Capital Structure and Dividend Lecture

advertisement

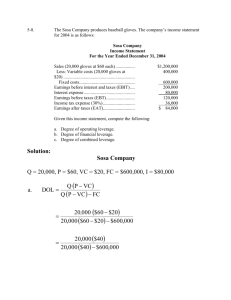

Goal of the Lecture: Understand how to determine the proper mix of debt and equity to use to fund corporate investments. Capital Structure and Dividend Policy 1. Capital Structure Theory - What Percent of Capital Should Be Raised Through Selling Stock, Bonds and Preferred? 2. Dividend Policy Theory – how much cash to pay out to shareholders instead or retain in the firm. Time Permitting We May Cover the Effects of Fixed Financial Costs in a Firm’s Risk a. Business or Operating Risk b. Financial Risk Firm’s Weighted Cost of Capital (WCC) General Formula WCC = Wdebtki + Wpskps + Wsks where, Wdebt = weight of debt in firm’s capital structure Wps = weight of preferred stock Ws = weight of common stock ki = after-tax cost of debt kps = after-tax cost of preferred stock ks = after-tax cost of common stock Calculating Capital Structure Weights From Market Prices If Firm Has No Target Weights FIRM SECURITIES VALUES Common stock = 1,000,000 shares * $50/share= 50 mm Debt = 50,000 bonds * $950/bond = 47.5 mm Preferred = 100,000 shares * $90/share = 9 mm 106.5 mm Figure the Weights? Weights Ws Wd Wps = 50/106.5 = 47% = 47.5/106.5 = 45% = 9/106.5 = 8% WCC = .45(6.30) + .08(11.11) + .47(25) = 2.84 + .89 + 11.75 = 15.48 Note: You may need to make adjustments for projects that are not average risk projects such as projects for different divisions. Capital Structure Refers a Firm’s Various Sources of Long-Term Financing as a Proportion of Total Capital Manager’s Goal: Increase EPS Through Leverage, But by Enough to Offset the Increase in Risk so that Stock Price Increases. Two Capital Structure Theories of Leverage a. Traditional - Share Price will Increase with Leverage up to a Point (Too Much Risk) b. Net Operating Income Theory - Any Increase in Leverage and EPS will be Offset by Increased Risk (Assuming No Taxes) Leaving the Share Price Unchanged. Illustration using the constant growth model. P = D1/ (ks - g) Increasing leverage may increase D1 and g but will increase beta (risk) so that ks will increase. Theoretically, P stays the same because the positive effect of the increase in D1 and g is just offset by the negative effect of the ks increase. Traditional Theory - As Debt is Added, D/E Rises But kavg Falls Because Debt has Lower Cost. Eventually kE and kD Rise Due to Rising Bankruptcy Probabilities, Pushing kavg Up Ke Cost of Capital Kavg minimum Kd optimal Debt to Equity Ratio Net Operating Income Theory - (Modigliani and Miller) No optimal capital structure and no advantage of debt over equity financing. kavg stays constant no matter what the debt level. Unlike in the graph above, the kavg line would be flat with no minimum kavg (assumes no taxes). Net Operating Income Theory - Modigliani and Miller With Corporate Taxes Changes the Theory’s Implications REMEMBER: The Value of the Firm Is the Discounted Value of It’s After-Tax Cash Flows Going to Bondholders and Stockholders. Without Income Taxes - income goes to 1. stockholders 2. bondholders With Income Taxes - income goes to 1. stockholders 2. bondholders 3. government. Because interest paid on debt is tax deductable we can reduce the amount going to the government (and increase the amount going to bondholders and stockholders) by increasing the amount of debt in the capital structure. Initial Capital Structure Increase Debt Financing S S B G B G S is the portion of EBIT paid to Stockholders B is the portion of EBIT paid to Bondholders G is the portion of EBIT paid to Government Value of the Levered Firm With Corporate Taxes Is the Value of the Unlevered Firm Plus the Present Value of the Debt’s Tax Shield Assume no growth in EBIT. The unlevered firm’s value, is Vu = EBIT (1- T) k su where EBIT = earnings before interest and taxes T = corporate tax rate ksu = the unlevered cost of equity capital Then the value of the levered firm, VL is VL = VU + (present value of the tax shield from debt) VL = VU + (tax rate)(value of debt) = VU + (T)(B) When there is a difference in personal tax rates on bond and stock income then adjust the equation above to VL = VU + [1 - (1 - T)(1 - Ts)/(1 - TB)]B where T Ts TB B = corporate tax rate = stock tax rate = bond tax rate = face value of bonds Because bondholders demand the same after tax rate of return as stockholders (assuming equal risk), if TB > Ts, then interest rates on bonds must be higher than stock returns so that after tax returns will be equal. This reduces the advantage of debt. Capital Structure Example Example: SI Inc. is an all-equity firm that generates EBIT of $3 million per year. Its cost of equity capital is 16 percent, its marginal corporate tax rate is 35 percent, and it has 1 million shares outstanding. a What is SI’s market value? b. If SI issues $4 million of debt and uses it to buy back some shares, what will be its new market value and new equity value? c. Show that the change in per-share value goes up even though total equity decreases. a. Vu = $3,000,000(1 - .35) / .16 = $12,187,500 b. VL = $12,187,500 + (.35)($4,000,000)=$13,587,500 equity = $13,587,500 - $4,000,000 = $9,587,500 c. Before buyback, share price= $12,187,500/1,000,000 = 12.187 After buyback of $4,000,000/12.187 = 328,218 shares we get a new price of P =$9,587,500/(1,000,000 - 328,218) = 14.27 Dividends and Retained Earnings 1. DIVIDENDS = EARNINGS - RETAINED EARNINGS Over 60% of all funds used by firms are internally generated 2. DIVIDEND POLICY INCLUDES a. Level of dividends - dollars per share or Payout Ratio Div. Payout Ratio = Dividends per share / earnings per share Payout ratio is more comparable across firms than dollars per share b. Stability of Dividends - non-decreasing 3. STABILITY OF DIVIDENDS a. Dividends per share - increase with earnings b. Long range target payout c. Constant payout ratio => constant % of earnings. d. Residual dividend policy - payout only what is left over after investments - no regard to stability. 4. AVERAGE PAYOUT RATIOS IN US IS BETWEEN 30 AND 60%. QUESTION: Why might firms wish to keep dividends stable or non-decreasing? Avoid bad signals. 5. THEORIES OF DIVIDEND PREFERENCE a. Dividend Preference Theory – based on risk b. Dividend Aversion – high taxes on dividends taxes can be delayed on capital gains => retain more earnings c. Signaling - unexpected changes signal info d. Preference for current income by shareholders e. Flotation costs -> save by retaining f. Transaction costs -> trading costs to sell stock g. Present shareholders may want to maintain control –retain cash to avoid new equity issue. 6. DIVIDEND IRRELEVANCE a. Investors can undo –buy or sell stock b. Assumes it is costless to buy and sell. 7. FACTORS AFFECTING DIVIDEND POLICY a. Legal constraints - State rules that dividends may not exceed current income plus cumulative retained earnings. No liquidating dividend. b. Bond Indentures - same – stricter c. IRS – no unwarranted retention to avoid taxes d. Controlling owners dictate dividend policy. e. Investment Constraints - large investments f. Stable are earnings allows higher payout utilities g. Access to capital markets - small firms retain more earnings. 8. THE POLICY MOST COMMONLY FOLLOWED IS A SMOOTHED, RESIDUAL DIVIDEND POLICY. a. Maintain target payout and capital structure. 9. DIVIDENDS, FINANCING AND CAPITAL STRUCTURE ARE CONNECTED. Cumulative dividends paid affects how much funds the firm will have to raise. Capital structure weights change as earnings are retained -> equity increases. 10. DIVIDEND REINVESTMENT Shareholders still pay tax But may get a break on stock price. 11. REPURCHASE STOCK May increase price per share. 12. STOCK SPLITS, REVERSE SPLITS, AND STOCK DIVIDENDS Many of these announcements should have little affect on stock price unless they are signals. Fixed Operating Costs Produce Operating Leverage and Fixed Financing Costs Produce Financial Leverage But Leverage Creates Risk Business Risk - Factors Affecting: a. Sensitivity of Sales to Business Cycle b. Firm Size and Industry Competition c. Operating Leverage (Proportion of Fixed to Variable Operating Costs in Total Costs) d. Input Price Variability e. Ability to Adjust Output Prices Degree of Operating Leverage DOL = % Change in EBIT / % Change in Sales = [Sales - Variable Costs] / EBIT = 1 + Fixed Cost / EBIT Financial Risk - Factors Affecting: a. Variability of Shareholder Earnings Per Share (EPS) which is also Earnings After Taxes (EAT) b. Financial Risk Increases with Leverage Degree of Financial Leverage DFL = % Change in EPS / % Change in EBIT = EBIT / [EBIT - I - L - d/(1 - T)] where, I = Interest, L = Lease Payments, and d = preferred dividends (Grossed Up by [1 - T] because there is No Tax Deduction) Degree of Combined Leverage: Operating and Financial DCL = DOL x DFL = % Change in EPS / % Change in Sales = [Sales - Variable Costs] / [EBIT - I - L -d/(1 - T)] Note: The larger is DCL, the larger the firm’s return variance . Leverage - DOL, DFL, and DCL “DOL - As sales rise, fixed cost per unit falls. DFL - Fixed Cost Financing causes EPS to fluctuate. DCL - Combined effects of operating and financial leverage.” Example: Clark Comp. has the following income statement in millions. Sales Variable Costs Revenues Before Fixed Costs Fixed Costs EBIT Interest EBT Taxes (30%) EAT 50 24 26 13 13 3 10 3 7 a) Calculate DOL, DFL, and DCL. b) If sales increase by 20%, by what % will EAT increase and to what amount? a. DOL = (50-24)/13 = 2.0 DFL = 13/(13-3) = 1.3 DCL = 2 x 1.3 = 2.6 b. EAT % Increase = .20 x 2.6 = .52 = 52% EAT Amount Increase = 7 x 1.52 = $10.64