3.02 Study Guide Procedures to Calculate Cost of Goods Sold and

advertisement

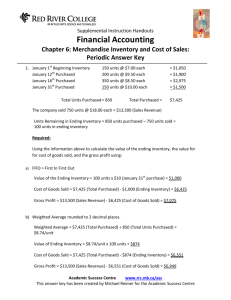

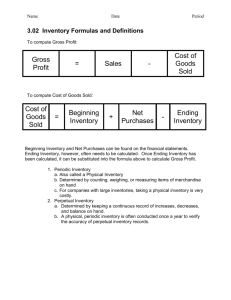

3.02 Study Guide I. Procedures to Calculate Cost of Goods Sold and Gross Profit for a Departmentalized Business A. Procedures to calculate Cost of Goods Sold 1. Start with the Beginning Inventory. 2. Add Net Purchases. 3. Subtract Ending Inventory. B. Procedures to calculate Gross Profit 1. Equals Sales less Cost of Goods Sold 2. Sales is taken directly from the General Ledger. 3. Cost of Goods Sold must be calculated. C. Procedures to calculate Estimated Ending Inventory 1. Procedures to calculate Estimated Ending Inventory using the Gross Profit Method a. List Beginning Inventory. b. Determine Net Purchases. c. Calculate Merchandise Available for Sale. d. Determine Net Sales. e. Calculate Estimated Gross Profit. f. Calculate the Estimated Cost of Merchandise Sold. g. Calculate Estimate Ending Inventory. 2. Procedures to calculate Estimated Ending Inventory using the Retail Method a. List the Beginning Inventory at both cost and retail. b. List the Net Purchases at both cost and retail. c. Calculate Merchandise Available for Sale. d. Calculate the cost ratio by dividing Merchandise Available for Sale – Cost ÷ Merchandise Available for Sale – Retail. e. Subtract Retail Sales. f. Determine retail value of Ending Inventory. g. Determine cost value of ending inventory by multiplying (f) above by the cost ratio found in (d) above. D. Procedures to Prepare a Statement of Gross Profit With Component Percentages 1. Prepare the heading to include the company name, name of statement, and time period for which the statement has been prepared. 2. List statement categories 3. Enter the appropriate amounts in the first department. 4. Enter the appropriate amounts in the second and subsequent departments. 5. Calculate the total amounts for each line item. 6. Calculate component percentages. a. Sales always equals 100%. b. Divide Cost of Merchandise Sold by Sales to get the component percentage. c. Divide Gross Profit by Sales to get the component percentage. d. Do the same for each department and for the total. II. Procedures to Prepare a Departmentalized Worksheet A. Extend the asset, liability, and stockholders equity Trial Balance amounts, plus or minus the adjustments to the Balance Sheet column. B. Extend the income summary, revenue, cost, and direct expenses, plus or minus the adjustments, into the appropriate Departmental Income Statement column. C. Extend the indirect expenses to the Income Statement Debit Column. D. Total and calculate the departmental margin for each department on the worksheet. E. Extend the adjusted balance of Federal Income Tax Expense and record it in the Income Statement Debit column. F. Total the Income Statement and Balance Sheet columns. G. Calculate Net Income. III. Procedures to Prepare a Departmental/Contribution Margin Statement A. Determine Net Sales for each department. B. Determine Cost of Merchandise Sold for each department. C. Calculate gross profit. D. Record direct expenses of the department. E. Calculate the departmental margin.