History

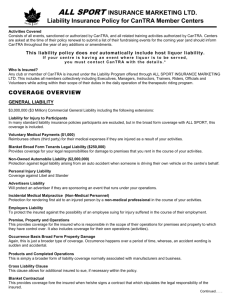

advertisement

CAR CONTRACTORS’ ALL RISKS INSURANCE Rohana Alagiyage Part I – Basic Policy Form Part II – Standstill Insurance CAR Vs EAR EAR- Erection All Risk Determining factor- Value of Erection & Installation works Less than 50% Above 50% - CAR - EAR SUBJECT MATTER INSURED CAR may be taken out for all building and civil engineering projects, such as: Residential and office buildings, hospitals, schools, theatres Production facilities Infrastructure facilities, airports Bridges, dams, tunnels and harbors (wet works) INSURED PARTIES - Jointly CAR insurance should be concluded for all parties concerned to avoid overlaps or gaps in cover: The principal (employer) &/or The main contractor &/or Subcontractors &/or* Project managers &/or Suppliers, if any*. * Un-named SCOPE OF COVER – Two Sections SECTION 1- Material Damage to: Contract works (permanent and temporary works forming part of the contract) Removable of debris Professional Fees Free issue materials Construction Equipment ( Site offices, storage sheds, silos, scaffolding, utilities etc) Construction machinery (earthmoving equipment, cranes, site vehicles) Principal’s existing property SECTION 2 - Third party liability: Bodily injury & Property Damage SECTION 1- Material Damage Cover on ALL RISK basis against unforeseen and sudden physical loss or damage to the insured property from ANY cause other than those specifically excluded SECTION 2 Where the Insured becomes legally liable to pay as damages consequent upon : Accidental bodily injury to third parties Accidental loss or damages to property owned by third party. Occurring in direct connection with construction works insured under Section 1 SCOPE OF COVER - Cont General Exclusions: Political risks, war or warlike operations, SRCC Nuclear, radioactive contamination Willful act or willful negligence of the insured or their representatives Cessation of work whether total or partial SCOPE OF COVER - Cont Special Exclusions to section I: Consequential loss of any kind Faulty design Defective material / workmanship (faulty part only) Mechanical and/or electrical breakdown Wear and tear, corrosion, gradual deterioration Road vehicles, waterborne vessels and air crafts Inventory losses SCOPE OF COVER - Cont Special Exclusions to section II: Property insured or insurable under Section I Vibration, removal, weakening of support Liability for bodily injury to employee/ workmen of insured parties Liability for damage to property belonging to insured parties Motor , Marine & Aviation liability Contractual liability PERIOD OF COVER Contractors’ All Risks Insurance Works cover Maintenance period Operational covers (Fire, Allied perils, TPL) Inception date Commencement of works PERIOD OF COVER Cover ATTACHES from the commencement of work or after the insured items have been unloaded at site or the inception date as specified in the policy Whichever is later And TERMINATES when the completed structure is taken over or put into service or the expiry date specified in the policy Whichever is earlier CALCULATION OF SUM INSURED • • • SI must be equal to the amount stated in the building contract plus a value of any free issue material Contractually, insured contractor may be required (e.g. Under FIDIC contracts) to include 15% of CV towards costs of rectification, removal of debris and professional fees Separate sums insured for: Construction machinery and construction plant and equipment (equal to NRV) Existing property and clearance of debris (Loss limits) Third party liability – Section II (as per contact conditions) PRINCIPLE EXTENSIONS TO BASIC CAR COVER Section I: Strike, Riot and Civil Commotion Maintenance Visits Vs Extended maintenance Expediting Expenses Airfreight expenses Offsite Storage Inland Transit Designer’s Risk Contracts works taken over or put into service PRINCIPLE EXTENSIONS TO BASIC CAR COVER Section II: Cross Liability TPL cover during maintenance period Vibration, removal or weakening of support PART 2