Financial & Operating Leverage: Formulas & Examples

advertisement

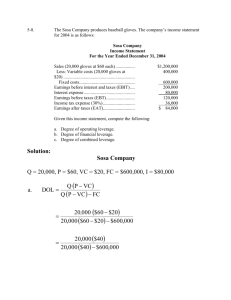

An increased means of accomplishing some purpose Ex: lifting of heavy objects with the help of leverage. TYPES OF LEVERAGE FINANCIAL LEVERAGE: It arises out of fixed financial charges OPERATING LEVERAGE: It arises out of fixed operating costs Financial Leverage The amount of debt used to finance a firm's assets. A firm with significantly more debt than equity is considered to be highly leveraged. MEASURE OF FINANCIAL LEVERAGE The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called financial leverage Degree of financial leverage = EBIT / EBIT-I EBIT = Earnings before Interest and Taxes I= Interest Degree of Financial Leverage = % changes in EPS / % change in EBIT Operating leverage: The operating leverage has got a bearing on fixed costs. If the firm employs more of fixed costs in its production process greater will be the operating leverage fixed costs Operating leverage = contribution/operating profit Ex: sales 5000unists @rs 6 per unit variable expenses Rs2 per unit fixed expenses 10000 When fixed costs are lower the operating leverage shows a lesser and will have more EBIT Combined Leverage: Financial Leverage exists with the use of debt funds, and it is determined by the mix of debt and equity funds operating leverage arises from the use of fixed costs and it is determined by the firms cost structure use of debt involves payments of interest, and fixed cost Combined leverage = OL X FL = contribution/EBIT X EBIT/EBIT-I Contribution /EBIT- I Degree of combined leverage = DOL X DFL (%change in EBIT / %change in Sales) X (%change in EPS / %Change in EBIT) A company has sales of 500000 variable costs 300000 fixed costs 100000 and long-term loans of 400000 at 10% rate of interest calculate the composite leverage Sales 2000000 variable cost 1400000 amd fixed cost 400000 and debt of 1000000 at 10% rate of interest find out combined leverage if the firm wants to double its EBIT how much of a rise in sale needed on percentage basis Calculate the percentage of change in EPS if sales are increased by 5% EBIT 1120 (Lakhs) EBT 320 Fixed cost 700 Sales revenue 1000000 Variable cost 600000 Fixed cost 250000 Calculate degree of operating leverage 1250000 750000 250000 Percentage change in EBIT/ Percentage change in sales P company calculate operating and financial leverages. The company’s current sales revenue is 1500000 lakhs and sales are expected to increase by 25% 900000 incurred on variable expenses for generating 15lakhs sales revenue the fixed cost is 250000. The company has 20 lakhs equity share capital share capital and 20 lakhs 10% debt capital Rs 10 per equity share and 50% tax rate Ex: A firm is considering tw0 financial plans with a view to examining their impact on EPS total funds required 5,00,000 Financial plan 10%Debt 4,00,000 1,00,ooo Equity 10Rs each 1,00,000 4,00,000 The earnings before interest and tax are assumed50,000 , 75000, 125000 tax 50% Ex: A Limited company has equity share capital of 500000 divided into shares of 100 each it wishes to raise further 300000 for expansion The company plan are 1)All common stock 2)100000 inequity and 200000 in 10% debentures 3) all debt 10% 4)100000 equity and 200000 in 8% preference shares The company earnings before interest and tax are 150000 tax rate 50% You are required to determine earnings per share in each plan