Opportunities to work with health and disability providers

advertisement

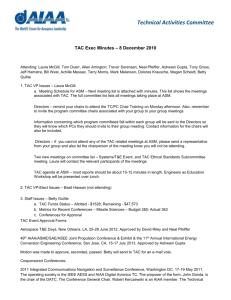

Opportunities to work with health and disability providers. Clare Amies Health Services Group WorkSafe Victoria/ TAC Expanding our approach: – Medical and community service models both important – Need to invest in community providers: allied health and disability providers – A partnership approach: understanding there is a shared commitment to maximising client outcomes – Improve capacity to improve injured workers and TAC clients experience and outcomes – Examples: Network Providers; Disability Services Strategy: ReNew 2 Network Providers – Focus on RTW and RTH A key strategic program for WorkSafe and TAC Aim Improve health and return to work outcomes for injured workers and TAC clients Strategy Establish networks of healthcare providers that have an interest in treating injured workers and TAC clients Partnering with providers to develop their skills and experience in managing compensable injuries Shared accountability on reviewing performance and continuous quality improvement 3 Network Providers – Key features Key Features Clients retain right to choose healthcare provider Specialised group of highly skilled and experienced providers: – Occupational physiotherapists – Network occupational therapists – Network pain management programs Higher remuneration for providers Training and education for providers Aimed at improving health and RTW outcomes for injured workers and TAC clients through… Expectations and shared goal setting Increased client engagement during recovery Earlier contact with the employer Focus on RTW as a treatment modality Early management of persistent pain Service agreements with providers 4 How are we tracking: – – – – Still in pilot phase Expanded provider numbers in physiotherapy Keen interest from providers to be involved All Networks are showing positive impacts in initial evaluations e.g. RTW, return to Health – All Networks have ongoing model refinements e.g. better understanding of who certain interventions work for, therefore better targeting service models to IW’s or TAC clients needs – Client experience of Network Providers more positive (client survey on provider satisfaction – WorkSafe & TAC) 5 Network Providers - Evaluation of Network Pain Improved RTW outcomes: – For WorkSafe – Network outperformed Non-Network pain management in reducing the number of days/month in receipt of weekly compensation for clients who were on a partial return to work at the time of commencing the pain management program. – Network outperformed Non-Network in the cohort of claims considered to be in receipt of intermittent compensation for the 12 months prior to the pain management program – For TAC – There was a greater percentage reduction in the number of active claims in receipt of LOE in the Network cohort post pain program compared to Non-Network Improved clinical outcomes: – For WorkSafe – Both Network and Non-Network pain management programs decrease medical and allied health expenditure across the services examined with Network marginally outperforming Non-Network pain management – Pain management programs are particularly effective at reducing ongoing physiotherapy, allied health and GP expenditure – The structured nature of pain management supports superior clinical reporting – For TAC – Network decreased medical and allied health expenditure across selected key service types by 50%, far outperforming Non-Network which experience a 30% increase across these services. Network Building – 100% of Network Pain Management providers felt positive about being part of the initiative. – 80% of respondents indicated their interactions with TAC claims and WorkSafe claims had improved substantially Network Providers - Evaluation of Network Occupational Physiotherapy RTW outcomes Health outcomes Those off work and first physio within 90 days (n=172): – 14% improvement in return to work percentage at 3 months – No difference in return to work percentage at 6 months – 15% reduction in days off work following first physiotherapy session – – – – Financial outcomes – Those off work & first physio within 90 days (n=172): – 10% reduction in income replacement paid – 25% reduction in healthcare costs – No difference in physio costs Those at work & first physio within 90 days (n=224): – 25% reduction in healthcare costs – La Trobe University study OP clients vs standard physiotherapy clients 21 matched participants Significant improvement in OP clients RTUA and physical health scores between 3 to 6 months Maintenance of mental health scores between 3 to 6 months for OP clients Findings provide support for Occupational Physiotherapy Network Providers - Evaluation of Network OT Measure 2 Liability Impact: : The difference between Attendant Care (AC) Actual and Attendant Care Expected comparing Network OT vs Non Contracted OT's – Tool: PWC AC Projections versus Actual post initiative implementation – Result: 0 to 3.5% less growth in AC on network OT claims compared with AC on non network claims. Measure 3 Health Outcomes: Goal orientated Therapy Outcome, – Tool: SMART Goals and GAS Results (Network OT only) – Result: TAC Business Intelligence has completed a statistical analysis of the GAS data which shows that 75% of all clients / injured workers therapy goals have been achieved as expected or greater. HSG have invested considerable resources into increasing the Network OT’s capabilities around setting good SMART goals and GAS indicators. With this investment and time it could be expected for this goal attainment percentage to increase. Client Focus - Maxim ising Independence Treatm ent focuses on em pow ering the client to m anage their ow n injury (Results from quarterly clinical audits beginning October 2010) 120.0% Percentage results Measure 1 Provider Capability : Treatment focuses on empowering the client to manage their own injury, – Tool: Quarterly Clinical Audit (Network OT Treatment Plans vs non contracted OT OTSPs) 100.0% 80.0% Non Contracted OT's 60.0% Netw ork OT's 40.0% 20.0% 0.0% Alw ays demonstrated (100%) 1 Alw ays demonstrated (100%) Alw ays demonstrated (100%) 2 3 Quarterly audit num ber Network OT's are consistently showing better results than non contracted OT's on this measure. GAS Results for Network OT as at August 2011 Provider Strategy - Independence The Provider Strategy focuses on three service areas: Attendant Care, Allied Health, Hospitals Why a Provider Strategy? • Existing services not always aligned with creating independence for clients • Currently purchase limited service models with limited focus on individual needs • Growth in attendant care and paramedical costs • Qualitative research indicates lack of client satisfaction • Lack of clear evidence base or outcome measures • Provider feedback re: lack of clear expectations and alignment in the sector • Workforce capacity & capability issues in attendant care 9 Key streams of work: Service models: – New support models to align with the TAC housing and accommodation strategy to build and purchase suitable housing – Develop or purchase service models to align with the TAC Independence model (e.g. within or outside attendant care) Provider Capability/Capacity: – As with Networks, work with our providers to improve the capacity/capability of our community providers TBI/ABI and Behaviours of Concern: – Develop greater understanding of the support needs and current gaps for clients – Identify service models that better meet client needs Partnerships: – Identify opportunities to partner with other funders, peak bodies and/or providers – Opportunities to partner on capability initiatives, new service models, developing evidence base on service models 10 ReNew Services – Neurobehavioural rehabilitation program for TAC clients (E.W Tipping) – New service model for TAC clients; based on the U.K. BIRT model (established August 2011) – For Victorians who have sustained a TBI/ABI and who require rehabilitation for behaviours we can find challenging – 20 bed Residential Unit and a transitional unit to become operational – Evaluation and performance frameworks developed with ReNew, regular reporting implemented – Worked closely with E.W. Tipping and BIRT on the service model and ongoing to ensure appropriateness/effectiveness of model 11