Chapter 8 Inventories: Special Valuation Issues

advertisement

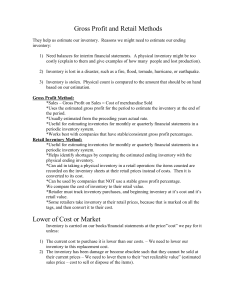

Chapter 8 Inventories: Special Valuation Issues Lower of Cost or Market LCM Rule – Inventory is valued at the lower of cost or market, with wmarket limited to an amount that is not more than NRV(Net Realizable Value) or less than NRV less a normal profit margin. 1. Cost => Determined using one of four cost flow assumptions 2. Market => Current Replacement Cost, subject to a defined ceiling and floor a. Ceiling = Net Realizable Value (NRV) i. NRV = Estimated Selling Price – Estimated Selling Expenses ii. Estimated Selling Expenses is sometimes call estimated costs of completion and disposal. b. Floor = NRV - Normal profit Margin Two Step Computational Approach to LCM Valuation 1. Determine the “Designated Market Value” This is the middle value of replacement costs, ceiling and floor. a. Replacement cost is used as market ONLY when it falls between the ceiling and the floor. b. If replacement cost is greater than the ceiling, the ceiling is used as market. c. If replacement cost is less than the floor, the floor is used as market. 2. Find the lower of historical cost or “designated market value” The LCM Rule may be applied to: 1. Each item inventory (required by the IRS) 2. Categories of inventory 3. Total inventory Recording Inventory at LCM 1. Direct Method => substitute the market value figures for cost when valuing the inventory. a. No loss is reported in the income statement because the holding loss is buried in the cost of goods sold 2. Indirect Method => does not change the cost amount, but establishes a separate contra asset account and a loss account to record a write-off. Estimating Ending Inventory Why would there be a need to estimate ending inventory? 1. Interim Reporting 2. Casualty Losses 3. Incomplete Records Two Methods Used to Estimate Ending Inventory 1. Gross profit method 2. Retail inventory method Gross Profit Method (Must have a consistent GP% or GM%) 1. Add beginning Inventory (BI) to Net purchase to produce Goods Available for Sale (GAS) 2. Net Sales are then multiplied by a gross margin on sales percentage. 3. The result from (2) is subtracted from net sales to produce an estimated Cost of Goods Sold (COGS) 4. The figure in (3) is subtracted from GAS to produce an estimated cost of Ending Inventory. Retail Inventory Method - The Retail Inventory Method can be used for 1. Interim and annual financial reporting in accordance with GAAP 2. Federal income tax purposes 3. Verifying year-end inventory and COGS as an analytical procedure by an independent auditor. 4. Simplifying the physical count at year-end, because the company can take its physical inventory at marked selling prices. This prevents personnel form having to refer to purchase invoices which can be very time consuming 5. Estimating inventory to determine insurance settlements after a casualty - The Retail Inventory Method can be used 1. with any of the major inventory cost flow assumptions (FIFO, LIFO, Average Costs) 2. With either of the inventory valuation methods (Cost or LCM) 3. With either of the LIFO approaches (Unit LIFO or Dollar-Value LIFO) - Three Basic Steps 1. Compute ending inventory at retail 2. Compute the cost to retail ratio 3. Apply the cost to retail ratio to the ending inventory at retail to obtain the ending inventory at cost or at LCM -Two Methods of Applying the Retail Inventory Method: 1. Conventional Retail Inventory Method: a. Computes a cost ratio after net markups but before net markdowns. b. This method approximates the LCM 2. Cost Method: a. Computes a cost ratio after both net markups and net markdowns. Terminology and Guidance in Applying the Retail Inventory Method 1. Net Markups => a net increase in the original selling price, shown as an increase in the retail vale of goods available for sale. a. Markups => an additional markup of the original retail price b. Markup cancellations=> decrease in prices of merchandise that had been marked up above the original retail price. 2. Net Markdowns => a net decrease in the original selling price, shown as a decrease in the retail value of goods available for sale. a. Markdowns => below the original sales price may be necessary because of a decrease in the general level of prices, special sales, soiled or damaged goods, overstocking, and competition. b. Markdown cancellations => these occur when the markdowns are later offset by increases in the prices of goods that had been marked down. 3. Transportation In => increases in the costs of goods available for sale 4. Purchase Discounts => decreases in the cost of goods available for sale 5. Purchase Returns and Allowances => the amount of merchandise available for sale has declined reduce the cost and retail value of goods available for sale. 6. Employee Discounts => the difference between the normal retail value of merchandise sold to employees and the amount actually paid by employees is subtracted along with sales (after the calculation of the cost ratio) from Goods Available for Sale at Retail to arrive at Ending Inventory at Retail. 7. Normal Spoilage => shown at retail value, subtracted along with sales (after the calculation of the cost ratio) from Goods Available for Sale at Retail to arrive at Ending Inventory at Retail. 8. Abnormal Casualty Losses => shown at both cost and retail, the amount of merchandise available for the sale has declined, reduce the cost and retail value of goods available for sale. This loss is usually recoverable through insurance.

![Winter 2010 Quiz 2 Ch 9 10[1]](http://s3.studylib.net/store/data/005849740_1-93a37338ab62849607e52f87564e2567-300x300.png)