GProfit-Retail-LCM methods explained

Gross Profit and Retail Methods

They help us estimate our inventory. Reasons we might need to estimate our ending inventory:

1) Need balances for interim financial statements. A physical inventory might be too costly (explain to them and give examples of how many people and lost production).

2) Inventory is lost in a disaster, such as a fire, flood, tornado, hurricane, or earthquake.

3) Inventory is stolen. Physical count is compared to the amount that should be on hand based on our estimation.

Gross Profit Method:

*Sales – Gross Profit on Sales = Cost of merchandise Sold

*Uses the estimated gross profit for the period to estimate the inventory at the end of the period.

*Usually estimated from the preceding years actual rate.

*Useful for estimating inventories for monthly or quarterly financial statements in a periodic inventory system.

*Works best with companies that have stable/consistent gross profit percentages.

Retail Inventory Method:

*Useful for estimating inventories for monthly or quarterly financial statements in a periodic inventory system.

*Helps identify shortages by comparing the estimated ending inventory with the physical ending inventory.

*Can aid in taking a physical inventory in a retail operation: the items counted are recorded on the inventory sheets at their retail prices instead of costs. Then it is converted to its cost.

*Can be used by companies that NOT use a stable gross profit percentage.

We compare the cost of inventory to their retail value.

*Retailer must track inventory purchases, and beginning inventory at it’s cost and it’s retail value.

*Some retailers take inventory at their retail prices, because that is marked on all the tags, and then convert it to their cost.

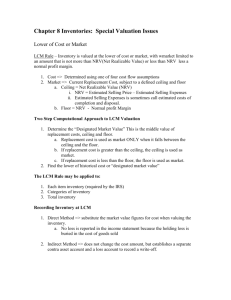

Lower of Cost or Market

Inventory is carried on our books/financial statements at the price/”cost” we pay for it unless:

1) The current cost to purchase it is lower than our costs. – We need to lower our inventory to this replacement cost.

2) The inventory has been damage or become obsolete such that they cannot be sold at their current prices – We need to lover them to their “net realizable value” (estimated sales price – cost to sell or dispose of the items).