Input Tax Claim In Certain Circumstances

进项税 (

input tax

)

ROYAL MALAYSIAN

CUSTOMS

1

2

3

4

5

6

7

进项税 (

input tax

)

进项税定义

索回进项税机制

封锁的进项税额

最低豁免水平的限制 (

De Minimis Limit)

退税 Refund of input tax

进项税要求在某些情况下 Input tax claim in certain circumstances

索回进项税条件

2

进项税定义

“

进项税额”是指 ---

(一)对商品或服务的纳税人的任何应税供应 ; 或

(二)纳税人支付货物进口时任何税,

与商品或服务的使用或将要使用纳税人士,进行任何业务的目的:

但如货物或服务的使用或将部分用于进行另一部分进行任何业务,税收的供应和

输入情况应当按比例分配,只有这样就像是归因于他的业务的目的算进项税额。

“Input tax” means ---

(a) any tax on any taxable supply of goods or services to a taxable person; or

(b) any tax paid or to be paid by a taxable person on any importation of goods, and the goods or services are used or are to be used for the purposes of any business carried on or to be carried on by the taxable person:

Provided that where the goods or services are used or to be used partly for the purposes of any business carried on or to be carried on by the taxable person and partly for other purposes, tax on the supply and importations shall be apportioned so that only so much as is attributable to the purpose of his business is counted as his input tax.

3

索回

进项税

机制

Supplies

taxable supplies

standard rated or zero rated supplies

disregarded supplies (supplies within group, supplies made in warehouse, supplies between venture operator and venturers and supplies between toll manufacturer and overseas principal)

supplies made outside Malaysia which would be taxable supplies if made in Malaysia

4

Supplies Made Outside Malaysia

Inputs: office rental, utilities, office furniture

Purchase clothes

A

Operational

Headquarters

B

Factory issue invoices

Supplies clothes

C

5

允许进项税

偶然财务供应 (

Incidental financial supplies):

钱存 deposit of money

外汇货币 exchange of currency

持有债券或其他债务证券 holding of bonds or other debt securities

证券的所有权转让 transfer of ownership of securities

提供贷款,垫款或贷款给员工,或关连人士 provision of loans, advance or credit to employees or connected persons

控股或信托单位转让 assignment of provision of trade receivables

利益,商品,工具或货运风险对冲 holding or transfer of trust unit hedging of interest, commodity, utility or freight risk

6

非允许进项税

载客汽车,包括雇用车 -<9 座位

家庭补助

俱乐部申购费

医疗及人身意外

保险

娱乐开支

7

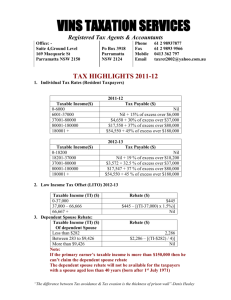

DE MINIMIS LIMIT

• 免税进项税可以全数收回,如果总值不过

规定金额

• 最低限额规定的数额

该豁免税物资总价值不超过

• 平均每月 5000 令吉 和

• 不超过 5% 总价值在此期间(所有应税

和豁免税物资)

Exempt input tax can be recovered in full if the total value less than a prescribed amount

Prescribed amount of de minimis limit

total value of the exempt supplies does not exceed

• an average of RM5,000 per month and

• not exceeding 5% of the total value of total supplies (all taxable and exempt supplies) made in that period

Applicable if registered person has exempt supply

De Minimis Limit

实施例 1 :

一家制造公司提供运输给它的工人和收费员工给出

的服务。

Activity

Value (RM)

Taxable

150,000

4,000/154,000=2.6%

Full recovery of input tax

Exempt

4,000

%

2.6

9

De Minimis Limit

Example 2 :

A manufacturing company provides bus transportation to its workers and charges them.

Activity Taxable Exempt %

Value (RM) 500,000 10,000 (10,000/510,000)

2.0

Full recovery of input tax are not allowed, have to apply apportionment rule on ITC

Residual

Input Tax

RM500

Taxable

Supplies

RM500,000

Exempted

Supplies

RM10,000

ITC

Claimable

98%

Total Input

Tax

RM490.00

ITC= 500,000/510,000=98% Total input tax= RM 500 X 98= RM 490

10

REFUND OF INPUT TAX

Make refund within:

28 working days for manual submission

14 working days for online submission

Late registration

:

pay net tax if output tax exceeds input tax

no refund if input tax exceeds output tax

11

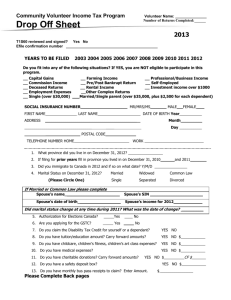

INPUT TAX CLAIM IN CERTAIN CIRCUMSTANCES

Pre-Incorporation

not eligible to claim input tax on goods and services

Pre-Registration

not eligible to claim input tax on services and goods consumed before registration

eligible to claim input tax on goods held on hand and capital goods

12

Input Tax Claim In Certain Circumstances

Example:

Plastic manufacturer purchases RM100,000 of resins

At the time of registration:

still holds RM70,000

RM10,000 incorporated in finished goods

RM20,000 consumed and sold as finished goods

Eligible to claim input tax on RM70,000 in the first return

13

Input Tax Claim In Certain Circumstances

Late registration

eligible to claim input tax on goods and services used in making taxable supplies during the period he is liable to be registered

for goods (including capital goods) held on hand acquired before date of liable to be registered, eligible to claim input tax

for goods and services acquired after date of liable to be registered, eligible to claim input tax 6 years from the date of purchase

14

Example – Late Registration

Value of goods for claiming input tax

Goods acquired before the date of registration or liable to be registered,

goods other than land and building - eligible to claim input tax on the book value of the goods.

for land and building, eligible to claim input tax on the open market value of the asset or book value whichever is the lower

15

Example – Late Registration

Value of goods for claiming input tax

Goods or services acquired after the date of registration or liable to be registered,

eligible to claim input tax on the value of the goods or services at the time of supply.

16

Input Tax Claim In Certain Circumstances

Deregistration

account as output tax on all goods on which input tax has been allowed to be claimed

not eligible to claim input tax if fails to claim after deregistration

Post deregistration

eligible to claim input tax on services related to deregistration

17

CRITERIA TO CLAIM INPUT TAX

Must hold valid document:

tax invoice

Customs No. 1 for imported goods

Customs No. 9 for goods removed from bonded warehouse

document to show claimant pays imported services

Tax invoice in the name of claimant not in the name of third party such as employees or directors

Tax invoice is lost get certified copy

No matching of input to output can claim input tax if holds valid document

20

Thank You

GST Unit

Royal Malaysian Customs Department