Revenue Recognition

advertisement

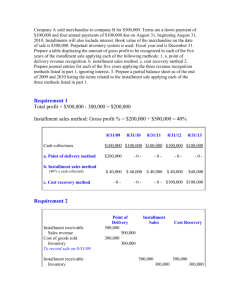

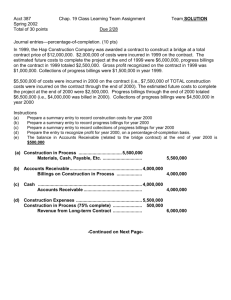

Stice | Stice | Skousen Intermediate Accounting,17E Revenue Recognition PowerPoint presented by: Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2010 Cengage Learning Revenue Recognition Recognition refers to the time when transactions are recorded on the books. The FASB’s two criteria for recognizing revenues and gains were articulated in FASB Concepts Statement No. 5. 8-2 Revenue Recognition Revenues and gains are generally recognized when: 1. They are realized or realizable. 2. They have been earned through substantial completion of the activities involved in the earnings process. 8-3 Revenue Recognition • Revenue is not recognized prior to the point of sale because either: • A valid promise of payment has not been received from the customer, or • The company has not provided the product or service. • Exceptions to these rules: • The customer provides a valid promise of payment. • Conditions exist that contractually guarantee the sale. 8-4 Revenue Recognition AICPA Statement of Position 97-2 gives companies more guidance through a checklist of four factors that amplify the two criteria: a. Persuasive evidence of an arrangement exists. b. Delivery has occurred. c. The vendor’s fee is fixed or determinable. d. Collectibility is probable. 8-5 Appropriate Layaway Accounting Receipt of $100 cash as initial layaway payment: Cash Deposit Received from Customers 100 100 Receipt of final $1,400 cash payment and delivery of goods to customer: Cash Deposit Received from Customers Sales Cost of Goods Sold Inventory 1,400 100 1,500 1,000 1,000 8-6 Appropriate Accounting for a Service Provided Over an Extended Period Seller Company receives $1,000 cash from a customer as the initial sign-up fee for a service. In addition to the sign-up fee, the customer is required to pay $50 per month for 100 months, which is the economic life of this service agreement. 8-7 Appropriate Accounting for a Service Provided Over an Extended Period Receipt of $1,000 cash as initial sign-up fee: Cash Unearned Initial Sign-Up Fees 1,000 1,000 Receipt of first monthly payment of $50: Cash Monthly Service Revenue 50 50 Partial recognition of the initial signup fee as revenue ($1,000/100 months): Unearned Initial Sign-Up Fees Initial Sign-Up Fee Revenue 10 10 8-8 EITF 00-21 A delivered element of a multipleelement arrangement is considered to be a unit of accounting if that delivered element has standalone value and if the fair value of any undelivered element can be objectively and reliably determined. 8-9 Appropriate Accounting for a Refundable Membership Seller Company receives $1,200 cash from each customer as a fully refundable, oneyear membership fee. It is estimated that the cost to Seller Company to provide the membership service to each customer will be $360 for one year. Seller Company can reliably estimate that 40% of the customers will request refunds during the year. Assume all refunds occur at the end of the year. There were 1,000 customers. (continues) 8-10 Appropriate Accounting for a Refundable Membership 8-11 Appropriate Accounting for a Contingent Rental On January 1, Owner Company signed a 1-year rental for a total of $120,000, with monthly payments of $10,000 due at the end of each month. In addition, the renter must pay contingent rent of 10% of all annual sales in excess of $3,000,000. The contingent payment is paid in one payment on December 31. (continues) 8-12 Appropriate Accounting for a Contingent Rental On January 31, sales for the renter had reached $700,000. On July 31, the renter had reached a sales level of $3,150,000. On December 31, the renter had reached a sales level of $5,000,000, of which $1,000,000 occurred in December. (continues) 8-13 Appropriate Accounting for a Contingent Rental 8-14 Asset-and-Liability Approach to Revenue Recognition Example Wilks Company sells a plasma TV screen and 2year warranty to a customer for a joint price of $2,000. All cash is collected upfront. Other relevant data: • Cost of plasma TV screen, $1,500 • Sales price of TV if sold separately, $1,785 • Sales price of 2-year warranty if sold separately, $315 • Amount payable to a TV wholesaler to accept responsibility to provide TV, $1,650 • Amount payable to service company to accept responsibility of providing warranty, $240 (continues) 8-15 Asset-and-Liability Approach to Revenue Recognition Example Journal entry at point of cash receipt: Cash Contract Liability—TV Screen Contract Liability—Warranty 2,000 1,700¹ 300² ¹$2,000 [$1,785/($1,785 + $315)] ²$2,000 [$315/($1,785 + $315)] Journal entries on delivery of TV: Contract Liability—TV Screen Sales Revenue Cost of Goods Sold Inventory 1,700 1,700 1,500 1,500 8-16 Measurement Model The fair values of the performance obligation liabilities create a contract signing. Recall that a TV wholesaler would charge $1,650 for accepting the responsibility of providing the plasma TV to the customer. Likewise, a service company would charge $240 for providing the two years of warranty. (continues) 8-17 Measurement Model The entry to record the cash asset and the two performance obligations created at the contract signing is as follows: Cash Contract Liability—TV Screen Contract Liability—Warranty Revenue 2,000 1,650 240 110 8-18 Revenue Recognition Prior to Providing Goods or Services • Completed-contract method recognizes all income when project is completed. • Percentage-of-completion method recognizes revenue throughout the term of the contract. • Proportional performance method reflects revenue earned on service contracts under which many acts of service are to be performed before the contract is complete. 8-19 Percentage-of-Completion Method Requirements 1. Dependable estimates of: • contract revenues • contract costs • progress toward completion 2. Contract clearly specifies: • enforceable rights of the parties • consideration to be exchanged • manner and terms of settlement (continues) 8-20 Percentage-of-Completion Method Requirements 3. The buyer can be expected to satisfy obligations under the contract. 4. Contractor can be expected to perform the contractual obligation. 8-21 Percentage-of-Completion Input Measures • Cost-to-cost method is perhaps the most popular of the input measures. The degree of completion is determined by comparing costs already incurred with the most recent estimates of total expected costs to complete the project. • Engineers are often called in to help provide estimates. 8-22 Measuring the Percentage of Completion In January 2010, Strong Construction Company was awarded a contract with a total price of $3,000,000. Strong expects to earn $400,000 profit on the contract. The construction was completed over a 3-year period. The table shown next provides the actual cost that Strong experienced and the completion rate. 8-23 Measuring the Percentage of Completion 8-24 Accounting for Long-Term Construction Contracts Continuing with the Strong Construction Company illustration, the direct and indirect costs, billings, and collections are as follows: 8-25 Completed-Contract Method 2010 Construction in Progress Materials, Cash, etc. To record costs incurred. 1,040,000 Accounts Receivable Progress Billings on Construction Contracts To record billings. 1,000,000 Cash Accounts Receivable To record cash collections. (continues) 1,040,000 1,000,000 800,000 800,000 8-26 Completed-Contract Method 2011 Construction in Progress Materials, Cash, etc. To record costs incurred. 910,000 Accounts Receivable Progress Billings on Construction Contracts To record billings. Cash Accounts Receivable To record cash collections. 900,000 (continues) 910,000 900,000 850,000 850,000 8-27 Completed-Contract Method 2012 Construction in Progress Materials, Cash, etc. To record costs incurred. 650,000 650,000 Accounts Receivable Progress Billings on Construction Contracts To record billings. 1,100,000 Cash Accounts Receivable To record cash collections. 1,350,000 1,100,000 1,350,000 8-28 Percentage-of-Completion Method • The entries we recorded using the completed-contract method are also the same entries that would be used for the percentage-of-completion method. • The completed-contract method is “wrapped up” using the entries shown in Slides 30 and 31. The percentage-ofcompletion method requires the entries presented in Slides 32 to 34. 8-29 Completed-Contract Method 2012 Under the completed-contract method, the following entries would be made to recognize revenue and costs and to close out the inventory and billing accounts. Progress Billings on Construction Contracts Revenue from Long-Term Construction Contracts (continues) 3,000,000 3,000,000 8-30 Completed-Contract Method 2012 Under the completed-contract method, the following entries would be made to recognize revenue and costs and to close out the inventory and billing accounts. Cost of Long-Term Construction Contracts Construction in Process 2,600,000 2,600,000 8-31 Percentage-of-Completion 2010 Under the percentage-of-completion method, the following additional entries would be made to recognize revenue. Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts (continues) 1,040,000 160,000 1,200,000 8-32 Percentage-of-Completion 2011 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 910,000 140,000 1,050,000 ($3,000,000 0.75) $1,200,000 (continues) 8-33 Percentage-of-Completion 2012 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 650,000 100,000 750,000 $3,000,000 $1,200,000 $1,500,000 8-34 Revision of Estimate Instead of the previous illustration, assume that at the end of 2011, it was estimated that the remaining cost to complete construction was $720,000 rather than $650,000. This would increase the total estimated cost to $2,670,000, reduce the expected profit to $330,000, and change the percentage of completion for 2011. (continues) 8-35 Revision of Estimate (continues) 8-36 Revision of Estimate • The entries for 2010 would be the same as those shown in the previous example. • All entries for 2011 would be the same except for the entry to record revenue and cost. Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 910,000 80,000 990,000 ($3,000,000 0.73) $1,200,000 (continues) 8-37 Revision of Estimate 2012 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 700,000 110,000 810,000 8-38 Reporting Anticipated Contract Losses Assume the same facts for Strong Construction Company, except the estimated cost to complete the contract at the end of 2011 was $1,300,000. Because $1,950,000 of costs had already been incurred, the total estimated cost would be $3,250,000. (continues) 8-39 Reporting Anticipated Contract Losses 8-40 Anticipated Contract Loss: Percentage-of-Completion (continues) 8-41 Anticipated Contract Loss: Percentage-of-Completion The entry to record the revenue, costs, and adjustments to Construction in Process for the loss in 2011 would be as follows: Cost of Long-Term Construction Contracts Revenue from Long-Term Construction Contracts Construction in Process 1,010,000 600,000 410,000 (continues) 8-42 Anticipated Contract Loss: Percentage-of-Completion 8-43 Proportional Revenue Recognition Most service contracts involve three different types of costs: 1. Initial direct costs related to obtaining and performing initial services on the contract 2. Direct costs related to performing the various service acts 3. Indirect costs related to maintaining the organization to service the contract 8-44 Accounting for Long-Term Service Contracts A correspondence school enters into 100 contracts with students for an extended writing course. The fee for each contract is $500, payable in advance. The initial direct costs related to the contracts total $5,000. Actual direct costs for lessons for the first period are $12,000. The sales value of the lessons completed is $24,000 (if sold separately, $60,000). (continues) 8-45 Accounting for Long-Term Service Contracts Receipt of fees: Cash Deferred Course Revenue 50,000 50,000 Initial direct costs: Liability account Deferred Initial Costs Cash 5,000 Asset account 5,000 Direct costs for lessons actually completed: Contract Costs Cash Expense account12,000 12,000 (continues) 8-46 Accounting for Long-Term Service Contracts Recognize course revenue: Deferred Course Revenue Recognized Course Revenue 20,000 20,000 Recognize contract costs from initial direct $24,000 $50,000 costs: $60,000 Contract Costs Deferred Initial Costs 2,000 2,000 $24,000 $5,000 $60,000 8-47 Revenue Recognition After Delivery of Goods 8-48 Installment Sales Method • Under the installment sales method, profit is recognized as cash is collected rather than at the time of sale. • It is used most commonly in cases of real estate sales where contracts may involve little or no down payment, payments are spread over 10 to 40 years, and a high probability of default in the early years exists. 8-49 Installment Sales Method Riding Corporation sells merchandise on the installment basis, and the uncertainties of cash collection make the use of the installment method necessary. The following data relate to three years of operations. (continues) 8-50 Installment Sales Method 2010—During the Year Installment Accounts Receivable—2010 Installment Sales 150,000 150,000 Cost of Installment Sales Inventory 100,000 Cash Installment Accounts Receivable—2010 30,000 100,000 30,000 (continues) 8-51 Installment Sales Method 2010—End of Year Installment Sales Cost of Installment Sales Deferred Gross Profit—2010 Deferred Gross Profit—2010 Realized Gross Profit on Installment Sales 150,000 100,000 50,000 10,000 10,000 $30,000 33.33% (continues) 8-52 Installment Sales Method 2011—During the Year Installment A/R—2011 Installment Sales 200,000 Cost of Installment Sales Inventory 140,000 Cash Installment A/R—2010 Installment A/R—2011 145,000 200,000 (continues) 140,000 75,000 70,000 8-53 Installment Sales Method 2011—End of Year Installment Sales Cost of Installment Sales Deferred Gross Profit—2011 Deferred Gross Profit—2010 Deferred Gross Profit—2011 Realized Gross Profit on Installment Sales 200,000 140,000 60,000 25,000 21,000 46,000 $75,000 33.33% $70,000 30% (continues) 8-54 Installment Sales Method 2012—During the Year Installment A/R—2012 Installment Sales 300,000 Cost of Installment Sales Inventory 204,000 Cash Installment A/R—2010 Installment A/R—2011 Installment A/R—2012 210,000 300,000 (continues) 204,000 30,000 80,000 100,000 8-55 Installment Sales Method 2012—End of Year Installment Sales Cost of Installment Sales Deferred Gross Profit—2012 Deferred Gross Profit—2010 Deferred Gross Profit—2011 Deferred Gross Profit—2012 Realized Gross Profit on Installment Sales 300,000 204,000 96,000 10,000 24,000 32,000 $30,000 33.33% 66,000 $80,000 30% $100,000 32% 8-56 Cost Recovery Method If the probability of recovering product or service costs is remote, the cost recovery method of accounting can be used. 8-57 Cost Recovery Method All entries are the same except do not record gross profit until all costs are recovered. 2011 Deferred Gross Profit—2010 Realized Gross Profit on Installment Sales 5,000 5,000 (continues) 8-58 Cost Recovery Method Because the cash collected in 2011 for 2011 sales is less than the cost of inventory sold, no gross profit would be recognized in 2011 on 2011 sales. 2012 Deferred Gross Profit—2010 Deferred Gross Profit—2011 Realized Gross Profit on Installment Sales 30,000 10,000 40,000 8-59