10.26+-+Chapter+8 - Berkeley Women in Business

advertisement

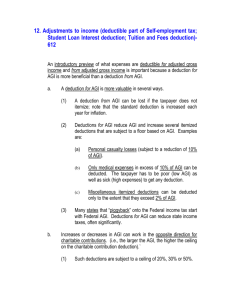

CONCEPTS IN FEDERAL TAXATION CHAPTER 8: TAXATION OF INDIVIDUALS October 26, 2012 ADMINISTRATIVE Attendance Midterm 1 Pass out exams Income dividend—5 points Research project Fill out spreadsheet Include email! HOMEWORK PROBLEMS HW Problems: Assignment #9 Chapter 8 P#46, 48, 52, 55, 57 Extra problems: #44 Keith bought his home several years ago for $110,000. He paid $10,000 down on the purchase and borrowed the remaining $100,000. When the home is worth $230,000 and the balance on his mortgage is $40,000, Keith borrows $120,000 using a home equity loan. Keith uses the proceeds of the loan to pay of f some gambling debts. During the year, Keith pays $3,200 in interest on the original home mortgage and $7,600 in interest on the home equity loan. What is Keith’s allowable itemized deduction for interest paid ? #44 Allowable home mortgage interest deduction: Interest paid on acquisition debt of up to $ 1 ,000,000 Must be used to acquire, construct, or substantially improve residence Interest paid on home equity loans of up to $100,000 Proceeds of the home equity loan may be used for any purpose Total acquisition debt and home equity debt cannot exceed the fair market value of the property Debt must be secured by the taxpayer’s qualified residence #44 Total debt: $160,000 ($40,000 + $120,000) Less than FV ($230,000) Only interest on $100,000 of the home equity loan is deductible: $6,333 [$7,600 x ($100,000 ÷ $120,000)] The remaining $1 ,267 of interest is considered personal interest and is not deductible All of the interest on the original home mortgage ($3,200) qualifies for deduction Keith’s total interest deduction is $9,533 ($6,333 + $3,200 ) #48 Stoycho and Selen are married and have the following investment income for 2011 and 201 2: 2011 201 2 Interest on U.S. Treasur y notes $ 1 ,200 $ 1 ,400 Cash dividends 3,000 2,200 Interest on savings 2,000 1 ,500 Interest on State of Montana bonds 800 800 Net long-term capital gain 1 ,000 500 Their adjusted gross income before considering the investment income is $84,000 in 2011 and $73,500 in 201 2. Stoycho and Selen pay $9,000 in investment interest in 2011 and $5,000 in 201 2. The investment interest is incurred to acquire all the investments in their por tfolio. Write a letter to Stoycho and Selen explaining how much investment interest they can deduct in 2011 and 201 2. #48 2011: The investment interest deduction is limited to net investment income Investment income is $3,200 ($1,200 + $2,000) The interest received on the municipal bonds is tax -exempt Not included The net long-term capital gain cannot be used in the calculation of gross investment income because it will be taxed at 15% Dividends receive special tax treatment and are taxed at a maximum rate of 15% #48 The $9,000 of interest is paid to produce $7,200 of taxable income and $800 of tax -exempt income The portion of the interest related to the production of the tax-exempt income is not deductible $900 [$9,000 x ($800 ÷ $8,000)] of the interest is not deductible Their investment interest expense is $8,100 ($9,000 - $900) Because this amount exceeds their investment income, their investment interest deduction is limited to $ 3,200 The remaining $4,900 ($8,100 - $3,200) is carried forward to 2012 #48 2012: Investment income: $2,900 ($1 ,400 + $1 ,500) Interest received on the municipal bonds is tax-exempt Not allowed for purposes of computing allowable investment interest deduction Dividends and net long-term capital gain cannot be used in the calculation of gross investment income because it will be taxed at 15% #48 The $5,000 of interest is paid to produce $5,600 of taxable income and $800 of tax -exempt income The portion of the interest related to the production of the tax-exempt income is not deductible $625 [$5,000 x ($800 ÷ $6,400)] of the interest is not deductible Their investment interest expense is $4,375 ($5,000 - $625) Because $4,375 exceeds their investment income, their investment interest deduction is limited to $ 2,900 The remaining $1 ,475 ($4,375 - $2,900) along with the $4,900 from 2011 is carried forward to the following year Total carryforward to 2013 is $6,375 ($4,900 + $1,475) #52 Miguel is a successful businessman who has been approached by St. Kilda University to make a donation to its capital campaign. He agrees to contribute $75,000, but he is unsure which of the following assets he should contribute : Asset Ordinary income property Long-term capital gain property Long-term capital gain property Basis $ 41 ,000 84,000 32,000 FMV $ 75,000 75,000 75,000 Write a letter to Miguel advising him which property he should contribute to St. Kilda’s capital campaign. #52 Ordinary income property: The amount of the contribution is limited to the lesser of: 1. the property’s fair market value at the date of the gift 2. the property’s adjusted basis Appreciation in the value of ordinary income property is not allowed as a deduction Limited to a maximum deduction of 50% of AGI #52 Long-term capital gain property: FM valuation allowed Appreciation in the value of a long -term capital gain property is allowed as a deduction Any property valued at fair market value is limited to a maximum deduction of 30% of AGI The taxpayer can elect to treat the long -term capital gain property as ordinary income property (valuing property at it’s adjusted basis) and be subject to the 50% limitation Any amounts in excess of the limits are carried forward #52 If Miguel contributes the ordinary income property, his charitable contribution is limited to his basis in the property ($41 ,000) Contributing either long-term capital gain property results in a charitable contribution of $75,000 If he contributes the capital gain property with a basis of $84,000, Miguel loses the benefit of being able to recognize the $9,000 ($75,000 - $84,000) loss If he contributes the capital gain property with a basis of $32,000, he does not recognize the $44,000 ($75,000 $32,000) gain on its appreciation #52 Miguel should contribute the long -term capital gain property that has a basis of $32,000 #52 Alternative solution: If Miguel wants to contribute the long -term capital gain property with a basis of $84,000, he could sell the property and realize the $9,000 loss He will recognize a $3,000 capital loss in the current year The amount of his donation to St. Kilda is $75,000 Instead of receiving property, St. Kilda would receive cash #55 Edna works as a marketing consultant. In her spare time, she enjoys painting. Although she sells some of her work at local craft shows, she either displays most of her paintings at home or gives them to family and friends. During the year, she receives $750 from the sale of her paintings. The cost of producing the sold paintings and the cost of attending the crafts shows is $1 ,850. Edna has other allowable miscellaneous deductions of $1 ,400, and her adjusted gross income before considering her painting activity is $48,000. Write a letter to Edna explaining her allowable miscellaneous itemized deduction for the year. #55 Edna must include the $750 from the sale of the paintings in her gross income Deduction of hobby expenses is limited to the $750 of income Hobby expenses are deducted as a miscellaneous itemized deduction Subject to the 2% of AGI limitation #55 Edna’s AGI af ter considering the income from her paintings is $48,750 ($48,000 + $750 ) Total miscellaneous itemized deduction is $2,150 ($1 ,400 + $750) $2,150 is reduced by the 2% of AGI limitation on miscellaneous itemized deductions: Total miscellaneous itemized deductions Less: $48,750 x 2% Allowable miscellaneous itemized deduction $2,150 (975) $1 ,175 #57 Michael owns a hair salon. During the current year, a tornado severely damages the salon and destroys his personal automobile, which is parked outside. It costs Michael $12,000 to make the necessary repairs to the salon. He had paid $21 ,500 for the automobile, which was worth $17,100 before the tornado. Michael’s business insurance reimburses him for $7,000 of the salon repair costs. His automobile insurance company pays only $12,000 for the automobile destruction. Michael’s adjusted gross income is $34,000 before considering the ef fects of the tornado. Write a letter to Michael explaining his deductible loss from the tornado. #57 The damage to the hair salon is a business casualty, which is deductible for adjusted gross income The deductible loss is $ 5,000 $12,000 cost of repairing the salon less $7,000 insurance reimbursement #57 The loss on the automobile is a personal casualty loss, which is deductible as an itemized deduction The amount of the loss is the lesser of: 1. $21,500 basis 2. $17,100 decline in value The $5,100 unreimbursed personal casualty loss ($17,100 $12,000) is reduced by the $100 statutory floor Total casualty loss for the year is subject to 10% of AGI Michael’s adjusted gross income is $29,000 ($34,000 $5,000 business casualty loss from the salon) The $5,000 allowable personal casualty loss is reduced by $2,900 ($29,000 x 10%) Casualty loss deduction is $2,100 #57 Amount of loss Less: Insurance reimbursement Less: Statutory floor Allowable loss before 10% of AGI limitation Less: Annual loss limitation (10% x $29,000) Deductible casualty loss $ 17,100 (12,000) (100) $ 5,000 (2,900) $ 2,100 EXTRA PROBLEMS—#36 Rebecca and Ir ving incur the following medical expenses during the current year: Medical insurance premiums $4,100 Hospital 950 Doctor s 1 ,225 Dentist 575 Veterinarian 170 Chiropractor 220 Cosmetic surger y 1 ,450 Over-the-counter drugs 165 Prescription drugs 195 Crutches 105 They receive $4,000 in reimbur sements from their insurance company of which $300 is for the cosmetic surger y. What is their medical expense deduction if: a. Their adjusted gross income is $44,000? EXTRA PROBLEMS—#36 Medical insurance premiums Hospital Doctors Dentist Veterinarian Chiropractor Cosmetic surgery Over-the-counter drugs Prescription drugs Crutches $4,100 950 1 ,225 575 170 220 1 ,450 165 195 105 No No No EXTRA PROBLEMS—#36 Medical insurance premiums Hospital Doctors Dentist Chiropractor Prescription drugs Crutches Total Allowable medical expenses $ 4,100 950 1 ,225 575 220 195 105 $ 7,370 EXTRA PROBLEMS—#36 Reimbursed medical costs: Insurance reimbursement: $4,000 Reimbursement for cosmetic surgery: $300 Reimbursement related to medical expense deduction: $3,700 The $3,670 of medical expenses is subject to the 7.5% AGI limitation EXTRA PROBLEMS—#36 Medical insurance premiums Hospital Doctors Dentist Chiropractor Prescription drugs Crutches Total Allowable medical expenses Less: Insurance reimbursements Unreimbursed medical expenses Less: AGI limitation ($44,000 x 7.5%) Medical expense deduction $ 4,100 950 1 ,225 575 220 195 105 $ 7,370 (3,700) $ 3,670 (3,300) $ 370 EXTRA PROBLEMS—#36 b. Their adjusted gross income is $61 ,000? No deduction is allowed The AGI limit is $4,575 ($61 ,000 x 7.5%), which is greater than their $3,670 of unreimbursed costs EXTRA PROBLEMS—#35 Arthur and Cora are married and have 2 dependent children. They have a gross income of $95,000. Their allowable deductions for adjusted gross income total $4,000, and they have total allowable itemized deductions of $14,250. a. What is Arthur and Cora’s taxable income? EXTRA PROBLEMS—#35 Gross income Deductions for AGI Adjusted gross income Deductions from AGI: The greater of: Itemized deductions $ 14,250 or Standard deduction $ 11 ,900 $ 95,000 (4,000) $ 91 ,000 (14,250) Personal & dependency exemptions (4 x $3,800) (15,200) Taxable income $ 61 ,550 EXTRA PROBLEMS—#35 b. What is Arthur and Cora’s income tax? $1 ,740 + [15% x ($61,550 - $17,400)] = Less: Child tax credit (2 x $1 ,000) Net tax liability $ 8,363 (2,000) $ 6,363 EXTRA PROBLEMS—#35 c. If Arthur has $2,900 and Cora has $3,800 withheld from their paychecks, are they entitled to a refund, or do they owe additional taxes? They are entitled to a refund of $337 [$6,363 - ($2,900 + $3,800)]