File

advertisement

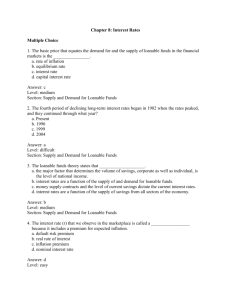

CHAPTER 2 The Financial Environment: Markets, Institutions, and interest rates Importance & Functions of Financial Markets Classification of Financial Markets Financial Institutions Determinants of Interest rates Yield Curves 2-1 Functions of Financial Markets Bridging the gap between net borrowers and net savers. Net borrowers or investors are the deficit sector. They demand loan. Net savers are surplus sector. They supply loan. The two groups do not know each other, financial market brings them together. (Slide 3) Providing the equilibrium interest rate. Net savers like to get more interest and net borrowers like to pay less interest. Financial market provides the equilibrium rate. (Slide 4) Separation principle: Financial institutions separate the pattern of current consumption from the pattern of current income by means of intertemporal consumption function. People in need of more current consumption than current income borrow money. People who like to defer consumption lend money. (Slide 5) 2-2 Bridging the gap . Net savers: Surplus sector Financial Market Net Borrowers: Deficit sector 2-3 Equilibrium interest rate: (Loanable Fund Theory) i S (Savings) i D (Investment) Quantity of Loanable Fund 2-4 Intertemporal consumption . C1 210 Lending 100 Borrowing 100 190.9 Co 2-5 Types of Financial Markets Debt vs. Equity Markets. Debt includes bond, debenture, bank loan, mortgage, commercial and consumer credit. Equity refers to the claim of ordinary stock. Interest on debt is a compulsory payment but dividend is not. Cost of debt is usually less than cost of equity. Money vs. Capital Markets. Money market deals in short term loan to provide firm’s liquidity. Capital market deals in long term debt of different types, preferred stock and ordinary stock Primary vs. Secondary Markets. In the primary market, the firm directly sells stock to the applicant of the share. In the secondary market, shares are traded among stock holders. 2-6 The concept of cost of money In case of debt capital, cost of money refers to the interest rate. In case of equity capital, cost of money is the required return. This is the return expected by the shareholders to leave the share price unchanged. 2-7 What four factors affect the cost of money? Production opportunities: More attractive production opportunity shifts the demand curve right. Cost increases. Time preferences for consumption: If present consumption gets more priority than deferred consumption, then supply curve shifts left. Cost increases. Risk: Increased risk makes savings less attractive, supply curve shifts left. Risk and return are proportional. Increased risk leads to an upward shift of demand curve. Cost increases. (Figure in the next slide) Expected inflation: If expected inflation increases savers demand more return, supply curve shifts left. Cost increases. 2-8 Effects of increased risk on cost of Money: Loanable Fund Theory i S1 S (Savings) k1 k D1 D (Investment) Quantity of Loanable Fund 2-9 “Nominal” vs. “Real” rates kRF= k*+IP k* = represents the “real” risk-free rate of interest. Like a T-bill rate, if there was no inflation. Typically ranges from 1% to 4% per year. kRF = represents the rate of interest on Treasury securities. IP= Inflation premium 2-10 Determinants of interest rates k = k* + IP + DRP + LP + MRP k = required return on a debt security k* = real risk-free rate of interest IP = expected inflation premium DRP = default risk premium LP = liquidity premium MRP= maturity risk premium 2-11 Concepts of risk premium Inflation Premium refers to the additional interest to cover the loss due to inflation. Default risk premium is the addition in the interest rate to compensate the possibility that the borrower may fail to pay interest and principal. Liquidity risk premium is the addition to compensate the possibility that the security may not be sold within a short notice. Maturity risk premium covers the possibility of price fluctuation of bond. The price depends on market interest rate. Bonds of longer maturity assumes more maturity risk premium. n Interestt Facevalue PB t t ( 1 r ) ( 1 r ) t 1 2-12 Risk-Return trade-off k=kRF + Risk Premium (RP) E(R) = Rf + RP RP=DRP+LP+MRP Return Rf Risk 2-13 Yield Curve: Relation between interest and time Normal Abnormal Flat k Maturity 2-14 Theories of Yield Curves Liquidity Preference Theory: Lenders to prefer to make short term loan than long term loan. Yield curve should be positive. Expectations Theory: Yield curve depends on the expectation about inflation. If inflation is expected to rise in future, then yield curve should be positive. Market Segmentation Theory: The short term market and the long term market are different from one another. Yield curve should not have a definite pattern. 2-15