Health Insurance 101 - University of Georgia

advertisement

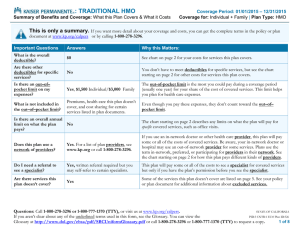

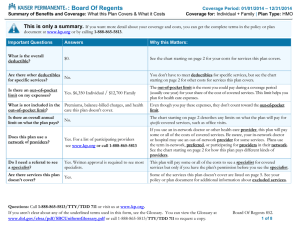

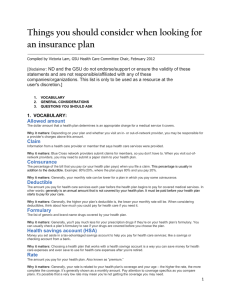

Health Insurance 101 Health Insurance 101 What is Health Insurance? • Health insurance is a contract between a consumer and an insurance company. • Health coverage helps people pay for medical costs and protects them from very high expenses. • With a plan, insurance companies and consumers both pay for health care. Health Insurance 101 Health Insurance Terms • The premium is the amount paid for health coverage. Consumers and/or their employers usually pay it monthly, quarterly, or yearly. • Premiums vary depending on: health care coverage and deductibles, copayments and coinsurance. Health Insurance 101 Health Insurance Terms (cont.) • The deductible is the amount consumers owe for health care services before the health insurance or plan begins to pay. Generally, a plan will have two deductibles: in-network and out-ofnetwork deductibles Health Insurance 101 Deductible Examined • Consumer has a $1,200 deductible • Consumer has a medical procedure and is charged $1,200 • Insurance company only allows $1,000 for procedure • Insurance company pays nothing, consumer pays $1,000 and has $200 of deductible amount left Health Insurance 101 Health Insurance Terms (cont.) • The copayment (or copay) is a fixed amount (e.g. $15) consumers pay for a covered health care service, usually at the time of service. Copays vary by the type of covered service, such as seeing a doctor, filling a prescription, or going to the emergency room. Co-pays may be lower for services delivered by primary care doctors than by specialists. Copays for in-network providers are typically lower than for out-of-network providers. Health Insurance 101 Health Insurance Terms (cont.) • Coinsurance is the percent of the cost of covered health care services paid by consumers. • The consumer pays coinsurance plus any deductibles and copayments that are owed. Health Insurance 101 Coinsurance Examined • Consumer has met the deductible • Consumer has a 80/20 coinsurance requirement • Consumer has $100 in covered medical expenses • Insurance company pays $80 and consumer pays $20. Health Insurance 101 Health Insurance Terms (cont.) • The coinsurance cap or stop loss provision places a cap on the amount of money the consumer pays for covered services after the deductible. • Coinsurance caps do not apply to copayments. Health Insurance 101 Health Insurance Terms (cont.) • Claim is a request for payment that a consumer or healthcare provider submits to the health insurance company for items or services rendered. Health Insurance 101 Health Insurance Terms (cont.) • Allowed amount is maximum amount allowed to be paid for covered health services by a health insurance company. • May also be called “eligible expense,” “payment allowance,” or “negotiated rate.” • If a provider charges more than allowed amount, the consumer usually doesn’t have to pay the difference (if using a participating provider). Health Insurance 101 Health Insurance Terms (cont.) • Balance billing: when the provider bills the consumer for the difference between the provider’s charge and the amount allowed by the health plan. Health Insurance 101 Balance Billing Examined • If the provider charges $100 and the allowed amount is $70, the provider may bill the consumer for the remaining $30. • Some providers may not balance bill consumers for covered services. This is the case with a preferred or participating provider. • It’s important to understand a plan’s provider network and whether it costs more to see certain providers. Health Insurance 101 How to Get Insurance Health insurance inside the marketplace – Consumers can enroll in health coverage through the marketplace beginning on November 15, 2014. Health insurance outside the marketplace – Consumers can obtain health coverage through a health insurance company that sells insurance outside of the marketplace. Job-based insurance – Consumers who are currently employed may be able to purchase health coverage through their employer, called employersponsored or jobbased. If consumers lose or quit their job, they may extend the job-based health insurance through a program called Consolidated Omnibus Budget Reconciliation Act (COBRA). Instead of choosing COBRA, consumers may also role in coverage through the marketplace instead. Insurance under a parent’s policy – Younger adults ( up to 26 years old) are eligible to enroll in health coverage under their parents health insurance plans if those plans cover dependents. Health Insurance 101 Additional Health Coverage Options Medicare – Medicaid – a Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with EndStage Renal Disease (permanent joint federal and state administered health insurance program for low income families and children, pregnant women, the elderly, people with disabilities, and in some states, other adults. kidney failure requiring dialysis or a transplant, sometimes called ESRD). . Children’s health insurance program (CHIP) - a program jointly funded by state and federal government that provides health coverage to low income children and, in some states, pregnant women, and families who earn too much to qualify for Medicaid, but they cannot afford private health insurance. TRICARE – is the Department of Defense (DoD) healthcare program available to eligible members and their families of the seven uniform services: the US Army, US Navy, US Air Force, US Marine Corps, US Coast Guard, commissioned Corps of the US Public health service, and the National Oceanic and Atmospheric Administration. Veteran affairs (VA) health benefits – the Department of Veterans Affairs (VA) administers a variety of benefits and services that provide financial and other forms of assistance to service members, veterans, their dependents and survivors. As part of these benefits and services, the VA provides health coverage for eligible veterans who served in the US military. Health Insurance 101 Different Types of Health Insurance Plans Health Insurance 101 Types of Health Insurance Plans (cont.) • Preferred Provider Organization (PPO) - a type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. Consumers pay less if they use providers that belong to the plans network. Consumers can visit doctors, hospitals, and providers outside of the network at an additional cost. Referrals are often not needed to see specialists. In exchange for greater access to providers, premiums are generally higher in a PPO than in an HMO. Health Insurance 101 Types of Health Insurance Plans (cont.) • Point of Service (POS) Plan – a type of plan in which consumers pay less if they use doctors, hospitals, and other healthcare providers that belong to the plan’s network. With this type of plan, a consumer may go to outof-network providers at a higher cost. POS plans may also require consumers to get a referral from the primary care doctor in order to see a specialist. Health Insurance 101 Types of Health Insurance Plans (cont.) • Health Maintenance Organization (HMO) - a type of health insurance plan that usually limits coverage to care from in-network doctors who work for or contract with the HMO. It generally will not cover out-of-network care except in an emergency. An HMO may require consumers to live or work in its service area to be eligible for coverage. In exchange for the limited access to providers, premiums are typically lower in an HMO than in other types of plans. Health Insurance 101 Types of Health Insurance Plans (cont.) • High Deductible Health Plan (HDHP) - a plan that features higher deductibles than traditional insurance plans in exchange for lower monthly premiums. HDHPs can be combined with a health savings account (HSA) or a flexible spending account (FSA). Health Insurance 101 Types of Health Insurance Plans (cont.) • Catastrophic Health Plan – a type of plan that is designed to provide emergency service and to protect consumers from unexpected medical costs, but has limits on regular doctor visits. The premium amount that a consumer pays each month for health care is generally lower than other types of plans. Out-of-pocket cost for deductibles, copayments, and coinsurance are generally higher than other plans. 1-800-318-2596 TTY Users: 1-855-889-4325 HealthCare.gov