Financial Analysis

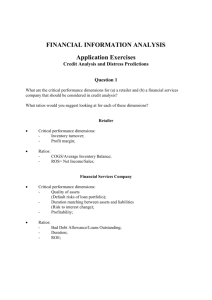

advertisement

Financial Analysis Credit Analysis Equity Analysis Creditors What is the borrowing cause? What is the firm’s capital structure? What will be the source of debt repayment? Credit Rating Business Risk Industry characteristics Company position Management Financial Risk Financial characteristics Financial Policy Profitability Capital Structure Cash Flow Protection Financial flexibility Standard & Poor’s rating method 1. 2. 3. 4. 5. 6. 7. 8. EBIT interest coverage EBITDA interest coverage Funds from operations/Total debt % Free operating cash flow/Total debt % Return on capital % Operating income/Sales Long-term debt/Capital Total debt/Capital Standard and Poors Corporate Ratings Financial distress The deterioration in a company’s financial condition such that its ability to repay debt is impaired Prediction of financial distress Univariate models Beaver (1966) relied on Cash flow to total debt Net income to total assets Total debt to total assets Working capital to total assets Current ratio No-credit (defensive) interval Prediction of financial distress Multivariate models Altman Z-score (Current assets – current liabilities)/total assets (weight-1,2) Retained earnings/Total assets (weight-1,4) EBIT/Total assets (weight-3,3) Preferred and common stock market value/Book value of liabilities (weight-0,6) Sales/Total assets (weight-1,0) Altman Z-score Z> 2,99 Not in financial distress Z< 1,81 In financial stress 2,99>Z>1,81 Uncertain Altman Z score Anadolu Cam Altman Z-score Ratio 1 Ratio 2 Ratio 3 Ratio 4 Ratio 5 Altman Z-score 2006 0,04 0,11 0,04 1,60 0,55 1,85 A. Cam 2005 2004 0,08 0,14 0,12 0,10 0,07 0,12 2,27 2,97 0,51 0,61 2,36 3,08 Additional considerations Mezzanine items Could be debt or equity Off-balance-sheet liabilities Operating leases Contingent liabilities Environmental liabilities Equity Analysis Buy-side Work for an institutional investors (mutual fund) Make internal recommendations regarding the purchase of equity securities Might review reports of sell-side analysts Sell-side Work for brokerage firms Issue reports for retail and institutional customers Valuation Current value V0 is a function of Present value of next year’s cash flow, CF1 Required rate of return, r Expected constant growth rate, g V0 CF1 r g Equity Analysis 1. 2. 3. 4. Provides information regarding The future cash flow generating ability of the firm The growth (or lack thereof) of those cash flows The risk of those cash flows, and The risk-free rate commanded by the market Top-Down Analysis Begin at highest (economy) level Allocation between domestic and international equities Market sectors Industries (within a sector) End with evaluation of specific companies Bottom-Up Analysis Begin with individual companies Screen large data bases for attractive characteristics Look for key strengths Compustat, Bloomberg, Baseline Search for a combination of characteristics Macroeconomic Analysis Gross Domestic Product (GDP): total value of all final goods and services produced within a country. Nominal, measured in current dollars Real, adjusted for changing prices Gross National Product (GNP): total value of all final goods and services produced by factors of production owned by citizens of a country regardless of production location Growth rates of both can be used as an initial estimate of a firm’s growth rate Business Cycle Expansion Period of economic growth Increased need for PP&E, labor, inventory Peak – high point following expansion Recession Contraction following a peak Rising unemployment, decreased need for factors of production Two quarters of falling real GDP Business Cycle Trough – low point following recession Depression Prolonged and severe recession Some sectors and industries will perform better in some stages of the cycle than in others. Cyclical firms are sensitive to stages of the economic cycle. Inflation Consumer Price Index (CPI) measures inflation of a market basket of consumer goods Producer Price Index (PPI) measures inflation at the wholesale level Higher inflation, higher required risk-free rate of interest Impacts all companies and all industries (to varying degrees) Economic Indicators Leading indicators Lagging indicators Move in advance of the business cycle Unemployment claims, new orders Follow behind the business cycle Average duration of unemployment, average prime rate Coincident indicators Move with the business cycle Industrial production Sector/Industry Analysis Assess the ability of companies within the industry to generate cash flow Assess the potential growth of that cash flow Assess the risks related to receipt of those cash flows Assess the industry’s ability to grow relative to the overall economy Porter’s 5 Competitive Forces that determine industry profitability 1. Threat of New Entrants - Capital requirements, government policy, access to distribution 2. Bargaining Power of Suppliers - Supplier concentration, switching costs, differentiation of inputs 3. Bargaining Power of Buyers - Buyer concentration, price sensitivity, brand identity 4. Threat of Substitute Products or Services 5. Rivalry Among Existing Firms - Industry growth, barriers to exit, current industry concentration Company Analysis 1. 2. 3. 4. 5. Understand the business Evaluate past performance Forecast performance Value the company Make an investment recommendation Understanding the Business Gain an understanding of the products and services provided by the company and the market for those products and services Talk to employees, suppliers, competitors Interview customers Utilize the company’s products or services Evaluating Past Performance Understand reported financial information Common size and ratio analysis Consider efficiency, liquidity, solvency, cash flow and relative valuation Understand US GAAP and IAS Financial reporting quality and conservatism Forecasting Performance Based on evaluation of past performance, economic/industry conditions and expected changes Pro-forma (projected) financial statements Projection of future earnings Use earnings model or statistical projection Valuing the Company Determine the appropriate price for making an equity investment Is the intrinsic value higher or lower than the current market price? Specific methods Discounted cash flow Market-multiple Residual income Making an Investment Recommendation Current price of subject company’s securities Results of valuation Risks of investment Investor’s risk tolerance, objectives and time horizon Buy/Attractive Hold/Market Perform Sell/Market Under perform Five Steps of a Financial Statement Analysis Step 1 Establish objectives of the analysis Who are you and why are you interested in this company? What questions would you like to have answered? What info is vital to the decision at hand? Five Steps of a Financial Statement Analysis (cont.) Step 2 Study the industry in which the firm operates and relate industry climate to current and projected economic developments Five Steps of a Financial Statement Analysis (cont.) Step 3 Develop knowledge of the firm and the quality of management How well does this firm appear to be run? Are they taking advantage of opportunities? Are they innovative, forward-looking, etc? Five Steps of a Financial Statement Analysis (cont.) Step 4 Evaluate financial statements–tools include: Common-size financial statements Key financial ratios Trend analysis Structural analysis Comparison with industry competitors Five Steps of a Financial Statement Analysis (cont.) Step 4 Evaluate financial statements–areas include: Short-term liquidity Operating efficiency Capital structure and long-term solvency Profitability Market ratios Segmental analysis (when relevant) Quality of financial reporting Five Steps of a Financial Statement Analysis (cont.) Step 5 Summarize findings based on analysis Reach conclusions about the firm relevant to your established objectives What we have accomplished Turned Maze Statement of Cash Flows Balance Sheet MD&A Income Statement Notes Auditor’s Report Statement of Shareholders’ Equity Financial Statements An Overview Map