13 Q10 and Q11 may be worked under “BGN” mode 10. Your father is about to retire, and he wants to buy an annuity that will provide him with $50,000 of income a year for 20 years, with the first payment coming immediately. The going rate on such annuities is 6%. How much would it cost him to buy the annuity today? a. b. c. d. e. $607,905.82 $416,110.34 $517,513.68 $615,976.84 $488,349.15 2 11. Your father has $500,000 and wants to retire. He expects to live for another 20 years, and he also expects to earn 8% on his invested funds. How much could he withdraw at the beginning of each of the next 20 years and end up with zero in the account? a. $53,431.83 b. $47,153.80 c. $54,764.40 d. $47,843.15 e. $45,119.76 (Do not forget to return to the “END” mode after this question) 12. How much would you pay for a perpetuity that pays $800 per month when interest rate (APR) is 12% monthly? a. b. c. d. e. 13. What’s the present value of $4,000 discounted back 3 years if the appropriate interest rate is 8%, compounded monthly? a. b. c. d. e. 14. $80,000 $6,666.66 $960,000 $66,666.66 $92,000 $3,149.02 $2,982.90 $2,649.78 $2,023.74 $3,708.26 Credit card issuers must by law print their Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 7.30% monthly, what is the interest rate per month? a. b. c. d. 0.303% 0.608% 0.0608% 0.309% 3 15.What is the present value of the following cash flows at a discount rate of 12%? t=0 -250,000 A) B) C) D) 16. t=1 100,000 t=2 150,000 t=3 200,000 $101,221 $200,000 $142,208 $153.317 Which of the following bank accounts has the highest effective annual return? a. b. c. d. e. 17. An account that pays 5.2% nominal interest with monthly compounding. An account that pays 4% nominal interest with quarterly compounding. An account that pays 4.5% nominal interest with daily compounding. An account that pays 5.4% nominal interest with annual compounding. An account that pays 4.5% nominal interest with monthly compounding. A lump sum payment of $1,000 is due at the end of 5 years. The nominal interest rate is 10%, semiannual compounding. Which of the following statements is CORRECT? a. The present value of the $1,000 would be greater if interest were compounded monthly rather than semiannually. b. The periodic rate is greater than 5%. c. The periodic interest rate is 5%. d. The present value would greater if the lump sum were discounted back for more periods. e. The PV of the $1,000 lump sum has a higher present value than the PV of a 5year, $200 ordinary annuity. 18. What’s the future value of a 3-year $100 annuity, if the quoted interest rate is 10%, compounded semiannually? 0 1 2 1 3 2 4 5 3 6 5% 100 100 100 Payments occur annually, but compounding occurs every 6 months. 2-34 A) B) C) D) E) $105*3 $386.74 $311.80 $331.80 $333.81 4 19. You are to make annual deposit of $3000/year into a retirement account that pays 11% interest compounded monthly. If your first deposit will be made one year from now, how large will your retirement account be in 30 years. A) $666,480 B) $734,222 C) $597,063 D) $701,130 E) $580,023 20. A real estate investment has the following expected cash flows: Year 1 2 3 4 Cash Flows $10,000 25,000 0 35,000 If the discount rate (interest rate) is 8%, what is the investment’s present value? a. b. c. d. e. $64,107 $56,418 $55,661 $80,308 $37,900 21. APY is also called: a. b. c. d. e. EAR APR quoted rate nominal rate periodic rate 5