Stock Valuation

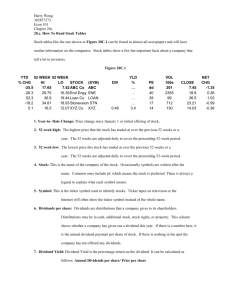

advertisement

Stock Valuation Chapter 9.1,9.2 Outline • Investing in stocks – Capital gains, dividend yield, return • • • • The Constant Dividend Growth Model The Dividend and Growth Tradeoff The DGM with Changing Growth rates Further problems Investing in Stocks A One-Year Investor There are two potential sources of cash flows form owning a stock: • The firm might pay out cash to shareholders in the form of dividends • The investor can generate cash flows by selling shares at some future date The investor pays the current price P0 and at the end of the year expects to receive dividend Div1 and to sell the stock at P1 Equity Cost of Capital Both potential sources of cash flows form owning a stock are risky • Dividends change overtime • Stock prices fluctuate considerably Equity investors demand compensation for this higher risk and require a risk-premium as reflected in the: Equity cost of capital rE Div1 + P1 P0 = 1+ rE Capital Gains and Dividend Yield The expected one-period total return on investment in a stock is the sum of the expected capital gain yield and dividend yield Div1 P1 - P0 rE = + P0 P0 Total return on the stock Dividend Yield Capital Gain Rate Stock Prices and Returns 5.33% Dividend Yield for stocks in the Dow Jones Industrial Average (2013) 3.5% 1.79% 3.03% 2.18% 2.31% Dividend Yield for stocks in the Dow Jones Industrial Average (2013) Dividend Yield for stocks in the Nasdaq 100 (2013) A Two Year Investment Suppose that the investor wishes to hold the stock for two years Setting the stock price equal to the present value of future cash flows implies Div1 Div2 + P2 P0 = + 2 1+ rE (1+ rE ) Dividend Discount Model Suppose that the investor wishes to hold the stock for n years Dividend Discount Model Div1 Div2 DivN PN P0 = + +... + + 2 N N 1+ rE (1+ rE ) (1+ rE ) (1+ rE ) In Efficient Markets ¥ Div1 Div2 DivN Divn P0 = + +... + +... = å 2 N n 1+ rE (1+ rE ) (1+ rE ) n=1 (1+ rE ) The Constant Dividend Growth Model Estimating Future Expected Dividend The simplest approach is to assume that Dividends grow over time with a constant growth rate, g, forever Constant Dividend Growth Model Div1 P0 = rE - g Stock Valuation: Constant Dividend Growth Constant Dividend Growth: Application GE Market Information Historical Dividends Dividends per-share (Dec 2000 – Sept 2013) Historical Stock Price Stock price appreciation (from $48.8 to $24.22): -50% Average annual dividend growth (2000-2013): 6.854% P2013 = Div2014 Div2014 Þ rE = +g rE - g P2013 Implied rate of return on equity for growth 6.854% rE = $0.76 + 6.854% = 9.99% $24.23 The Dividend and Growth Tradeoff (within the Constant Dividend Growth model) Dividends and Growth The stock price increases with the level of dividends and the growth rate Div1 P0 = rE - g What determines the level of growth? Can management increase the share price by changing its dividend policy? A Simple Model of Growth Dividends are paid out of earnings according to the dividend payout rate Divn = EPSn ´ Dividend Payout Rate Earningsn EPSn = Shares Outstandingn Cash flows that are not paid out as dividends are retained Retention Rate = 1- Dividend payout rate Dividends and Investment The firm can pay a higher current dividend by increasing its payout rate How would a higher payout rate affect future dividends? Earnings year n Earnings year n+1 Div n Div n+1 New Investment n New Investment n+1 Calculating Earnings Growth Rate Change in Earnings = New Investment ´ Return on Investment New Investment = Earnings ´ Retention rate Change in Earnings g = Earnings growth rate = Earnings = Retention Rate ´ Return on Investment Cutting Dividends for Profitable Growth Cutting Dividends for Profitable Growth Cutting Dividends for Profitable Growth Second Example Comparing the two alternatives Stocks in Nasdaq 100 that have zero dividends The DGM with changing Growth Rates Changing Growth Rates Often firms’ growth rates change overtime: Young firms tend to retain a high fraction of earnings in order to take advantage of investment opportunities and as a result have high earnings growth rates As firms mature, their growth slows to rates more typical of established companies. At that point, their earnings exceed their investment needs and they begin to pay dividends DDM with Constant Long-Term Growth When growth rates only stabilize at a constant level “g” after period “N+1” ends we value according to: Div1 Div2 DivN PN P0 = + +... + + 2 N N 1+ rE (1+ rE ) (1+ rE ) (1+ rE ) Where the future price PN is DivN+1 PN = rE - g Varying Growth Rate Varying Growth Rate Varying Growth Rate Further Problems Acap Corporation Question 3 (2nd Edition) Suppose Acap Corporation will pay a dividend of $2.80 per share at the end of this year and $3 per share next year. You expect Acap’s stock price to be $52 in two years. If Acap’s equity cost of capital is 10%: a. b. c. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? Suppose instead you plan to hold the stock for one year. What price would you expect to be able to sell a share of Acap stock for in one year? Given your answer in part (b), what price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year? How does this compare to your answer in part (a)? Acap Corporation Buy and hold for two years Div1 Div2 + P2 $2.8 $55 P0 = + = + 2 = 48 2 1+ rE (1+ rE ) 1.1 1.1 Price one year from now P1 = Div2 + P2 $55 = = 50 (1+ rE ) 1.1 Price one year from now P0 = Div1 + P1 = 48 (1+ rE ) Colgate-Palmolive Question 12 (2nd Edition): Colgate-Palmolive Company has just paid an annual dividend of $0.96. Analysts are predicting an 11% per year growth rate in earnings over the next five years. After then, Colgate’s earnings are expected to grow at the current industry average of 5.2% per year. If Colgate’s equity cost of capital is 8.5% per year and its dividend payout ratio remains constant, what price does the dividend-discount model predict Colgate Stock should sell for? Colgate-Palmolive Expected price time 5 Div6 $1.7 P5 = = = $51.52 rE - gLongTerm 8.5%- 5.2% Current Price 5ö æ æ ö Divt P5 $1.07 1.11 $51.52 ç ÷ P0 = å + = 1+ = $39.43 ç ÷÷ t 5 5 ç (1+ rE ) (-2.5%) è è 1.085 ø ø 1.085 t=1 (1+ rE ) 5