Alternative Financial/Organizational Structures for Farm Businesses

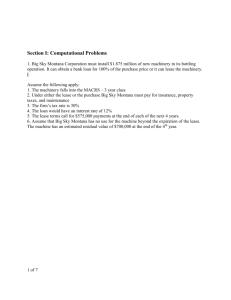

advertisement

Alternative Financial/Organizational Structures: How Should I Organize and Finance My Farm Business? Objectives • Identify criteria for choosing a financial/organizational structure • Describe the options – – – – – Legal organization Business arrangement Leasing options Equity debt Financial/Organizational Structure of the Farm Firm: Choices and Options • • • • • Legal organization Business arrangement Leasing options Equity Debt Financial/Organizational Structure Alternatives Legal Organization •Sole proprietorship •Partnership •Corporation •Land trust •Cooperative Business Arrangement •Independent •Contract •Subcontractor •Joint venture •Franchise •Licensing Leasing Options Equity Debt •Real estate •Sources •Loans lease –Initial –Maturity •Facility/equip capital –Interest ment contributions rate •Capital/fin–Retained –Amortizati ancial earnings on •Leveraged –Stock arrangement s •Sale–External Leasebacks equity –Collateral •Business –Conversion Practices s –Payout •Bonds policy –Convertibl –Family e transfers –Callable Criteria for Choice • • • • Control Returns Risk Maturity/permanence/liquidity Organizational Structure and ROE Ownership 26% Leverage 50% 70% Mix of rent, Mean 17.0% 20.1% 24.9% share, own Std. Dev. 5.3% 7.1% 10.0% All owned Mean 9.9% 10.7% 12.3% Std. Dev. 2.4% 3.5% 5.5% Rent Mean 25.6% 30.7% 37.9% $110/acre Std. Dev. 11.8% 15.2% 20.0% Share Mean 20.3% 23.9% 28.9% (50/50) Std. Dev. 5.8% 7.5% 9.8% Financial Performance of Pork Production Units Financial Structure 0% Debt 40% Debt Mean Return on Equity (%) Probability of Default Independent farrow to finish 17.0 0.0 23.5 0.05 56.5 0.26 Efficiency and marketing incentive contract 10.4 0.0 12.5 0.00 23.1 0.33 Death loss incentive only 11.3 0.0 14.0 0.00 27.6 0.11 Pork Production Business Arrangement finishing contract Mean ProbReturn on ability Equity of (%) Default 80% Debt Mean Return on Equity (%) Probability of Default Legal Organization • Sole proprietorship • Partnership – General – Limited • Corporation – Regular – Subchapter S Legal Organization • Limited liability company • Land trust • Cooperative Business Arrangement • • • • • • • Independent producer Contract producer Subcontractor Joint venture Strategic alliance Franchise agreement Licensing Contracting Options • • • • Marketing agreements Profit/Loss sharing Profit/Loss sharing with provided resources Flat fee plus efficiency bonuses What Do End Users Want From Producers? • • • • • • Cost competitiveness Consistent quality Timely delivery Predictability/reliability Flexibility/adaptability A qualified supplier What Do Producers Want From End Users? • • • • Equitable reward and risk allocation market presence/position Dependability Access to innovation – products – markets – technologies Types of Networks: • Information networks • Marketing networks • Production networks Benefits of Networking • • • • Capture proven technology Capture real economies Improve product quality and market access Utilize production, marketing, and information systems Limitations of Networking • • • • Commitment of people Joint responsibility Formal business procedures Loss of markets and suppliers Networking Questions: 1. 2. 3. 4. 5. 6. 7. Who to partner with? How do I identify? How to negotiate? How to govern? How to manage? How to finance? How to exit? Leasing Options Real Estate Lease – – – – Cash lease Share lease Flexible cash base Shared appreciation lease Leasing Options • • • • Facility/Equipment operating lease Capital/Financial lease Leveraged lease Leaseback Equity Sources – – – – Initial capital contributions Retained earnings Valuation Equity Stock • common stock • preferred stock – “External” equity/contributions – Warrants or options – Venture capital Equity Business Practices – – – – Payout (dividend or withdrawal) policy Intrafamily transfers ESOPs and stock options “Buyout” policies Debt Loans – – – – – – Maturity Interest rate Amortization arrangements Prepayment features Security/collateral Conversion of terms Debt Loans – Shared appreciation mortgages – Reverse mortgages – Interest rate strips, futures, options, swaps Debt Bonds – Convertible bonds – Callable bonds – “Zero coupon” or deep discount bonds Conclusions – Financial/Organizational Structure • • • • Critical strategic decisions Significant impact on ROE Numerous alternatives Diversification Strategic Business Planning for Commercial Producers