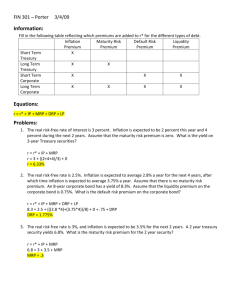

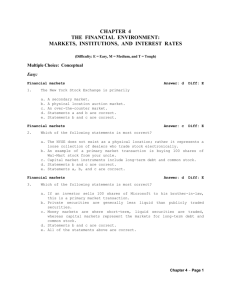

Samples of Possible Test Questions for FIN 303 Ch 6

advertisement

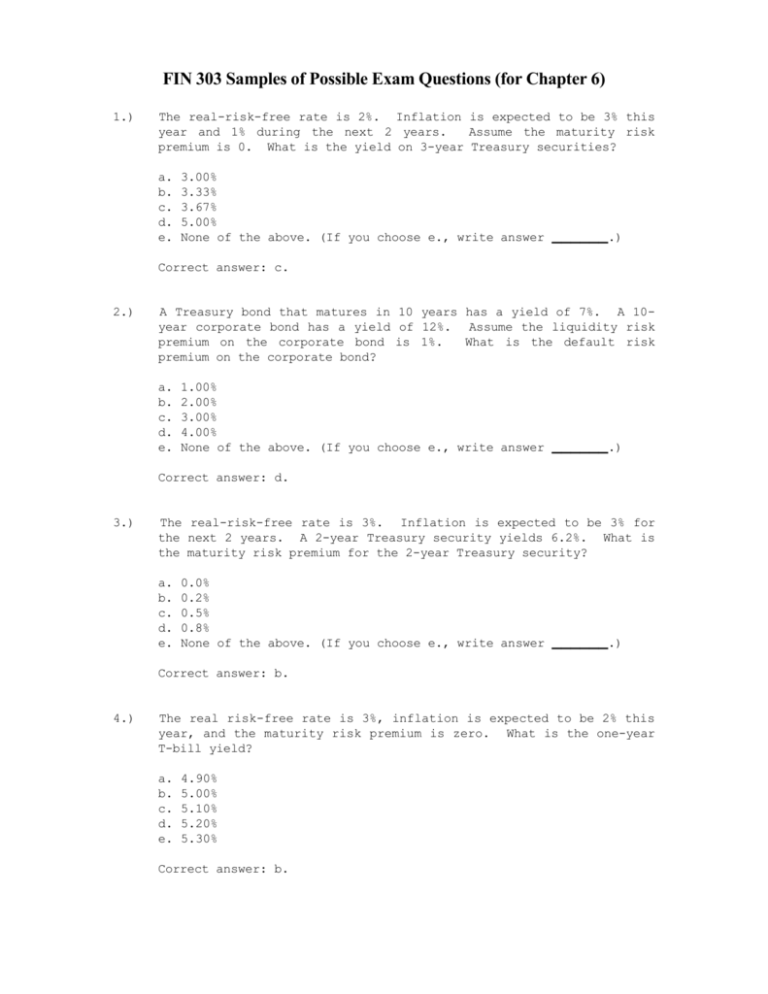

FIN 303 Samples of Possible Exam Questions (for Chapter 6) 1.) The real-risk-free rate is 2%. Inflation is expected to be 3% this year and 1% during the next 2 years. Assume the maturity risk premium is 0. What is the yield on 3-year Treasury securities? a. b. c. d. e. 3.00% 3.33% 3.67% 5.00% None of the above. (If you choose e., write answer ______.) Correct answer: c. 2.) A Treasury bond that matures in 10 years has a yield of 7%. A 10year corporate bond has a yield of 12%. Assume the liquidity risk premium on the corporate bond is 1%. What is the default risk premium on the corporate bond? a. b. c. d. e. 1.00% 2.00% 3.00% 4.00% None of the above. (If you choose e., write answer ______.) Correct answer: d. 3.) The real-risk-free rate is 3%. Inflation is expected to be 3% for the next 2 years. A 2-year Treasury security yields 6.2%. What is the maturity risk premium for the 2-year Treasury security? a. b. c. d. e. 0.0% 0.2% 0.5% 0.8% None of the above. (If you choose e., write answer ______.) Correct answer: b. 4.) The real risk-free rate is 3%, inflation is expected to be 2% this year, and the maturity risk premium is zero. What is the one-year T-bill yield? a. b. c. d. e. 4.90% 5.00% 5.10% 5.20% 5.30% Correct answer: b. 5.) Which of the following would be most likely to lead to a higher level of interest rates in the economy? a. Households start saving a larger percentage of their income. b. Corporations step up their expansion plans and thus increase their demand for capital. c. The level of inflation begins to decline. d. The economy moves from a boom to a recession. e. The Federal Reserve decides to try to stimulate the economy. Correct answer: b. 6.) Which of the following statements is CORRECT? a. The yield on a 3-year Treasury bond cannot exceed the yield on a 10-year Treasury bond. b. The real risk-free rate is higher for corporate than Treasury bonds. c. Most evidence suggests that the maturity risk premium is zero. d. Liquidity premiums are higher for Treasury than corporate bonds. e. The pure expectations theory states that the maturity risk premium for long-term Treasury bonds is zero and that differences in interest rates across different maturities are driven by expectations about future interest rates. Correct answer: e. 7.) Which of the following statements is CORRECT? a. The yield on a 2-year corporate bond should always exceed the yield on a 2-year Treasury bond. b. The yield on a 3-year corporate bond should always exceed the yield on a 2-year corporate bond. c. The yield on a 3-year Treasury bond should always exceed the yield on a 2-year Treasury bond. d. If inflation is expected to increase, then the yield on a 2-year bond will exceed that on a 3-year bond. e. The real risk-free rate increases if people expect inflation to increase. Correct answer: a. 8.) One-year Treasury bills yield 6%, while 2-year Treasury notes yield 6.7%. If the expectations theory holds, what is the market’s forecast of what 1-year T-bills will be yielding one year from now? a. b. c. d. e. 6.70% 7.40% 7.80% 8.00% 8.20% Correct answer: b. 9.) One-year Treasury securities yield 5%, 2-year Treasury securities yield 5.5%, and 3-year Treasury securities yield 6%. Assume that the expectations theory holds. What does the market expect will be the yield on 1-year Treasury securities two years from now? a. b. c. d. e. 6.01% 6.51% 7.01% 7.51% 8.01% Correct answer: c. 10.) Suppose that the annual expected rates of inflation over each of the next five years are 5%, 6%, 9%, 13%, and 12%, respectively. What is the average expected inflation rate over the 5-year period? a. 6% b. 7% c. 8% d. 9% e. 10% Correct answer: d. 11.) The real risk-free rate, r*, is 3%. Inflation is expected to average 2% a year for the next three years, after which time inflation is expected to average 3.5% a year. Assume that there is no maturity risk premium. A 7-year corporate bond has a yield of 7.6%. Assume that the liquidity premium on the corporate bond is 0.4%. What is the default risk premium on the corporate bond? a. b. c. d. e. 0.70% 1.34% 1.45% 2.01% 2.20% Correct answer: b. 11.) The real risk-free rate, r*, is 3%. Inflation is expected to average 2% a year for the next three years, after which time inflation is expected to average 3.5% a year. Assume that there is no maturity risk premium. A 7-year corporate bond has a yield of 7.6%. Assume that the liquidity premium on the corporate bond is 0.4%. What is the default risk premium on the corporate bond? a. b. c. d. e. 0.70% 1.34% 1.45% 2.01% 2.20% Correct answer: b. 12.) Which of the following affect the level of interest rates? a. b. c. d. e. f. Production opportunities (i.e., the demand for money). Time preferences for consumption (i.e., the supply of money). Risk (i.e., the chance of getting a negative return). Expected inflation. All of the above. None of the above. Correct answer: e. 13.) The relationship between interest rates and maturities: a. b. c. d. e. Can be upward sloping, downward sloping, flat, or even humped. Is called the term structure. Can be graphically represented as the “yield curve”. All of the above. None of the above. Correct answer: d. 13.) Which of the following statements is true? a. The yield curve for Treasury securities lies above the yield curves of corporate securities. b. The yield curves for corporations with good credit ratings lie above the yield curve of corporations with bad credit ratings. c. The yield curves for corporations with bad credit ratings lie above the yield curve of corporations with good credit ratings. d. None of the above. Correct answer: c. 14.) Which of the following affect the level of interest rates? a. b. c. d. Federal Reserve policy. Federal budget surplus or deficit. Level of business activity (e.g., boom or recession). International factors (e.g., trade imbalances and exchange rates). e. All of the above. f. None of the above. Correct answer: e. foreign