International Students - The Cuyahoga Earned Income Tax Credit

International Students

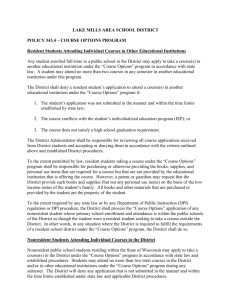

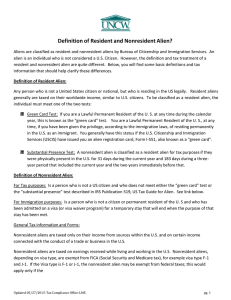

Resident vs Nonresident

• Green Card = Resident – file 1040!

• Substantial Presence – 31 days this year or 183 days over last 3 years

• Exempt are:

– Students with F, J, M or Q visas – 5 years exempt

– Family of students

– Teacher/researcher with J or Q visas – no more than

2 of last 6 years in US

– Exempt years are counted by calendar year – if student comes in December then that counts as a full year!

Tax Treaties

• They are complicated. List of Codes

• Form 1042-S instead of a W-2 for income exempted by treaty.

• India is the only country allowing students to claim the standard deduction – most countries allow the personal exemption only.

• Scholarships – Code 15: List of Countries with limited nontaxable living expenses.

• Tuition for Services - taxable

Income Codes - 18

• Code 18: Teaching and Research – 2 to 3 years for visiting professors.

• Does not apply to spouse’s earnings.

• Germany, India, Netherlands, Thailand and UK – exceed the time limit and lose

ALL benefits!! Should claim no benefit.

Code 19: Student Wages

• F-1 students must work on-campus only for the first year.

• Spouses of F-1 cannot work.

• Income limits by country.

Example

• Yumiko from Korea earned $4,516 from working at the Case library.

Wages $4,516

Treaty $2,000

Subject to Tax $2,516

Exemption

Taxable

$3,650

$0

Any Withholding should be returned to Yumiko.

Other Incomes/Treaties

• Personal service or non-related income is not covered by the treaty – except Canada.

• Canada – under 10,000 exempt for NR; over

10,000 all taxable.

• India – Standard Deduction; Could lose Code 18 scholar benefit if over time limit

• China – Treaty is for 3 years though status would switch from Nonresident to Resident.

Third Year Form 8833 with 1040

Family Issues

• Cannot file as Head of Household

• Normally cannot claim family members.

• If they can be claimed then must have an

ITIN – similar to a SSN

• Claiming spouses – Canada, Mexico,

South Korea and India

• Married – usually filing separately.

Children

• Cannot claim dependents even if they are

US citizens

• Exceptions are:

– Canada and Mexico

– South Korea

– India (not F-2, J-2 or M-2)

• May be able to claim CTC and Child Care

Credit but doubtful; Child must be citizen, national or resident alien of US.

Spousal Income

• F-2 status – should not be working

• J-2 status – authorized to work and have to pay social security taxes.

Other Income

• Taxed at higher rate because not effectively connected with US business – dividends, capital gains, rental income and interest EXCEPT bank interest

• Bank interest is excluded from income – it need not be reported.

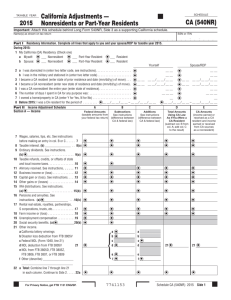

Itemized Deductions

• Nonresidents except Indian students are not entitled to the standard deduction

• Itemize state and local taxes – Will be income in the following year if a refund!!

• Charitable Contributions

• Some Job Expenses – Rare

• Student Loan Interest difficult to deduct.

Credits

• Education Credits – No (if nonresident alien)

• EITC – No (if nonresident alien)

Form 8843

• Helps exempt a nonresident from future substantial presence test.

• Should be completed by person filing a tax return

• Also, spouse and dependents should each file one too – even without an ITIN or SSN

Social Security Tax

• Nonresidential Aliens do not pay Social Security and Medicare taxes.

• The exception is a J-2 working spouse.

• Client should contact employer for a reimbursement. If that doesn’t work then

• File Form 843 including

– W-2

– Form 8316

– 1040NR

– Visa

Where to file

Mail to:

Department of Treasury

Internal Revenue Service

Austin, TX 73301-0215