reverse Charge presentation by CA Manoj Goyal

advertisement

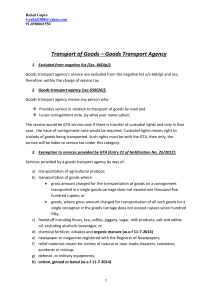

BY CA MANOJ KUMAR GOYAL 4F CS02, 4TH FLOOR, ANSAL PLAZA VAISHALI MOBILE: 09810148436 EMAIL: manoj.goyal1975@sify.com REVERSE CHARGE MECHANISM OF SERVICE TAX (RCM) With effect from 1-7-2012, the central government has notified the new partial reverse charge mechanism for the payment of service tax in respect of certain taxable services. THE LIABILITY TO PAY SERVICE TAX Service tax is an indirect tax, where the service provider has to collect tax from the service receiver and has to deposit in to Government account. As per Sec 68 (1) of Finance act 1994, every person providing taxable service to any person is liable to pay service tax. Hence the liability to pay service tax is on the service provider. However an exception to the above said rule has been provided under sub section (2) of 68 of the Act., in terms of which the central government has the powers to notify services in respect of which even the service receiver shall be liable to pay service tax wholly or partially. This is termed as REVERSE CHARGE MECHANISM. Since in respect of some services both the service provider and service receiver are liable to pay service tax proportionately, it is termed as “PARTIAL REVERSE CHARGE MECHANISM" SERVICES COVERED UNDER RCM Insurance Agent’s Services : 100% Services Provided by a GTA in respect of transportation by road(GTA): 100% Sponsorship services Provided to any Body Corporate or Partnership Firm located in Taxable Territory: 100% Services of Arbitral Tribunal provided to any business entity located in India: 100% (Minimum threshold of INR 10 lacs) SERVICES COVERED UNDER RCM Legal Services provided by Individual advocates or by a firm of Advocates to any business entity located In Taxable Territory:100% (Minimum turnover 10 lacs) Support services Provided by Government or local authority to any business entity located in taxable territory (Few exceptions) : 100% Renting of a motor vehicles designed to carry passengers, to a Body Corporate who is not in the similar line of business: 100% / 40% SERVICES COVERED UNDER RCM Supply of Man power for any purpose or Security Services: 75% Service Portion In the Execution Of Works Contract: 50% Taxable Services Provided By a person located In a non taxable Territory To any person located in the Taxable Territory: 100% Services Provided By a Director of a company to the said Company: 100% SPECIAL NOTES Reverse charge in case of Road Transportation Services will only be in case where recipient of service falls under specified category. Renting of Motor Vehicle, Supply of Manpower Services & Services related to Works Contracts to fall under RCM if provided by Individual, HUF, Partnership Firm (whether Registered or not) (including AOP). SPECIAL NOTES In case of GTA Services, the person who pays or is liable to pay the freight LOCATED IN THE TAXABLE TERRITORY shall be treated as the person who receives the service. In Works Contract Service, Service Recipient has the option of choosing the valuation method as per choice, independent of the method chosen by the Service Provider. SPECIAL NOTES Business entity means any person ordinarily carrying out any activity relating to Industry, Commerce or any other business or profession and includes individual, HUF, Company, Society, LLP, Firm, AOP, BOI. Services provided by one advocate or Firm of advocates to another advocate/Firm providing legal services is exempt from Service Tax. CENVAT credit can not be availed by a Service Recipient against the Tax payable under RCM. THANK YOU CA MANOJ KUMAR GOYAL MOB: 09810148436 EMAIL: manoj.goyal1975@sify.com