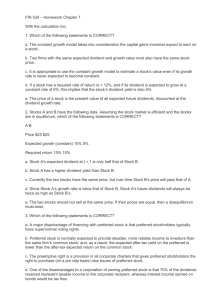

Common Stock Valuation

Theory of Stock Valuation

Same theory as bond valuation

Find PV of future cash flows

Use investor’s required rate of return as the discount rate in finding PV

Cash Flows from Owning Stock

Dividends

Capital gain (loss) from selling at a higher (lower) price than you paid for the stock

Difficulties in Valuing Stock

1) Future cash flows not known

2) Stock has no maturity - infinite life of corporation

3) No way to easily observe the rate of return that the market requires

Stock Valuation Symbols

D = dividend

Subscript tells when dividend is expected to be paid/received

P = price

Subscript tells when price is expected to be paid/received

K c

= investor’s required rate of return

Example 1

D

1

= $1.00

D

2

= $1.25

D

3

= $1.50

P

3

= $50

If you require a 10% rate of return, what is the most you will pay for this stock?

Using Financial Calculator

P/Y C/Y N I/Y PV PMT FV

1

1

1

1

1

1

1

1

3

3

1

2

10

10

10

10

-.9090

0

-1.033

0

-1.127

0

-37.57

0

1.00

1.25

1.50

50.00

Sum PVs to get -40.63

$40.63 is max price you are willing to pay for this stock if you require a 10% rate of return.

Pay more than $40.63 → Return < 10%

Pay less than $40.63 → Return > 10%

BUT…future stock cash flows are not known with certainty

Future dividends aren’t known with certainty

Dividends may be estimated, but it will only be an estimate

Future selling price isn’t known with certainty

How to overcome these problems?

Future Selling Price

Can prove mathematically that it doesn’t matter that we don’t know what we can sell a stock for in the future

Need to use mathematical formula for finding PV to prove this point

Mathematical Formula for

Finding PV

PV = FV x (1+i) -n

PV = 1.00(1.10) -1 + 1.25(1.10) -2 +

1.50(1.10) -3 + 50(1.10) -3

P

0

= $40.63 (same answer as we got using a financial calculator)

Theoretical Determination of

Future Selling Price

The future selling price (P n

) is based on what the next investor will pay for the stock.

The next investor is valuing the stock based on the present value of his/her expected future dividends and future selling price.

The next investor follows the same process, etc., etc., etc.

Since stock never matures, the actual determination of the next selling price can be put off indefinitely.

If the actual determination of the future selling price is pushed far enough out into the future, its present value will eventually approach zero.

With PV of future selling price dropping off to zero, value of stock becomes the PV of its dividend stream.

The question now becomes, how can you find the PV of an unending stream of dividends?

Can do it if you make assumptions about how dividends grow from year to year.

Constant Dividend (No Growth)

P

0

= D p

/K p

P

0

= Intrinsic value = Price today

D p

= Preferred Dividend (fixed amount, doesn’t change)

K p

= Required rate of return on P/S

Preferred stock is an example where the dividend is constant

Example 2

If you require a 12% rate of return, what is the maximum price you will pay for a share of preferred stock that pays a

$1.25 annual dividend?

P

0

= $1.25/.12 = $10.42

Dividends Growing at a Constant

Growth Rate

P

0

= D

1

/(K c

- g)

P

0

= Intrinsic value = Price today

D

1

= Dividend expected 1 year from now

D

1

= Last dividend paid x (1 + g)

K c

= Required rate of return

g = Constant annual dividend growth rate

Example 3

How much would you pay for a share of common stock if the last dividend paid was $2.00 per share, dividends are expected to grow at a constant annual rate of 5%, and you require a 10% rate of return?

P

0

= ($2 x 1.05)/(.10 - .05) = $42

What if a company isn’t paying dividends?

Just because a company is not currently paying dividends doesn’t mean that they never plan to.

Estimate when first dividend will be paid and at what rate dividends will grow.

Find price for year prior to first dividend.

Discount future price back to present.

Example 4

You estimate that a company that is not currently paying dividends will pay a $5 dividend per share at the end of 5 years and that dividends will grow at a constant annual rate of 8% thereafter. If you require a 12% rate of return, what is the maximum price you will pay for the stock today?

P

4

= D

5

/K c

-g

P

4

= $5/(.12-.08) = $125

P

0

= P

4

(1 + K c

) -4

P

0

= $125(1+.12) -4 = $79.44 maximum price you are willing to pay today

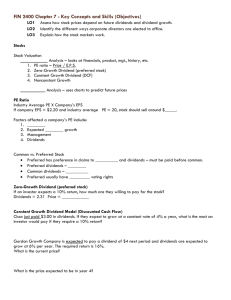

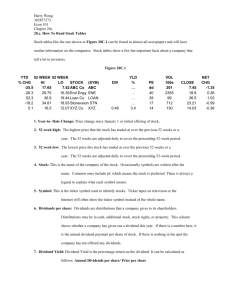

Valuing Non-public Corporations

Twitter article

Estimate total revenue

# users = 250 M by 2013

Revenue per user = $2 by 2013

250 M * $2 = $500 M total rev by 2013

Borrow ratios from comparable firm

Google’s profit margin = .27 and

Google’s PE = 20

.27 * $500 M = $135 M profit

$135 * 20 = $2.7 B total value (as measured by price * # shares)

Discount future value back to present

Use 20% as appropriate rate for small, risky, high growth company

N = 4; I/Y = 20; PMT = 0; FV = $2.7B

PV = $1.3 Billion estimated value for