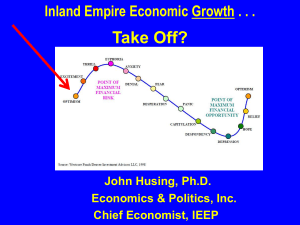

San Bernardino Community College District

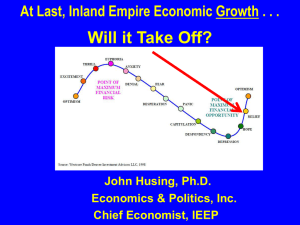

advertisement