The amount you pay annually, quarterly or monthly

advertisement

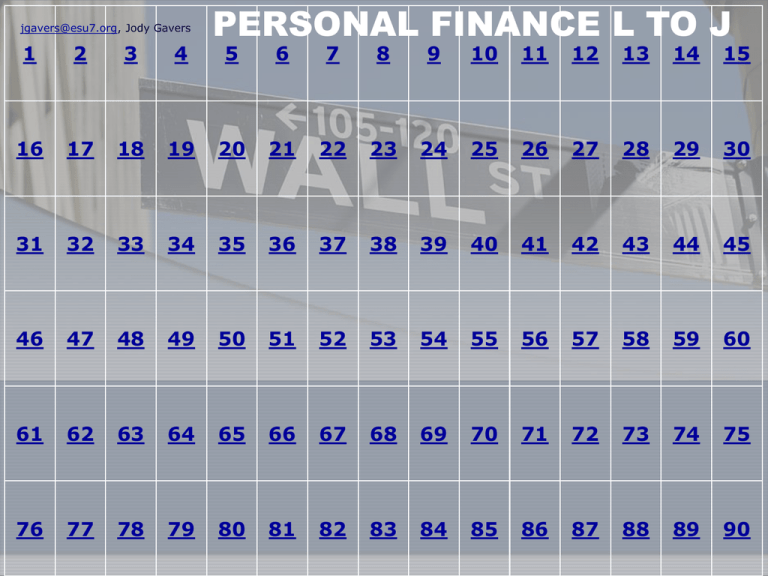

jgavers@esu7.org, Jody Gavers 1 2 3 4 16 17 18 31 32 46 PERSONAL FINANCE L TO J 5 6 7 8 9 10 11 12 13 14 15 19 20 21 22 23 24 25 26 27 28 29 30 33 34 35 36 37 38 39 40 41 42 43 44 45 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 1 Place your emergency fund in this type of account. Money Market End 2 2 Baby Step one is ________. $500-$1000 End 3 3 The typical American has a ________ savings rate. Negative End 4 4 Saving must become a ________. Priority End 5 5 A fully funded emergency fund is ________ months of expenses. 3-6 End 6 6 ________ says that whatever can go wrong will go wrong. Murphy's Law End 7 7 The percentage by which your money grows is called the ________. Rate of Return End 8 8 Use the ________ approach instead of borrowing to purchase things. Sinking Fund End 9 9 Never invest using _________ money. Borrowed End 10 10 Oil and gold are examples of _________. Commodities End 11 11 When investing, you should always check the _________ track record. 5-10 year End 12 12 _________ is for anything less than five years. Saving End 13 13 The availability of your money is called _________. Liquidity End 14 14 _________ are savings accounts with insurance companies. Annuities End 15 15 In _________, investors pool their money. Mutual Funds End 16 16 A ________ is a debt instrument where a company owes you money Bond End 17 17 A retirement plan for self-employed people. SEPP End 18 18 Typical retirement plan found in most companies 401(k) End 19 19 Retirement plan found in non-profit groups (schools, hospitals) 403(b) End 20 20 Save for college by first using this type of account Educational Savings Account End 21 21 Invest 15% of income for retirement is baby step _______ 4 End 22 22 College Funding is baby step 5 End 23 23 A widely held, but mistaken belief Myth End 24 24 Mortgage loans where the interest rate is adjusted periodically ARM End 25 25 A tax on the poor and people who can’t do math Lottery End 26 26 The debt snowball is baby step ______ 2 End 27 27 Most expensive way to finance a new car Leasing End 28 28 Using equity in a home as collateral when borrowing money Home Equity Loan End 29 29 Combining separate debt payments into one single payment Consolidation End 30 30 A drop in the value of property Depreciation End 31 31 The true cost of something in terms of what you give up Opportunity Cost End 32 32 Borrowing money and paying over time Financing End 33 33 Finding the right place in the store for a product Shelf Positioning End 34 34 Financing as a marketing tool 90 Days Same-as-Cash End 35 35 Causes some pain when purchased with cash Significant Purchase End 36 36 Doubting a purchase Buyer's Remorse End 37 37 Insures you against an unclean title Title Insurance End 38 38 Experian, TransUnion, Equifax are examples of ________ Credit Bureaus End 39 39 The percent of total debt each creditor gets when you can’t make minimum payments Pro Rata End 40 40 Court action that allows a lender to take wages directly from a paycheck Garnishment End 41 41 If you file ________ code, it will stay on your credit report for 10 years Chapter 7 Bankruptcy End 42 42 Protects the mortgage lender against loss if the loan is defaulted PMI End 43 43 The only information that can be legally removed from your credit bureau report Inaccurate Information End 44 44 Place a fraud victim alert on your credit report after this happens Identity Theft End 45 45 Amount of time a credit bureau has to remove inaccuracies from your report 30 days End 46 46 Legal procedure for dealing with debt problems (filed under chapters) Bankruptcy End 47 47 Cash flow plan Budget End 48 48 A sign of crisis living Bounced Checks End 49 49 Spend every dollar on paper before the month begins Zero-Based Budget End 50 50 Checking your bank statement against your account register Reconcile End 51 51 Buying without thinking Impulse Purchase End 52 52 Used to pay cash for planned monthly expenses Envelope System End 53 53 Fee for an overdrawn account Non-Sufficient End 54 54 Used to help plan for annual expenses Lump Sum Planning Form End 55 55 Used when you don’t have a predictable monthly income Irregular Income Form End 56 56 Both parties benefit in negotiations Win-Win End 57 57 Bidding on items Auction End 58 58 Bargaining for a lower price Negotiating End 59 59 Paying a lower price for an item Bargain End 60 60 Emotional, visual and has immediacy Cash End 61 61 Used to get something else just before closing a deal "If I" take away End 62 62 It’s a myth that these places have stolen goods Pawn Shop End 63 63 The ability to leave if you are not satisfied with the price offered Walkaway Power End 64 64 Earning money based on the work you do Commission End 65 65 Don’t necessarily have to work to earn this Allowance End 66 66 Having to do with money Fiscal End 67 67 Taking responsibility Accountable End 68 68 What is important to you Value System End 69 69 Motivation to work Work Ethic End 70 70 Attitude about yourself Self-Esteem End 71 71 Lists your personal, work and education history Resume End 72 72 Used to fund government programs, agencies, roads, etc. Federal Income Tax End 73 73 Source of revenue for local governments Property Tax End 74 74 Your line of work career End 75 75 Major source of revenue for state governments Sales Tax End 76 76 The one thing you can count on when it comes to careers Change End 77 77 Life insurance for a specified period of time Term Insurance End 78 78 The amount you pay annually, quarterly or monthly for insurance Premium End 79 79 Provides an income if the insured person is unable to perform the job he/she trained for Occupational disability End 80 80 The time between the disabling event and when payments Elimination Period End 81 81 Filed with an insurance company to get coverage for a loss Claim End 82 82 Covers the contents of a house or apartment when you rent Renter's Insurance End 83 83 Portion of the medical bill you pay before insurance kicks in Deductible End 84 84 Insurance that covers damage to a vehicle due to an accident Collision End 85 85 Covers damage to a vehicle not due to an accident Comprehensive End 86 86 Loan payments on a house Mortgage End 87 87 An opinion of value on what a house is worth Appraisal End 88 88 Experts in buying and selling homes Realtor End 89 89 The balance of your mortgage payment, not including interest Principal End 90 90 The value of your house minus what you owe Equity End 91 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 10 0 10 1 10 2 10 3 10 4 10 5 10 6 10 7 10 8 10 9 11 0 11 1 11 2 11 3 11 4 11 5 11 6 11 7 11 8 11 9 12 0 12 1 12 2 12 3 12 4 12 5 12 6 12 7 12 8 12 9 13 0 13 1 13 2 13 3 13 4 13 5 13 6 13 7 13 8 13 9 14 0 14 1 14 2 14 3 14 4 14 5 14 6 14 7 14 8 14 9 15 0 15 1 15 2 15 3 15 4 15 5 15 6 15 7 15 8 15 9 16 0 16 1 16 2 16 3 16 4 16 5