Credit Management

advertisement

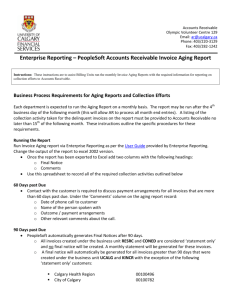

Credit Management (Text reference: Chapter 29) why credit exists terms of sale optimal credit policy credit analysis collection policy factoring 1 Why Credit Exists clearly, businesses would prefer to receive cash due to market imperfections, it is beneficial for firms to provide credit to their customers – in a perfect market, customer should be able to borrow at the same rate from anyone (bank, business selling the goods, etc.) – in an imperfect market, information asymmetry exists: between customer and seller between seller and other potential lenders 2 Terms of Sale “terms of sale” refers to the period for which credit is granted, the cash discount, and the type of credit instrument typical credit terms for accounts receivable are 2/10, net 30. Note that this implies a significant cost to late payment: credit terms (and their effect on sales) determine the profitability of extending credit e.g. Home Carpet Inc. currently doesn’t extend credit to its customers. If 2/10, net 30 terms were adopted, sales would increase by 40%, with 40%, 30%, and 30% of customers paying in 10, 30, and 50 days respectively. Revenues and expenses for an average sale are $500 and $400. If the OCC is 6%, should credit be granted? 3 in general, we must also consider probability of non-payment, e.g. does your answer change if the probability of non-payment for overdue accounts is 75%? clearly, as you gain information about customers (e.g. previous payment history), you can make better credit decisions 4 Optimal Credit Policy a decision to grant credit is a trade-off between – carrying costs – opportunity costs cost in $ level of credit extended 5 in perfect markets, credit policy is inconsequential (i.e. there is no optimal credit policy): in imperfect markets, the optimal policy depends on the characteristics of the individual firm, e.g.: – does a firm have a cost advantage in extending credit? – is the firm lacking established reputation and trying to attract customers? – does the firm have excess capacity, or low variable operating costs? – does the firm have a stable, repeat customer base? – what is the nature of the firm’s product? – etc. 6 Credit Analysis firms gather information to evaluate likelihood of payment: – financial statements – credit reports on customer payment history with other firms (e.g. Dun & Bradstreet Canada) – banks – customer’s payment history with the firm typical credit worthiness evaluation criteria (the 5 C’s) – character (willingness to pay) – capacity (ability to pay from operating cash flow) – capital (ability to pay from capital reserves) – collateral (pledged asset in case of default) – conditions (economic conditions of customer’s line of business) systems have been developed based on these and similar criteria 7 Collection Policy “collection” refers to obtaining payment of past due accounts collection may involve – sending past-due delinquency notices – calling the customer – employing a collection agency – taking legal action against the customer collection analysis tools – day’s sales outstanding (a.k.a. day’s sales in receivables, average collection period). E.g. ABC Corp. sells $3.2 million of goods annually. Its accounts receivable balance is $750,000. Calculate the average collection period. 8 – accounts receivable aging schedule, e.g. based on the outstanding A/R data provided below, prepare the company’s accounts receivable aging schedule age (days) amount o/s 0-30 17,000 30-60 10,000 60-90 8,000 90 5,000 total 40,000 % of total A/R – using average collection period and aging schedule statistics: statistics have limited use on their own useful when compared to the firm’s own history and similar companies and industries – note that these type of statistics can also be of use in bad debt analysis 9 Factoring a factor is an independent firm which acts as a credit department, handling aspects such as collection, authorization, bookkeeping the factor pays the firm the amount collected from invoices less a discount as collections are made late accounts must be paid by a specified date legally, the factor purchases the accounts receivable from the firm since factors do business with many firms, can attain scale economies 10