What are Financial Markets?

advertisement

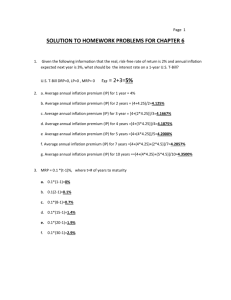

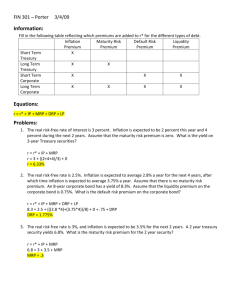

Lecture 2 CHAPTER 4 The Financial Environment Markets, Institutions, and Interest Rates KEY CONCEPTS Financial markets Types of financial institutions Determinants of interest rates Yield curves Basically we have discussed that finance has 3 broad areas Money & Capital Markets Investments Financial Management What are Financial Markets? • A market is a venue where goods and services are exchanged. • A financial market is a place where individuals and organizations wanting to borrow funds are brought together with those having a surplus of funds (bringing buyers and sellers of financial instruments together) • The purpose of financial markets is to efficiently allocate savings to ultimate users. • So it acts as a medium between sources & uses of funds. Page 1 of 8 Types of Financial Markets • Physical assets markets vs. financial assets Physical markets are tangible or real asset markets while financial asset markets deal with stocks, bonds, notes, mortgages and other claims on real assets. • Money vs. Capital Money markets are markets for short term, highly liquid debt securities (markets where funds are borrowed or loaned for short periods). Whereas financial markets for stocks and for long term debt are capital markets. • Primary vs. Secondary Markets where corporate raise capital by issuing new securities are primary markets & the markets where securities and financial assets are traded among investors after they have been issued by corporations. • Spot vs. Futures Spot markets and the futures markets are terms that refer to whether assets are being bought or sold for “on the spot” delivery or for delivery at some future date. • Public vs. Private Transactions are worked out directly between two parties are private markets whereas standardized contracts traded on organized exchanges are referred to as public markets. A healthy economy is dependent on efficient transfers of funds from people who are net savers to firms and individuals who need capital. Efficient transfer is a crucial factor. Page 2 of 8 Financial Institutions Transfer of capital between savers and those who need capital take place in three different ways: A. Direct Trans fers B. Indirect Transfers through Investment Bankers C. Indirect Transfers through a Financial Intermediary Now these direct transfers are taking at a price known as “cost of money” Page 3 of 8 The Cost of Money Capital in the free economy is allocated through the price system. There are two main sources of capital o Debt o Equity Interest rate is the price paid to borrow debt capital. With equity capital, investors expect to receive dividends and capital gains, & these are the components whose sum is the cost of equity money. Factors affecting cost of money include: • Production opportunities: The returns available within an economy from investments in productive (Cash generating) assets. • Time preferences for consumption: Preferences of consumers for current consumption as opposed to saving for future consumption. • Risk: Chance that an investment will provide low or negative return. • Expected inflation: Amount by which prices increase over time. Bottom line: The interest rate paid to savers depends in a basic way on: 1. 2. 3. 4. Rate of return producers expect to earn on invested capital Savers time preference for current versus future consumption Riskiness of loan. Expected Future rate of inflation. Page 4 of 8 THE DETERMINANTS OF MARKET INTEREST RATES In general, quoted (nominal) interest rate on debt security is composed of: 1. Real risk free rate of interest 2. Premiums that reflect: a. Inflation b. Riskiness of the security c. Security’s marketability (liquidity) k = k* + IP + DRP + LP + MRP k = kRF + DRP + LP + MRP Here K = the quoted or nominal rate of interest on a given security. k* = the real risk free rate of interest. The rate on riskless security if zero inflation is expected. kRF = k* + IP. Quoted risk free rate on a security which is very liquid and also free of most risks. IP = Inflation premium. Its equal to the average expected inflation over the life of security. DRP = Default risk premium. LP = liquidity or marketability premium MRP = Maturity risk premium. Page 5 of 8 DISCUSSION OF EXPECTATIONS THEORY Yield curve depends on expectations of investors about future interest rates. Long term interest rates are weighted average of current and expected future short term interest rates. Examples: 1. The real risk free rate of interest is 3%. Inflation is expected to be 2% this year and 4% during next two years. Assume that maturity risk premium is zero. What is the yield on 2 year treasury security? B. Yield on 3 year treasury security? Page 6 of 8 2. A treasury bond which matures in 10 years has a yield of 6%. A 10 year corporate bond has a yield of 8%. Assume that liquidity premium on corporate bond is 0.5%. What is the default risk premium on corporate bond? Page 7 of 8 3. The real risk free rate is 3%, and inflation is expected to be 3% for next two years. A 2 year treasury security yields 6.2%. What is maturity risk premium for 2 year security? 4. Interest rates on 4 year treasury securities are currently 7%, while interest rates on 6 year treasury securities are currently 7.5%. If pure expectations theory is correct, what does market believe that 2 year securities will be yielding 4 years from now? Page 8 of 8