Tax Saving Strategies for Small Businesses

advertisement

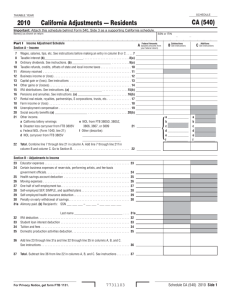

Small Business Tax Saving Strategies for the 2013 Filing Season The Simple Stuff • Understand Tax timing • Get the big picture at totaltaxinsights.org • Pay your estimated tax payments • Have solid books • Don’t be cheap: Capitalize on the value of tax planning often 3 to1 return • If you cant pay still file • Pick up all of your expenses - Meals and entertainment - Learning and education/Professional dues - Mileage - IT and Communications 2 Contribute to Retirement • 401(k) • IRA - Payroll Deduction IRA - SEP - Simple IRA - Profit Sharing • ** Refer to IRS Comparison Worksheet 3 Planning for Retirement • Variety of options, designed to fit your needs - 401(k) allows flexibility; salary deferrals and/or employer contributions - SIMPLE IRA and SIMPLE 401(k) are available only to small businesses; for SIMPLE 401(k), employer is required to contribute - SEP is simple, inexpensive 4 Expenses: Section 179 Deduction • Expensing provision for certain business property • Maximum $500,000 first-year • Most tangible personal property eligible - Computer, office furniture, vehicles and machinery, software • Phaseout begins at $2 million • Limits and exceptions • Does not have to be cash can be credit/loan 5 Expenses: Bonus Depreciation • If 179 is not enough…. • First-year bonus depreciation allowance for eligible property • 50% deduction for property placed in service in 2013 • Property eligibility requirements • Benefits of using bonus depreciation: - Immediate tax relief - Improved cash flow - Additional reinvestment capital 6 Expenses: Start-up and Organizational Costs • Start-up Costs - Deduction in year business starts/succeeding years - Can include full range of business investigatory costs - First $5,000 in expenses deducted; the remaining is amortized over 180 months - The deduction requires an election • Organizational Costs - Deduction for certain costs in creating C or S corporation or partnership - $5,000 maximum - Same rules as business start-up costs - Certain legal and accounting fees 7 Small Business Health Insurance Credit • 35% of premiums paid • Must cover > 50% of health care • Pay at least ½ of employees health insurance • 10 or fewer FTE – Avg Wages < $25,000 Or • 25 or fewer FTE – Avg Wages < $50,000 • Carryback/forward 8 Choose the right entity at the right time • Sole Proprietorship • Partnership • Corporation • S-Corporation • LLC • Sole Proprietorship – most affordable, least fees, no protections, limited tax planning. • Partnerships – unplanned complexity, simple as a handshake, always limited protections for someone. • Corporations – double taxation • S-Corporation – most opportunity for tax planning • LLC – Simple to set-up, provides protection 9 Home Office Deduction • Simplified • $5 per square foot up to 300 square feet • Interest and property taxes in addition 10 State taxes • Debt forgiveness not extended • California state income tax rate increased • California Enterprise Zone going away December 31, 2013. 11 Tax Credit Example: Hiring Credit • Up to $37,440 per eligible employee over a 5-year period • Employees can be full-time, part-time, or seasonal • Employees must work in the Enterprise Zone at least 50% of the time • Our sister company assists with claiming this tax credit Caliber 4/9/2015 12 Important Tax Rule: Corporation Built-in Gains • No net built-in gains tax on certain property • If sold more than 5 years after conversion from C corporation to S corporation • Special rule for 2011 – normally 10 years • Reduced taxes and additional investment capital 13 Planning for Net Operating Losses • NOL deduction available when current year’s income is less than current year’s deductions • NOLs can be carried back 2 years and forward 20 • Planning required to maximize deduction • NOL versus Section 179 deduction • NOL versus bonus depreciation • Many businesses have large NOLs generated during economic downturn. Proper planning will insure best tax result so that NOL benefits are not allowed to expire. 14 Planning for Business Succession • Critical to start now – need to have plan for unexpected events • Significant impact if a principal owner/ partner suddenly leaves or dies • Several strategies available to finance a smooth transition • Sources of financing can include: - Life insurance - Buy-sell agreement - Grantor trust • Best plan should fit structure of company, personal preferences & needs 15 Key Takeaways • CPA-small business owner partnership • CPA advice • Year-round tax planning 16 We are a full service CPA firm. Let us know how we can help. www.mbsaccountancy.com (559) 421-7033 17