International Parity Conditions

advertisement

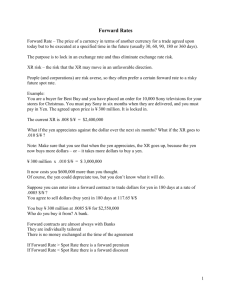

International Parity Conditions (or chapter 4) Agenda • • • • • • What is PPP & law of one price? What is exchange rate pass-through? How do interest rates & exchange rates link? Interest rate parity? What is covered interest arbitrage? What is uncovered interest arbitrage? 2 Prices and Exchange Rates Law of one price: product’s price same in all markets P$ S = P¥ where spot exchange rate is S, yen per dollar. ¥ P S $ P 3 Purchasing Power Parity & Law of One Price Absolute purchasing power parity: spot exchange rate is determined by relative prices of similar basket of goods. Relative purchasing power parity: Relative change in prices b/n countries determines change in forex rate. 4 Absolute PPP: Big Mac Index Economist’s Big Mac PPP: • Big Mac in China costs Yuan 9.90. • Big Mac in US costs $2.71. • Implied PPP exchange rate Yuan9.90 Yuan3.7/$ $2.71 5 Economist, 4/ 2003 Sfr6.30 Sfr2.4803/ $ $2.54 6 Relative PPP 4 P % change spot rate foreign currency US$/ yen 3 2 1 -6 -5 -4 -3 -2 -1 1 -1 2 3 4 5 6 InfJAPAN- InfUS -2 -3 -4 7 But: PPP is not very accurate predictor… • Why? PPP holds well over very long term… PPP holds better for countries w/ high inflation & underdeveloped capital markets… • Why? 8 Is forex under-/over- valued? Use forex indices: trade-weighted bilateral exchange rates b/n the home country & trading partners Nominal exchange rate index : use actual exchange rates. Real effective exchange rate index indicates how the weighted average purchasing power of the currency has changed relative to some arbitrarily selected base period. $ C E E x FC C $ R $ N 9 Q: • Can you tell when a currency is overvalued? • Why the real exchange rate deviates from 100? 10 Real Effective Exchange Rate Indices United States & Japan (1995 = 100) 180 160 United States Japan 140 120 100 80 60 40 20 0 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 11 Exchange Rate Pass-Through Pass-through: change in prices of imported/exported goods when exchange rate changes • BMW made in Germany cost @ spot rate US$ 35,000. $ BMW P € PBMW x S €/$ • where P$ is the price in US$, P€ is price in euros, S is spot • • rate Euro appreciates by 20%. But BMW is now only $40,000. Pass-through: $ PBMW, 2 $ PBMW, 1 $40,000 1.1429, or 14.29% $35,000 • Degree of pass-through: 14.29 % / 20 % = 0.71 or 71 % 12 Interest Rates & Exchange Rates? What is a fair nominal interest rate? – Well, can ask a banker … or read Irvin Fisher… • Fisher Effect: nominal interest rates in each country are equal to the required real rate of return plus compensation for expected inflation. i = r + + r • i is nominal rate, r is real rate, is expected rate of • inflation. FE good for short maturity bonds, NOT long maturity ones. – Why? 13 International Fisher effect International Fisher effect (Fisher-open): spot exchange rate change equals opposite of interest rate differential. S1 S2 $ x 100 i i FC S2 where S is indirect quote. Direct Quotes: US$/ Foreign Currency. Indirect Quotes: Foreign Currency / US$. Fisher-open not precise in short-term. • Why? Should include forex risk premium. 14 Forward Rate Forward Rate • A forward rate: exchange rate quoted today for settlement @ future date F90FC/$ SFC/$ FC 90 1 i x 360 x $ 90 1 i x 360 15 Forward Rate Spot rate SF 1.48/$ 90-day euro Swiss franc deposit rate 4% p.a. 90-day euro-dollar deposit rate 8% p.a. SF/$ F90 90 1 0.04 x 360 SF1.48x 90 1 0.08 x 360 SF1.48 x 1.01 Sfr1.4655/$ 1.02 16 Premium or discount? Forward premium or discount : % difference b/n spot & forward rates in annual percentage terms. • For indirect quotes (FC per home currency, FC/$) then f f SF FC Spot - Foward 360 x x 100 Foward days SF1.48 - SF1.4655 360 x x 100 3.96% p.a. SF1.4655 90 • Swiss franc sells forward @ premium 3.96% p. a. (takes 3.96% more US$ to get franc at 90-day forward rate) • For direct quotes ($/FC), use (F-S)/S. 17 Currency Yield Curve & Forwards Interest yield 6.0 % Euro yield curve 5.0 % 4.0 % Forward premium on low interest rate currrency 3.0 % Eurodollar yield curve 2.0 % 1.0 % 1 2 3 4 Months 5 6 18 Interest Rate Parity (IRP) Interest rate parity:difference in national interest rates for securities of similar risk & maturity should be equal to opposite of forward rate discount/ premium for foreign currency. 1 i S US$ FC/US$ 1 i F FC 1 FC/US$ or FFC/US$ 1 i FC FC/US$ S 1 i US$ 19 Interest Rate Parity (IRP) i $ = 8 % per annum (2 % 90 days) Start $1,000,000 S = SF 1.4800/$ End 1.02 $1,020,000 Dollar money market $1,019,993 90 days F90 = SF 1.4655/$ Swiss franc money market SF 1,480,000 1.01 SF 1,494,800 i SF = 4 % per annum (1 % 90 days) 20 Covered Interest Arbitrage (CIA) Because spot & forward markets are not in equilibrium, arbitrage exists. Covered interest arbitrage (CIA): invests in currency that offers higher return on covered basis. 21 Covered Interest Arbitrage (CIA) Eurodollar rate = 8.00 % per annum Start $1,000,000 End 1.04 $1,040,000 $1,044,638 Arbitrage Potential Dollar money market S =¥ 106.00/$ 180 days F180 = ¥ 103.50/$ Yen money market ¥ 106,000,000 1.02 ¥ 108,120,000 Euroyen rate = 4.00 % per annum 22 Uncovered Interest Arbitrage (UIA) Uncovered interest arbitrage (UIA): investors borrow in currencies w/ low interest rates & convert proceeds into currencies w/ high interest rates. “Uncovered” because investor does not sell the currency forward. 23 Uncovered Interest Arbitrage (UIA): The Yen Carry Trade Investors borrow yen at 0.40% per annum Start ¥ 10,000,000 Then exchanges End 1.004 Japanese yen money market ¥ 10,040,000 Repay ¥ 10,500,000 Earn ¥ 460,000 Profit the yen proceeds for US dollars, S =¥ 120.00/$ investing in US 360 days S360 = ¥ 120.00/$ dollar money US dollar money market markets for one year $ 83,333,333 1.05 $ 87,500,000 Invest dollars at 5.00% per annum 24 Interest Rate Parity (IRP) & Equilibrium 4 3 Percentage premium on foreign currency (¥) 2 1 4.83 -6 -5 -4 -3 -2 -1 1 2 3 4 5 6 -1 -2 -3 Percent difference between foreign (¥) and domestic ($) interest rates -4 X U Y Z 25 Forward Rate - Unbiased Predictor? Exchange rate F2 S2 Error Error S1 F1 F3 Error S3 S4 Time t1 t2 t3 t4 26