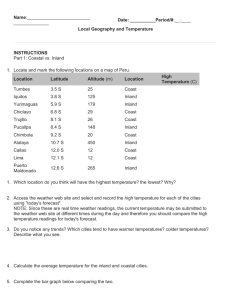

After Losing 8.78 Million Jobs

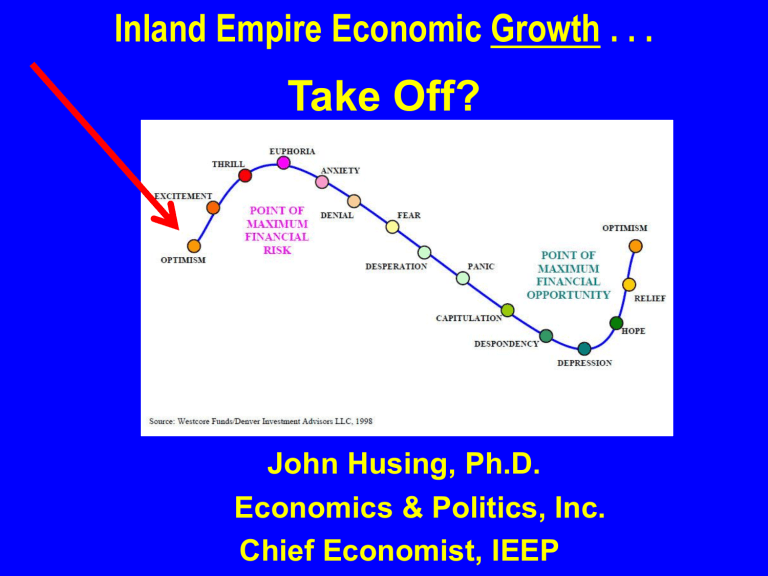

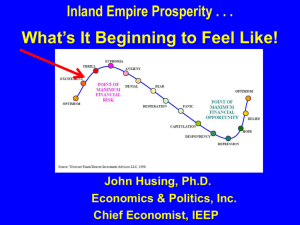

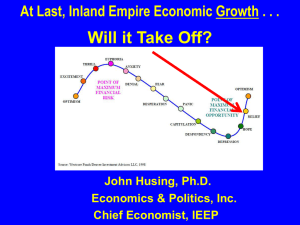

Inland Empire Economic Growth . . .

Take Off?

John Husing, Ph.D.

Economics & Politics, Inc.

Chief Economist, IEEP

After Losing 8.78 Million Jobs …

U.S. Jobs Are Still Crawling Back

-664,000 Government Jobs

+8,221,000 Private Sector (94.1%)

Unemployment Falling, But High

Worst U.S. Metropolitan Area

Unemployment Rates

How Regional Economies Work

Secondary Tier

Economic Development … Increase The Economic Base!

Primary Tier

Three Step Growth Process

Based On Interaction Of:

• Population

• Preferences

• Dirt

Prices Force Decisions

Southern California Population Growth,

2000-2012

People Prefer To Live Near The Coast

As a homeowner, would you prefer to move closer to work if it involved a townhouse or condo?

(I-15 & Sr-91 Commuters, 2008)

87.5% No

Answer stable over 5 years

Same question to Renters:

72.3% No

Stage #1: Rapid Population Growth

• People forced to move inland for affordable homes

• Population Serving Jobs Only

• High Desert & I-215 South are current examples

Commuting Bad, But Stable Over Time

1,650,384 Total Jobs

1,156,313 Inside IE

494,071 Commute Outside County

154,845 Between IE Counties

339,226 Outside IE

20.6% Commute Outside the IE

16.3% Orange County Commuters

Construction: Finally Some Hope

Share of Underwater Homes Plunging

4Q 2012 to 3Q 2013

333,720 to 170,768

-48.8%

Home Price Trends

49.5% less for

Existing home

32.3%

-39.2%

52.8%

Long Term Competitive Price Advantage Still Exists

Permits: Finally Some Optimism

Firms Prefers The Coastal Counties

Stage 2: Strong Industrial Growth

Vacancy Nearing Historic Lows

Undeveloped Land …

Industrial Prices Much Lower In Outlying Areas

Exhibit 13.-Industrial Space Costs Differences

Southern California, Sub-Markets, March 2013

156.6%

Price Per Sq. Ft.

Price with 20% Cubic Factor

.

Difference

% Difference

$0.56

84.2% $0.63

107.2%

$0.78

$0.38

$0.30

Inland Empire Los Angeles Co.

Orange Co.

San Diego (non-R&D) nnn=net of taxes, insurance, common area fees

Source: CB Richard Ellis

Workforce Needs Jobs Without

Educational Barriers

Workers Will Work

For Less Not To Commute

Exhibit 82.-Median Wage & Salary Percent Difference

Inland Empire vs. Coastal Counties, 2010

459 Common Occupations, Under $70,000

Weight Median Pay Percent IE Pay Is Lower

$33,240

$34,656 $34,089

$35,173

4.26%

5.81%

2.55%

0.0%

Inland Empire San Diego Los Angeles Orange

Note: Occupations in common weighted by Inland Empire Jobs

Source: CA Employment Development Department, Occupational Wage Survey, Economics & Politics, Inc. calculations

Logistics Flow of Goods

Port Container Volumes

Fulfillment Centers

17 Firms Looking For Space

7 Are Fulfillment Centers

1,500,000

1,000,000

1,000,000

800,000 to 1,000,000

700,000 to 1,000,000

500,000 to 800,000

700,000 to 900,000

850,000

700,000

700,000

700,000 to 800,000

600,000

600,000 to 700,000

500,000

450,000

300,000 to 400,000

350,000

Source: Jones LaSalle

Inland Empire Logistics Jobs

32.5% of All Inland Jobs …

Jan-Nov. 2012-2013

Manufacturing:

Could Be A Major Growth Source

Manufacturing Orders Irregular

U.S. v. California Manufacturing Jobs

Manufacturing Slowing

Regulatory Environment Aimed At

“Dirty” Blue Collar Sectors Impacts

Construction, Manufacturing, Logistics

Median Pay By Sector Groups

Air Becoming Cleaner

Exhibit 6.-PM 2.5 Days over National Standard vs.

Total Square Feet of Net Industrial Absorption Since Highest PM2.5 level

Monitoring Sites

Mira Loma-Van

Buren

Riverside-

Magnolia

Riverside-

Rubidoux

Fontana-Arrow

Highway

Ontario-1408

Francis Street

San Bernardino-

4th Street

2006

2007

2008

2009

2010

2001

2002

2003

2004

2005

2011

2012

Change From

Highest

Change

Net Absorptiont

Since Highest

46.2

43.4

*

19.0

8.0

13.0

7.0

*

*

-39.2

-84.8%

86,378,254

88.4

69.7

47.8

*

31.3

*

12.4

6.0

6.3

7.1

*

-81.3

-92.0%

183,911,357

120.2

92.6

78.1

57.3

39.7

15.0

15.1

*

*

4.0

5.0

7.0

-113.2

-94.2%

229,967,544

27.2

*

19.3

6.2

6.6

58.2

73.7

54.3

*

22.9

7.1

10.6

-63.1

-85.6%

183,911,357

19.4

9.0

*

*

3.2

79.5

67.4

62.2

*

25.3

6.8

0.0

-79.5

-100.0%

229,967,544

9.5

6.2

*

*

5.9

80.8

88.9

55.2

*

9.3

*

0.0

-88.9

-100.0%

183,911,357

Poverty

Exhibit 2.-Share & Number of Inland Residents Below Poverty Level

Census Bureau

Year

1990

People In Poverty

306,417

Share of Population in Poverty

11.8%

Population

2,588,793

2000

2012

Changes

477,496

809,234

+164.4%

14.7%

19.0%

+7.2%

3,255,526

4,293,892

+65.9%

African American:

Hispanic:

White:

Asian:

27.2%

23.9%

12.1%

10.4%

Stage 3.-Office Based Firms

Follow Their Workers

Skilled Workers Migrate Inland

For Better Homes

Office Absorption Finally Starting to Recover

High-End Jobs

Follow Workers into the Area

Outlying Workers Will Work

For Less Not To Commute

$86,806

Exhibit 98.-Median Wage & Salary Percent Difference

Inland Empire vs. Coastal Counties, 2010

138 Common Occupations, $70,000 & Up

Weight Median Pay

$93,489

Percent IE Pay Is Lower

$94,768 $94,806

7.70%

9.17% 9.22%

0.0%

Inland Empire San Diego Los Angeles Orange

Note: Occupations in common weighted by Inland Empire Jobs

Source: CA Employment Development Department, Occupational Wage Survey, Economics & Politics, Inc. calculations

Office Vacancy Rates Improving

But Still Very High

18.1%

High End Occupations & Office Unstable

Inland Empire’s In-migration From Coastal

Counties Has Not Yet Recovered

-15,538

Not Bringing Skills, Wealth, Income & Spending

Health Care

Health Care Jobs: Continuous Growth

700 600 800

Health Care Demand Set To Explode

People Without Health Insurance (2012): 828,431 (19.0%)

People Will Age, Already Those 55 & Over are 926,696 (21.3%)

Population Growth Will Resume (2000-2013) 1,075,807 (33.0%)

Inland Health Care Workers Handle More People Than CA: (35%)

Federal Job Cuts

Debt Ceiling

Budget Fights

Assessed Valuation

Finally Growing (6.1% for SB County)

-1.0%

Government Remains Weak

How Regional Economies Work

Secondary Tier

Primary Tier

Retail Sales Almost Back

Retail, Consumer Service, Hotel, Amusement

Jobs Gaining Speed

Where Will IE Be In Its Job History?

Exhibit 8.-Wage & Salary Job Change

Inland Empire, Annual Average, 1984-2014e

2011-2013

55,958 of 148,425 lost or 37.7%

2011-2014

90,958 of 148,425 lost or 61.3%

Sources: CA Employment Development Department, U.S. Bureau of Labor Statistics, Economics & Politics, Inc.

Forecast

2014 Better Than 2013

•

Health Care Will Grow

• Logistics Will Grow

• Retail Gaining

• Office Growth Very Slow

• Home Building Starts Back

•

Growth Looks Normal

• Still Well Below Pre-Recession

![The progress of the Northern Cities Shift in the Inland North [N=71]](http://s2.studylib.net/store/data/005278121_1-6c7b61110e83fce2e7b3ab15c9a37e24-300x300.png)