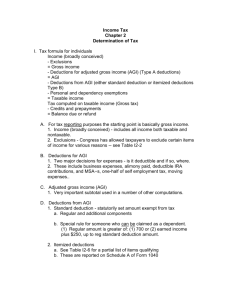

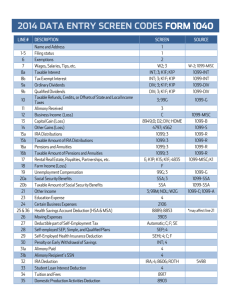

Step 2: Computing Taxable Income

advertisement

Chapter 4: Managing Taxes Objectives • Explain how taxes are administered and classified. • Describe the concept of the marginal tax rate. • Determine who should file an income tax return. Objectives • Describe the two ways of paying taxes: payroll withholding and estimated taxes. • Identify the three steps involved in calculating federal income taxes. • Understand planning strategies to legally avoid overpayment of income taxes. • Explain the basics of IRS audits. Taxes on Purchases State and local taxes are added to the purchase price of goods. Excise tax is imposed on specific goods and services • • • • • • Gasoline Cigarettes Alcohol Tires Air travel Telephone service Taxes on Property Real estate property tax is based on the value of land and buildings. Personal property taxes on the value of automobiles, boats, furniture, and farm equipment are imposed in some areas. New Math Taxes on Wealth Estate tax-federal tax imposed on the value of an individual’s property at the time of death. Inheritance tax-state tax levied on the value of property bequeathed by a deceased individual. 3 Steps in Determining Taxes 1. Determining Adjusted Gross Income 2. Computing Taxable Income 3. Calculating Taxes Owed What is Tax Management? ATTENTION! A PLANNING PROCESS FOR TAX: • Reduction • Deferment • Elimination Administration/Classification of Income Taxes • Federal tax laws • Marginal tax rate • Progressive nature of income tax • Effective marginal tax rate • Regressive • Average tax rate Step 1: Determining Adjusted Gross Income (AGI) Earned Income-money received by personal effort. Investment Income-money received in the form of dividends, interest, or rent Passive Income-activities in which you do not actively participate. Other Income-Alimony, awards, lottery winning, prizes Other Items That Impact Income Exclusion-amount not included in gross income. Tax Exempt Income-another name for exclusions-Qualified scholarships and fellowships where money is used for tuition, fees, supplies, and equipment, VA payments Tax Deferred Income-income that will be taxed at a later date Adjusted Gross Income (AGI)-gross income after certain reductions have been made Tax Shelters-immediate tax benefits and a reasonable expectation of a future financial return (IRA’s Keogh’s) Taxes on Earnings Social Security Income Tax • Federal tax • State tax in all but 7 states • • • • • • • Alaska Florida Nevada South Dakota Texas Washington Wyoming The Marginal Tax Rate Affects Your Final Decision $3,650 personal exemption is not taxed $5,700 standard deduction is not taxed Next $8,350 of income is taxed at 10% Remaining $16,700 of income is taxed at 25% Next $25,600 of income is taxed at 15% 0 + 0 + $835.00 + Gross Income = $60,000 Taxes = $8,850 Marginal Tax Rate = 25% $3,840.00 + $4,175 Eight Steps in Calculating Your Income Taxes Step 1 Total Income Step 2 Gross Income Step 3 Adjusted Gross Income Step 4 Subtotal Step 5 Taxable Income Subtract exclusions Subtract adjustments to income. Subtract standard deduction or total itemized deductions. Subtract value of exemptions Step 6 Apply tax table or tax-rate schedule to determine liability. Step 7 Final tax liability Step 8 Calculate balance owed or refund. Subtract tax credits Step 2: Computing Taxable Income Deduction-an amount subtracted from AGI to arrive at taxable income. • Standard deduction ($5,700/single in 2010) • Itemized deduction Exemption-a deduction from AGI for yourself, your spouse, and qualified dependents ($3,650 in 2010) Step 3: Calculating Taxes Owed Use your taxable income in conjunction with the appropriate tax table or tax schedule. Marginal tax rate-the tax on the last dollar of income. Average tax rate-total tax due divided ty your taxable income. Tax credit-amounts subtracted from the amount of tax owed. The Progressive Nature of the Federal Income Tax-2010 If your filing status is Single If your taxable income is: Over: But not over -- The tax is: Of the amount over-- $0 $8,350 ------------ 10% $0 8,350 33,950 $835.00 + 15% 8,350 33,950 82,250 4,675.00 + 25% 33,950 82,250 171,550 16,750.00+ 28% 82,250 171,550 372,950 41,754 + 33% 171,550 372,9650 ---------- 108,216 + 35% 372,950 The Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. It is not used to figure ones’ taxes. Tax Credit Versus Tax Deduction $100 tax credit reduces your taxes by $100 $100 tax deduction reduces taxes by your tax bracket. For instance, if a person is in the 25% tax bracket it would reduce your taxes by 25% Who Should File a Tax Return? STUDENTS WITH: • Earned income • Unearned income • Transfer payments Is it Taxable Income? Is it Deductible? Is it Taxable Income? Yes No Is it Deductible? Lottery Winnings Life Insurance Premiums Child Support Received Cosmetic Surgery for Improved Looks Worker’s Compensation Benefits Fees for Traffic Violations Life Insurance Death Benefits Mileage for Driving to Volunteer Work Municipal Bond Interest Earnings An Attorney’s Fee for Preparing Will Bartering Income Income Tax Preparation Yes No