The Financial Environment: Markets, Institutions, and Interest Rates

advertisement

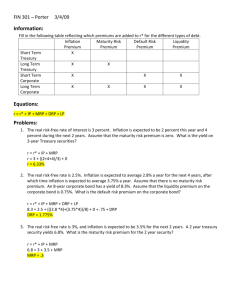

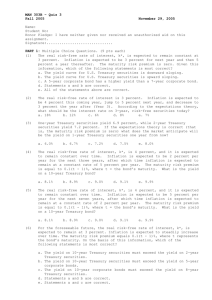

CHAPTER 2 & 6 The Financial Environment: Markets, Institutions, and Interest Rates Financial markets Types of financial institutions Determinants of interest rates Yield curves What is a market? A market is a venue where goods and services are exchanged. A financial market is a place where individuals and organizations wanting to borrow funds are brought together with those having a surplus of funds. Financial Markets What is the role of financial markets in Finance? Cash flows to and from the Firm • SECURITIES - STOCKS AND BONDS REPRESENTING OBLIGATIONS OF THE ISSUER TO PROVIDE THE PURCHASER AN EXPECTED RETURN ON THE INVESTMENT Types of financial markets Physical assets vs. Financial assets – (Physical: wheat, real estate, machinery) Money vs. Capital – (Money Market: where funds are borrowed or loaned for less than one year) Financial Market: stocks and long term debt trade Primary vs. Secondary PRIMARY MARKET - NEW ISSUES OF SECURITIES ARE SOLD PUBLICLY FOR THE FIRST TIME SECONDARY MARKETS MARKET WHERE SHARES OF STOCKS AND BONDS WHICH WERE PREVIOUSLY ISSUED TRADE Public vs. Private (Public: Market in which standardized contracts are traded on an organized exchange) 1 How is capital transferred between savers and borrowers? Direct transfers Investment banking house Financial intermediaries Types of financial intermediaries Commercial banks Savings and loan associations Mutual savings banks Credit unions Pension funds Life insurance companies Mutual funds Physical location stock exchanges vs. Electronic dealer-based markets Auction market vs. Dealer market (Exchanges vs. OTC) NYSE vs. Nasdaq Organized Exchanges - Trading takes place in a location with face to face trading (auction market) New York Stock Exchange - NYSE (1792): Before 2006 the NYSE was a nonprofit corporation with 1366 seats. In 2006 it became a publicly traded company (ticker symbol: NYX). Membership seats are replaced by annual trading licenses. Then in April 4, 2007 NYSE-Euronext is formed, merging NYSE with major European exchanges. 2800 stocks listed on NYSE Specialist - Specialists are people on the trading floor of the exchange of the NYSE who hold inventories of particular stocks. A specialist's job is not only to match buyers and sellers, but also to keep an inventory for him or herself that can be used to shift the market during a period of illiquidity 1. Auctioneer – Shows best bids and offers, becoming a market maker 2. Catalyst – Keeps track of the interests of different buyers and sellers and continually updates them. 3. Agent – Places electronically routed orders on behalf of clients. Floor brokers can leave an order with a specialist, freeing themselves up to take on other orders. Specialists then take on the responsibilities of a broker. 4. Principal – Acts as the major party to a transaction - specialists are responsible for keeping the market in equilibrium, they are required to execute all customer orders ahead of their own. 2 The specialists at the NYSE are employed by seven firms. Companies listed on certain exchanges will interview employees of the specialist firms, seeking out suitable people to represent them (by holding inventories of the companies' stocks). Here are the seven NYSE specialist firms: Bear Wagner Specialist LLC., Fleet Specialist, Inc., LaBranche & Co., LLC.,, Performance Specialist Group, LLC., Spear, Leeds & Kellogg Specialists LLC.,SIG Specialists, Inc.,Van der Moolen Specialists USA, LLC. Floor broker – (commission brokers) execute customer orders (working for brokerage houses) 500 floor brokers at NYSE- use electronic trading system (SuperDOT) to place orders through specialist Independent brokers – don’t work for brokerage house but place trades for customers of brokerage firms. Collect fee for service SuperDot system – orders transmitted directly to specialists – especially Small orders NASDAQ – National Association of Security Dealers Automated Quotation system OTC Market – Over the Counter market – when securities market is characterized by dealers (market makers) who buy and sell securities for their inventories – NASDAQ is an OTC market NASDAQ – Composed of two separate markets – NASDAQ National Market – lists 4000 securities (larger companies) NASDAQ Capital Market – for smaller companies lists 1000 companies ECN – Electric Communication Network – late 1990s investors trade directly with each other through order book – buy sell order are placed in ECN and then transmitted to NASDAQ and displayed (fourth market) - Instinet, Island, Tradebook (trade stocks and currencies) THIRD Market - Trading of exchange listed stocks occur off exchange through independent securities firms FOURTH Market – Instinet, Tradebook – investors trade among themselves. Big for after hours trading 3 Orders Market Order - An order to buy or sell a stated quantity of a security at the current market price. Limit Order - An order to buy or sell a security at a specific price or better. A buy limit order is placed below the market price. A sell limit order is place above the market price. Additional limit order instructions: Day-order; Good Til Cancelled Stop Order - An order to buy or sell at the current market price once the stock has traded at, or through, the specified stop price. A sell stop or stop loss order is used to protect a profit or limit a loss in the event of a decline the security's market price. The cost of money The price, or cost, of debt capital is the interest rate. The price, or cost, of equity capital is the required return. The required return investors expect is composed of compensation in the form of dividends and capital gains. What four factors affect the cost of money? “Nominal” vs. “Real” rates r = represents any nominal rate r* = represents the “real” risk-free rate of interest. Like a T-bill rate, if there was no inflation. Typically ranges from 1% to 4% per year. rRF = represents the rate of interest on Treasury securities. Determinants of interest rates r = r* + IP + DRP + LP + MRP r r* IP DRP LP MRP = = = = = = required return on a debt security real risk-free rate of interest inflation premium default risk premium liquidity premium maturity risk premium Premiums added to k* for different types of debt 4 Yield curve and the term structure of interest rates Term structure – relationship between interest rates (or yields) and maturities. The yield curve is a graph of the term structure. Step 1 – Find the average expected inflation rate over years 1 to n: Constructing the yield curve: Inflation Suppose, that inflation is expected to be 5% next year, 6% the following year, and 8% thereafter. IP1 = 5% / 1 = 5.00% IP10= [5% + 6% + 8%(8)] / 10 = 7.50% IP20= [5% + 6% + 8%(18)] / 20 = 7.75% Must earn these IPs to break even vs. inflation; these IPs would permit you to earn r* (before taxes). Constructing the yield curve: Inflation Step 2 – Find the appropriate maturity risk premium (MRP). For this example, the following equation will be used find a security’s appropriate maturity risk premium. Constructing the yield curve: Maturity Risk Using the given equation: MRP1 = 0.1% x (1-1) = 0.0% MRP10 = 0.1% x (10-1) = 0.9% MRP20 = 0.1% x (20-1) = 1.9% Notice that since the equation is linear, the maturity risk premium is increasing in the time to maturity, as it should be. Add the IPs and MRPs to k* to find the appropriate nominal rates Step 3 – Adding the premiums to k*. rRF, t = r* + IPt + MRPt Assume r* = 3%, rRF, 1 = 3% + 5.0% + 0.0% = 8.0% rRF, 10 = 3% + 7.5% + 0.9% = 11.4% rRF, 20 = 3% + 7.75% + 1.9% = 12.65% 5 1. Maturity risk premium The real risk-free rate. is 3 percent, and inflation is expected to be 3 percent for the next 2 years. A 2-year Treasury security yields 6.2 percent. What is the maturity risk premium for the 2-year security? Hypothetical yield curve An upward sloping yield curve. Upward slope due to an increase in expected inflation and increasing maturity risk premium. What is the relationship between the Treasury yield curve and the yield curves for corporate issues? Corporate yield curves are higher than that of Treasury securities, though not necessarily parallel to the Treasury curve. The spread between corporate and Treasury yield curves widens as the corporate bond rating decreases. Illustrating the relationship between corporate and Treasury yield curves Pure Expectations Hypothesis The PEH contends that the shape of the yield curve depends on investor’s expectations about future interest rates. If interest rates are expected to increase, L-T rates will be higher than S-T rates, and vice-versa. Thus, the yield curve can slope up, down, or even bow. Assumptions of the PEH Assumes that the maturity risk premium for Treasury securities is zero. Long-term rates are an average of current and future short-term rates. If PEH is correct, you can use the yield curve to “back out” expected future interest rates. Average annual rate = r = [(1 + r1) (1 + r2)..( 1 + rn)]1/n - 1 Geometric average of individual one year rates 2. One-year Treasury securities yield 5 percent. The market anticipates that 1 year Expected rate from now, l-year Treasury securities will yield 6 percent. If the pure expectations of interest theory is correct, what should be the yield today for 2-year Treasury securities? 6 3. Expected rate of interest 4. Expected rate of interest Interest rates on 4-year Treasury securities are currently 7 percent, while interest rates on 6-year Treasury securities are currently 7.5 percent. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Suppose the annual yield on a 2-year Treasury bond is 4.5 percent, while that on a 1-year bond is 3 percent. r* is 1 percent, and the maturity risk premium is zero. a. Using the expectations theory, forecast the interest rate on a 1-year bond during the second year. (Hint: Under the expectations theory, the yield on a 2-year bond is equal to the average yield on 1-year bonds in Years 1 and 2.) b. What is the expected inflation rate in Year 1? Year 2? An example: Observed Treasury rates and the PEH Maturity Yield 1 year 6.0% 2 years 6.2% 3 years 6.4% average annual rates 4 years 6.5% 5 years 6.5% If PEH holds, what does the market expect will be the interest rate on one-year securities, one year from now? Three-year securities, two years from now? One-year forward rate .062 = [(1.06)(1 + x)]1/2 - 1 (1.062)2/1.06 = (1 + x) x = 6.4% PEH says that one-year securities will yield 6.4%, one year from now. Three-year security, two years from now 7 Conclusions about PEH Some would argue that the MRP ≠ 0, and hence the PEH is incorrect. Most evidence supports the general view that lenders prefer S-T securities, and view L-T securities as riskier. Thus, investors demand a MRP to get them to hold L-T securities (i.e., MRP > 0). Other factors that influence interest rate levels Federal reserve policy Federal budget surplus or deficit Level of business activity International factors Risks associated with investing overseas Factors that cause exchange rates to fluctuate Changes in relative inflation Changes in country risk 8