Fetakgomo Revenue Management

advertisement

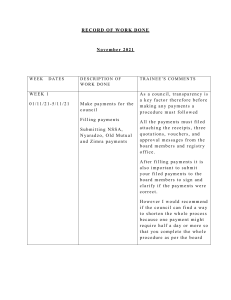

REVENUE MANAGEMENT PRESENTATION IN RURAL AREA / ESKOM AREA 1 2 3 4 5 6 BACKGROUND REVENUE MANAGEMENT AND SOURCES PRACTICAL CREDIT CONTROL STRATEGIES CURRENT CHALLENGES ALTERNATIVE REVENUE SOURCES CONCLUSION Section 229 of the Constitution empowers municipalities to impose taxes and surcharges as along as the imposition of the taxes and surcharges does not conflict with the national legislation. It is against this background that FTM developed the revenue enhancement strategy with an intention of providing practical solution to the concept of revenue management. Using council as the champion of revenue management Prioritising top 100 debtors. Mapping of debtors in terms of weight. Alignment of indigent management policy with the credit control policies. Using SCM processes as the key credit control measures. Timeous delivery of bills Improved data integrity Hand over debtors above 90 days to debt collectors Property Rates; Refuse Removal; Traffic related revenue sources e.g. learner licences, traffic fines, renewal etc; Rental of council facilities; Sundry income Rural nature of the municipality Lack of buy in by key some of the stakeholders (Government departments not showing interest to pay for the property rates etc. Lack of understand by the community on how municipality function. Poor culture of payment of services by the residence. Identifying new revenue sources in line with municipal fiscal powers and functions Act. Failure for municipality to collect monies due undermines the provision of key services to the society and payment of services by residents is a good indication of democratic accountability.