Health Insurance 101 - Washington Health Benefit Exchange

advertisement

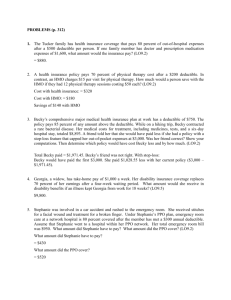

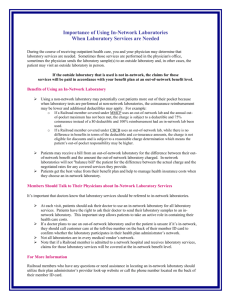

Washington Health Benefit Exchange Insurance 101 Summer 2013 Purpose and Objectives Purpose This presentation is to provide an overview on health insurance and what the Affordable Care Act (ACA) is changing within the structure of insurance plans Objectives Upon completion of this presentation you will: ▪ Have a general understanding of health insurance ▪ Understand common health insurance terms ▪ Understand most common health insurance plans ▪ Understand the benefits of health insurance 2 Today’s Agenda ▪ Health Insurance Basics ▪ The ACA Individual Mandate ▪ Health Insurance Terms ▪ Types of Commercial Health Insurance ▪ Things to consider about health insurance ▪ Understanding health insurance cost-sharing ▪ Benefits of health insurance ▪ Let’s review Explore Your Options 4 Customer Support Field Level Help Key Point Estimated Premium This is the amount of money that you will pay monthly for your health insurance coverage. This does not include any out-of-pocket health care expenses. 5 Cycle without Health Insurance Uninsured consumer can't afford doctor Consumer drops policy due to high price and is now uninsured Consumer delays care, goes to ER Insurers shift cost to consumer Consumer can't pay Providers shift cost to Insurers 6 Health Insurance Basics Key Point ▪ What is Health Insurance ▪ The Value of Health Insurance ▪ The 10 Essential Health Benefits 7 Ten Essential Health Benefit Categories 1. Ambulatory services 6. Prescription drugs 2. Emergency services 7. Rehabilitative and habilitative services and devices 3. Hospitalization 8. Laboratory services 4. Maternity and newborn care 9. Preventive and wellness services and chronic disease management 5. Mental health and substance use disorder services, including behavioral health treatment 10. Pediatric services, including oral and vision care 8 The ACA Individual Mandate Key Point ▪ What is the Individual mandate? ▪ How does the mandate work? ▪ What is Qualifying Health Coverage? ▪ What if someone cannot afford insurance? ▪ Are there Exemptions? 9 Individual Mandate ▪ Require all citizens and legal residents (there are some exceptions) to have health coverage in 2014. ▪ What happens if someone does not meet this deadline? ▪ Will they go to jail? NO! 10 What is the penalty? Key Point 2014: $95 per adult and $47.50 per child (up to $285 for a family) or 1% of income, whichever is greater 2015: $325 per adult and $162.50 per child (up to $975 for a family) or 2%, whichever is greater 2016: $695 per adult and $347.50 per child (up to $2,085 for a family) or 2.5% of family income, whichever is greater 11 the Mandate IS SATISFIED WHEN You were insured for the whole year through a combination of any of the following sources: ▪ Medicare ▪ TRICARE ▪ The veteran’s health program ▪ A plan offered by an employer No Penalty. The requirement to have health insurance is satisfied ▪ Medicaid or the Children’s Health Insurance Program (CHIP) ▪ Insurance bought on your own that is at least at the Bronze level ▪ A grandfathered health plan in existence before the health reform law was enacted 12 Types of Commercial Health Insurance ▪ Health Maintenance – HMO’s ▪ Preferred Provider Organizations – PPO’s 13 Health Maintenance Organizations (HMO’s) ▪ Network providers and primary care physician ▪ Co-payment Key Point ▪ Lower out of pocket expenses “In-Network” Individual must seek care from Health Care Professionals Laboratory Medical Facilities Pharmacy In-Network Providers Only 14 Preferred Provider Organization (PPO) ▪ Contracted Preferred Provider List ▪ More choice of providers Key Point ▪ Higher costs for using non-Preferred Providers “Yes! My provider’s on this list!” Provider List Choosing a provider from the list = lower costs $$ Choosing a provider that is not on the list = higher costs $$$$$ 15 Cost Sharing Key Point ▪ Cost Considerations ▪ Maximum Out-of-Pocket ▪ Your choices determine your costs 16 Understanding Health Insurance Cost Sharing http://www.dol.gov/ebsa/pdf/SBCUniformGlossary.pdf 17 Things to Consider about Health Insurance ▪ Commercial private insurance ▪ Coinsurance or copayment ▪ Plan or calendar year deductible HMO limited to “InNetwork Providers PPO – Your choice of contracted Providers. To find out if a provider is contracted with a specific health care plan either contact the provider’s office or the health care plan and ask. ▪ Contracting ▪ Protection Cost Sharing Coinsurance = a percentage Key Point Deductible Copayment = a predetermined amount 18 Questions to ask Yourself ▪ What is the premium? Monthly? Annually? ▪ What is the deductible? ▪ What is the maximum amount of money my customer might have to pay out of pocket during a policy year? ▪ My customer has specific health care needs. Are these needs covered by the Qualified Health Plans we’re looking at? ▪ Are there any services that are limited in this policy? ▪ What services are excluded in this policy? 19 What are the Benefits of Health Insurance? ▪ Better Health ▪ Peace of mind ▪ Financial protection ▪ Control in health care options ▪ Ability to shop, compare and enroll online through the Washington Healthplanfinder 20 Let’s Review ▪ Health insurance terms ▪ Benefits of health insurance ▪ Health insurance plan types 21 Knowledge Check What is the definition of Estimated Premium? A. The percentage owed for each visit to a provider until the deductible is met. B. The co-payment required until the maximum out of pocket expenses are met. C. A deductible. D. The amount of money paid monthly for health insurance coverage. This does not include any out-of-pocket health care expenses. E. All of the above. 22 Knowledge Check What is health insurance? A. Health insurance is a contract between an individual and an insurance company. B. Health insurance is something bought to protect against fire. C. Health insurance can be “sold” by a Navigator or In-person Assister. D. Health insurance is required for all dogs and cats. 23 Knowledge Check Starting ____________, all individual and small employer health plans must include 10 essential health benefit categories. January 1, 2014 October 1, 2013 March 31, 2013 December 15, 2014 24 Knowledge Check What is the Individual Mandate? A. Every United State’s citizen and legal resident (with no exceptions) must have qualifying health care coverage or pay a penalty. B. Every United State’s citizen and legal resident (with some exceptions) must have qualifying health care coverage or pay a penalty. C. Individuals are mandated to have fire insurance. 25 Knowledge Check This is the amount you and/or your family pay each policy period before your health plan starts to pay for covered services. A. Co-Insurance B. Co-Payment C. Premium D. Deductible 26 Knowledge Check It’s the end of the year, 2014. I am an individual adult that decided not to get qualifying health care coverage. What is the minimum penalty I will be assessed. A. The cost of one year’s worth of premiums based on a bronze level plan. B. The cost of one year’s worth of premiums based on a silver level plan. C. $95 D. The cost of one year’s worth of premiums based on a gold level plan. 27 Knowledge Check In a HMO an individual must seek care from… A. Any provider they wish. B. An In-Network provider. C. A provider they’ve seen in the past. D. The provider that is closest to the individual’s home. 28 Knowledge Check Which of the following is not a characteristic of a PPO? A. They provide a Contracted Preferred Provider List B. Out of pocket costs are lower when an insured individual uses providers from the Contracted Preferred Provider list. C. Insured must use In-Network providers. 29 Knowledge Check An individual policy has a $200 yearly deductible and a 30% coinsurance. This individual is not eligible for any cost sharing reductions. The individual has not been feeling well and decides to go to the Dr. for the first time. Will the individual have any out of pocket costs and if so, what will they be? A. This individual is responsible for the first $200 of the bill. B. This individual is responsible for the first $200 of the bill plus 30% of anything over $200. C. Nothing. This is what they bought health care coverage for. 30 Knowledge Check In the previous scenario the maximum out of pocket expense the insured is responsible for is $2000. The insured has been very ill and needs to go back to the Dr. for further treatment. The insured has paid $1900 out of pocket to date. They have already met their $200 deductible. This Dr. visit is $200. How much will this visit cost the insured? A. $100 B. $60 C. $40 D. $200 31 Knowledge Check The insured has met their Maximum Out of Pocket expense. They go to the Dr. and receive treatment that is not a covered service. What amount of the bill will they be responsible for? A. $200 B. 30% C. All of it. The service was not covered D. None of it. This is why they purchased health care coverage 32 Knowledge Check The insured has met their Maximum Out of Pocket expense. They go to a Dr. and receive treatment for a covered service. The bill is $173.50. How much of this bill is the insured responsible for? A. $17.35 B. $52.05 C. $173.50 D. Nothing 33 Knowledge Check Which of the following is not included in cost sharing reductions? A. Co-payments B. Co-insurance C. Premiums D. Deductibles 34 Questions 35 Congratulations! You have completed Insurance 101 course! Thank you! 37