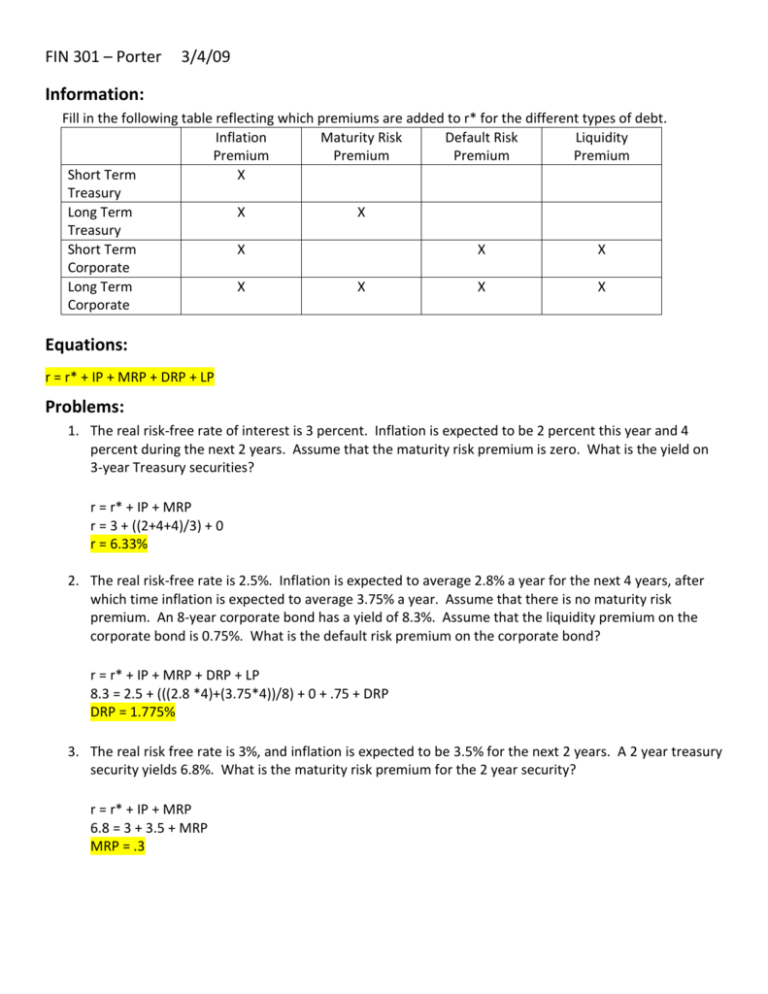

FIN 301 – Porter 3/4/09 Information: Fill in the following table

advertisement

FIN 301 – Porter 3/4/09 Information: Fill in the following table reflecting which premiums are added to r* for the different types of debt. Inflation Maturity Risk Default Risk Liquidity Premium Premium Premium Premium Short Term X Treasury Long Term X X Treasury Short Term X X X Corporate Long Term X X X X Corporate Equations: r = r* + IP + MRP + DRP + LP Problems: 1. The real risk-free rate of interest is 3 percent. Inflation is expected to be 2 percent this year and 4 percent during the next 2 years. Assume that the maturity risk premium is zero. What is the yield on 3-year Treasury securities? r = r* + IP + MRP r = 3 + ((2+4+4)/3) + 0 r = 6.33% 2. The real risk-free rate is 2.5%. Inflation is expected to average 2.8% a year for the next 4 years, after which time inflation is expected to average 3.75% a year. Assume that there is no maturity risk premium. An 8-year corporate bond has a yield of 8.3%. Assume that the liquidity premium on the corporate bond is 0.75%. What is the default risk premium on the corporate bond? r = r* + IP + MRP + DRP + LP 8.3 = 2.5 + (((2.8 *4)+(3.75*4))/8) + 0 + .75 + DRP DRP = 1.775% 3. The real risk free rate is 3%, and inflation is expected to be 3.5% for the next 2 years. A 2 year treasury security yields 6.8%. What is the maturity risk premium for the 2 year security? r = r* + IP + MRP 6.8 = 3 + 3.5 + MRP MRP = .3 FIN 301 – Porter 3/4/09 4. The real risk free rate is 4%. Inflation is expected to be 3% this year, 4% next year, and then 2% for the following 2 years. Assume that the maturity risk premium is 0. What is the yield on 2 year Treasury securities? What about 4 year treasury securities? r2 = r* + IP + MRP r2 = 4 + ((3+4)/2) + 0 r2 = 7.5% r4 = r* + IP + MRP r4 = 4 + ((3+4+2+2)/4) + 0 r4 = 6.75% 5. You read in The Wall Street Journal that 30-day T-bills are currently yielding 5.5%. Your brother-in-law, a broker at Safe and Sound Securities, has given you the following estimates of current interest rate premiums: Inflation premium= 3.25% Liquidity premium= 0.6% Maturity risk premium= 1.8% Default risk premium= 2.15% On the basis of these data, what is the real risk-free rate of return? r = r* + IP 5.5 = r* + 3.25 r* = 2.25% 6. Using the information and risk free rate found in #5, what would the yield of a 30-day corporate bond be? r = r* + IP + DRP + LP r = 2.25 + 3.25 + 2.15 + .6 r = 8.25% 7. 4-year corporate securities are currently yielding 5.8%. You know the following are the current interest rate premiums. Calculate the inflation premium. Liquidity premium= 1.2% Maturity Risk premium= 0.75% Default Risk premium= 1.35% Risk Free Rate = 1.8% r = r* + IP + MRP + DRP + LP 5.8 = 1.8 + .75 + 1.35 + 1.2 + IP IP = .7% FIN 301 – Porter 3/4/09 8. Interest rates on 4-year Treasury securities are currently 7%, while interest rates on 6-year Treasury securities are currently 7.5%. If the pure expectations hypothesis is correct, what does the market believe that 2-year securities will be yielding 4 years from now? (1 + .075)6 = (1 + .07)4 * (1 + x)2 1.5433 = 1.3108 * (1 + x)2 Divide both sides by 1.3108 1.1774 = (1 + x)2 Take the square root of both sides to get ride of the 2 1.0851 = 1 + x x = .0851 or 8.51% 9. Interest rates on 3-year treasury securities are currently 8%, while 6-year treasury securities are 8.5%. If pure expectations hypothesis is correct, what does the market believe that 3-year securities will be yielding 3 years from now? (1 + .085)6 = (1 + .08)3 * (1 + x)3 1.6315 = 1.2597 * (1 + x)3 Divide both sides by 1.2597 1.2951 = 1 + x)3 Take both sides to the 1/3 power to get ride of the 3 1.09 = 1 + x x = .09 or 9% 10. One-year Treasury securities yield 4.78%. The market anticipates that 1 year from now, 1-year Treasury securities will yield 5.29%. If the pure expectation theory is correct, what should be the yield today for 2-year Treasury securities? (1 + x)2 = (1 + .0478) * (1 + .0529) (1 + x)2 = 1.1032 Take the square root of both sides to get ride of the 2 1 + x = 1.0503 x = .0503 or 5.03% 11. 3-year treasury securities beginning two years from now are expected to yield 5.75%, whereas a 2-year Treasury security is currently yielding 5%. A 2-year security is expected to yield 6.2% beginning 3 years from now. What is the yield for a 3-year treasury security beginning today? (1 + x)3 * (1 + .062)2 = (1 + .05)2 * (1 + .0575)3 (1 + x)3 * 1.1278 = 1.1025 * 1.1826 (1 + x)3 * 1.1278 = 1.3038 Divide both sides by 1.1278 (1 + x)3 = 1.1561 Take both sides to the 1/3 power to get ride of the 3 1 + x = 1.0495 FIN 301 – Porter 3/4/09 x = .0495 or 4.95%