Inland Empire & San Bernardino County 2009 … A

advertisement

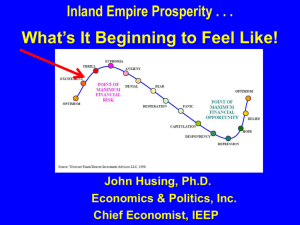

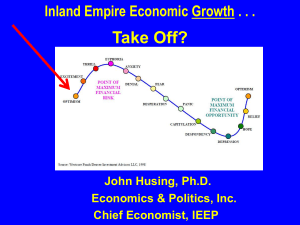

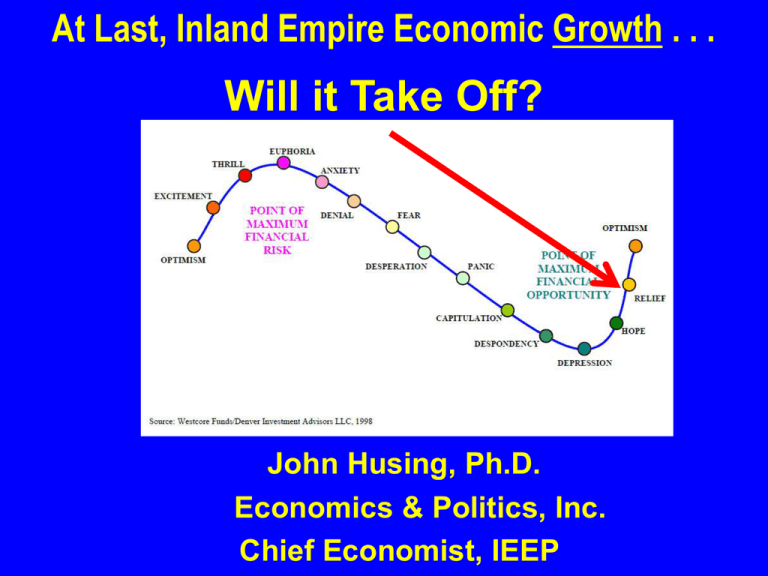

At Last, Inland Empire Economic Growth . . . Will it Take Off? John Husing, Ph.D. Economics & Politics, Inc. Chief Economist, IEEP After Losing 8.74 Million Jobs … U.S. Job Creation Is Crawling Back Pattern of Likely Recovery VU Congressional Madness Sequester Debt Limit U.S. Economy??? California Wage & Salary Employment Back to Mid-1999 Level Every Wage & Salary Job Created In California In This Decade Has been Lost: Not A State Priority Worst National Unemployment Rate Unadjusted Rates: U.S. 7.4% CA 9.6% There is Some Good News Locally IE Up 16,106 Jobs in 2012 thru November 16,300 was Husing Forecast for 2012 -146,400 -11.4% Sectors Creating/Losing Jobs Lower Paying Modest Paying White Collar Blue Collar Good Paying Admin. Support Distribution & Transportation Employment Agcy Health Care Eating & Drinking Manufacturing Mgmt & Professions Accommodation Social Assistance Amusement Agriculture Utilities Mining Higher Education Publish, telecomm, Other Construction Other Services Financial Activities Local Government Retail Trade Federal & State K-12 Education Exhibit 8.-Inland Empire Growing & Declining Sectors Average January-November 2011-2012 5,164 4,691 3,782 3,055 1,545 1,127 1,100 1,000 855 609 155 64 9 (9) (55) (464) (473) (518) (673) (773) (1,473) (2,609) Source: California Employment Development Department The Great Challenge Construction Share of Lost Jobs Construction Share Of Lost Jobs Inland Empire, 2006-2012 130,200 57.3% 74,600 Total Job Decline 2006-2012 Construction Job Decline Construction Share of Lost Jobs Source: CA Employment Development Department 500,000 People In SB County Underwater homes Existing Home Prices Slight Upward Move $437,200 Exhibit 5.-Price Trends, New & Existing Homes Inland Empire, 1988-2012, Quarterly $450,000 $420,000 $390,000 $360,000 $330,000 $300,000 $270,000 $240,000 $210,000 $180,000 $150,000 $120,000 $90,000 $60,000 $30,000 $0 $295,442 New Existing $107,617 36.4% $389,924 -51.8% $155,319 Source: Dataquick & Economics & Politics, Inc. $187,825 Inland Empire’s Long Term Price Competitive Advantage Still Exists Exhibit 20.-Home Price Advantage, Inland Empire & So. California Median Priced New & Existing Home, 3rd Quarter 2012 Median All Home Price Inland Empire Advantage $384,000 $352,000 $324,000 $197,000 $187,000 $155,000 Inland Empire $521,000 Los Angeles San Diego Source: Dataquick Orange Gap To Coastal Markets Getting Larger Exhibit 27.-Gap Between Coastal & Inland County Prices Existing & New Homes, 1988-2012 $350,000 $325,000 $300,000 $275,000 $250,000 $225,000 $200,000 $175,000 $150,000 $125,000 $100,000 $75,000 $50,000 $25,000 $0 Los Angeles Orange San Diego Source: Dataquick $350,000 $325,000 $300,000 $275,000 $250,000 $225,000 $200,000 $175,000 $150,000 $125,000 $100,000 $75,000 $50,000 $25,000 $0 Record Inland Housing Affordability Should Be Stimulating Demand But Consumers Are Again Skeptical About The Near Term Future 100.0 = Normal Home Sales Volume Down Slightly Investor Pre-Market Buying Exhibit 10.-Direct Investor Purchase of Foreclosure Sales Inland Empire, 2007-2012 50% 50% 45% 45% 40% 40% 35% 35% 30% 30% 25% 25% 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% 2007 2008 2009 2010 2011 Source: Foreclosureradar.com 2012 Investor Purchases By SB Co. Area Exhibit 11.-Home Purchases By Absentee Owners San Bernardino County, Second Quarter 2007 v. 2012 46.4% 44.7% 2007 2012 37.8% 31.5% 30.6% 31.2% 23.4% 13.1% 14.7% 13.1% 11.9% 9.3% San Bdno Co. Unincorp. Morongo Basin Victor Valley SB County Source: Dataquick East Valley Westend Single Family Rentals & Police Calls How This Ends: A Housing Shortage During 2008 thru 2012 California Population Grew by 993,624 106,230 9.35 per new person When Underwater Homes Solved Sep-13 1.7% Mar-14 5.1% Mar-15 12.7% Apr-17 35.7% Apr-18 50.0% Jan-19 60.0% Jul-20 78.8% Nov-21 89.9% Feb-23 95.2% Mar-24 97.9% Mar-25 98.9% Assessed Valuation Finally Growing Assessed Valuation, Slow Rise -8.1% Construction Permits At An Historic Low ! Construction Jobs: At the Bottom Gold Mine Theory Secondary Tier Primary Tier Construction: Blue Collar Health Care: White Collar Logistics: Blue Collar Manufacturing: Blue Collar Adult Educational Levels 31.4% Rest of So. CA Health Care Jobs 100 3,000 200 Inland Empire Underserved by Health Care Workers 34.4% More People Per Health Care Worker Exhibit 10.-Number of People Per Health Care Worker Inland Empire & California, 1990-2012 47.5 45.9 46.5 45.7 44.7 Inland Empire 42.7 41.8 California 41.7 41.4 40.5 40.3 40.4 40.3 40.1 39.6 40.0 39.9 39.1 39.4 40.4 41.1 39.2 38.5 36.2 35.1 34.7 34.8 34.8 34.5 34.1 33.8 33.6 33.4 33.7 33.3 32.7 32.5 32.5 32.5 32.4 31.8 31.1 31.0 Source: CA Employment Development Department 29.6 29.2 28.6 Who Will Health Care Workers Serve? Inland Empire is Under-Officed Office Space Per Capita & Per Local Job Southern California Areas, 2010 51.7 Per Person Per Job 45.4 41.7 19.0 16.0 18.2 L.A. County San Diego Co. 23.4 5.0 Inland Empire Sources: Grubb & Ellis, CA Employment Development Dept., CA Dept. of Finance Office Occupations: Strong Growth Has Stopped Logistics Flow of Goods Imported Container Volume Returning +19.2% -25.4% Record Export Container Volume All Time Record Inland Empire Logistics Jobs Manufacturing Activity: Slowing Manufacturing Jobs In Neutral Gold Mine Theory Secondary Tier Primary Tier Inland Empire’s In-migration From Coastal Counties Has Stopped -15,538 Not Bringing Skills, Wealth, Income & Spending Retail Sales, San Bernardino County -$3.7 Billion -6.0% Retail Jobs Have Faltered California Grabbing Money From Local Government … School Funding Cut Jerry Brown’s Hand Government Jobs 2012 Better than 2011 Foreclosures A Continuing Issue Complete Recovery 2016-2018?? 2012 Jobs Growing As Expected 2013 Better Than 2012 IF Federal Issues Solved www.johnhusing.com