Chapter 8: Interest Rates Multiple Choice 1. The basic price that

advertisement

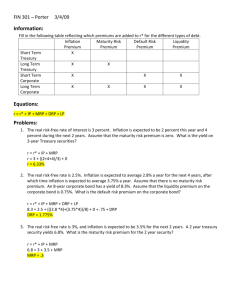

Chapter 8: Interest Rates Multiple Choice 1. The basic price that equates the demand for and the supply of loanable funds in the financial markets is the ________________. a. rate of inflation b. equilibrium rate c. interest rate d. capital interest rate Answer: c Level: medium Section: Supply and Demand for Loanable Funds 2. The fourth period of declining long-term interest rates began in 1982 when the rates peaked, and they continued through what year? a. Present b. 1990 c. 1999 d. 2004 Answer: a Level: difficult Section: Supply and Demand for Loanable Funds 3. The loanable funds theory states that ____________________. a. the major factor that determines the volume of savings, corporate as well as individual, is the level of national income. b. interest rates are a function of the supply of and demand for loanable funds. c. money supply contracts and the level of current savings dictate the current interest rates. d. interest rates are a function of the supply of savings from all sectors of the economy. Answer: b Level: medium Section: Supply and Demand for Loanable Funds 4. The interest rate (r) that we observe in the marketplace is called a _________________ because it includes a premium for expected inflation. a. default risk premium b. real rate of interest c. inflation premium d. nominal interest rate Answer: d Level: easy Section: Determinants of Market Interest Rates 5. Compensation for securities that cannot easily be converted to cash without major price discounts is the definition of what term? a. liquidity premium b. interest rate risk c. maturity risk premium d. default risk premium Answer: a Level: difficult Section: Determinants of Market Interest Rates 6. The risk-free rate of interest is a combination of which two factors? a. the real rate of interest and the inflation premium b. the default risk premium and the liquidity premium c. the maturity risk premium and the inflation premium d. the liquidity premium and the real rate of interest Answer: a Level: medium Section: Risk Free Securities: U.S. Treasury Debt Obligations 7. Given a real rate of 2% and an inflation premium of 5%, a short-term government security with no default risk premium or maturity risk premium will have a nominal interest rate of a. 3% b. 5% c. 7% d. 9% Answer: c Level: easy Section: Risk Free Securities: U.S. Treasury Debt Obligations 8. The term for federal obligations issued with maturities up to one year is _______________. a. treasury bills b. treasury notes c. treasury bonds d. government securities notes Answer: a Level: medium Section: Risk Free Securities: U.S. Treasury Debt Obligations 9. A properly constructed yield curve must first reflect what factor? a. the term structure of interest rates b. securities of similar default risk c. yields on a number of securities with differing lengths of time to maturity d. yields for the remaining time to maturity Answer: b Level: difficult Section: Term or Maturity Structure of Interest Rates 10. As a result of quantitative easing in 2008, interest rates a. rose to historical highs. b. remained about the same. c. fell to historic lows. d. became very unstable. Answer: c Level: easy Section: Term or Maturity Structure of Interest Rates 11. The Expectations Theory states that the shape of the yield curve indicates investor expectations about ______________________. a. maturity risk premium rates b. yields for the remaining time to maturity c. the term structure of interest rates d. future inflation rates Answer: d Level: difficult Section: Term or Maturity Structure of Interest Rates 12. What theory states that investors are willing to accept lower interest rates on short-term debt securities that provide greater liquidity and less interest rate risk? a. liquidity preference theory b. market segmentation theory c. expectations theory d. differential maturities theory Answer: a Level: easy Section: Term or Maturity Structure of Interest Rates 13. Inflation occurs when an _________________ in the price of goods or services is not offset by an _______________ in quality. a. increase, increase b. increase, decrease c. decrease, increase d. decrease, decrease Answer: a Level: easy Section: Inflation Premium and Price Movements 14. The first outstanding example of inflation due to the issuing of an excessive amount of paper money was in what country or province? a. Germany b. France c. America d. England Answer: b Level: medium Section: Inflation Premiums and Price Movements 15. Ratings of Baa or higher that meet financial institution investment standards are considered __________________. a. single maturity bonds b. junk bonds c. investment grade bonds d. treasury bonds Answer: c Level: medium Section: Default Risk Premiums