Chapter 17

Tax Consequences of

Personal Activities

McGraw-Hill Education

McGraw-Hill/Irwin

Copyright © 2015 by McGraw-Hill Education. All rights reserved.

© 2007 The McGraw-Hill Companies, Inc., All Rights Reserved.

17-2

Objectives

• Identify personal receipts that are taxable income

• Describe the tax consequences of divorce settlements

• Identify personal expenses and losses that result in itemized

deductions

• Describe the tax treatment of revenues and expenses from a

hobby

• Compute the itemized deduction for home mortgage interest

• Describe the preferential treatment of gain from the sale of a

personal residence

• Identify itemized deductions that are limited or disallowed for

AMT purposes

17-3

Gross Income

• Section 61 states that gross income means all

income from whatever source derived – even

income from personal activities

17-4

Gratuitous Receipts

• Prizes and awards are included in

gross income

• Scholarships are excluded to

extent spent on:

• Tuition, books, fees, equipment

required by institution

• Gifts, inheritances, and life

insurance death benefits are

excluded from gross income

17-5

Legal Settlements and Government Payments

• Legal settlements are included in gross income unless

compensation for physical injury or illness

• Workers’ compensation is excluded

• Unemployment compensation is included

• Need-based payments such as welfare

and food stamps are excluded

• Social Security:

• 85%, 50%, or 0% included in gross income depending

on income level

17-6

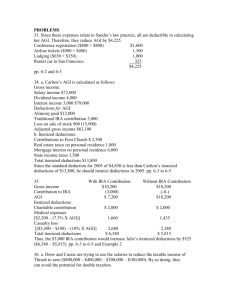

Application Problem 1

• Marcy Tucker received the following items.

Determine to what extent each item is included

in gross income.

• $25,000 cash gift from her parents

• $500 cash award from the local Chamber of Commerce

for her winning entry in a contest to name a new public

park

• $8,000 alimony from her former husband

• $100,000 cash inheritance from her grandfather

17-7

Divorce

• Property settlements are

nontaxable

• Transferred property

takes a carryover basis

• Alimony is taxable to the recipient, deductible

above-the line by the payer

• Child support is neither taxable nor deductible

17-8

Divorce Example

• Ted and Alice divorced on July 1. In the property

settlement, Ted transferred one-half ownership of their

home (FMV $250,000) to Alice. Ted will pay $450 per

month alimony and $800 per month child support

• Tax consequences to Ted?

• No deduction for property transfer or payment of child support.

Ted has a $2,700 ($450 x 6 months) above-the-line deduction for

payment of alimony

• Tax consequences to Alice?

• No income from the receipt of property or child support. Alice

recognizes $2,700 ordinary income from receipt of alimony

17-9

Personal Use Assets and

Personal Expenses

• Personal use assets

• Personal use assets may not be depreciated

• Gains on sale are capital gain

• Losses on sale are not deductible

• No deduction is allowed for personal, living, or

family expenses except for:

•

•

•

•

Medical expenses

Certain taxes

Home mortgage interest

Charitable contributions

17-10

Personal Expenses - Medical

• Taxpayers may deduct the excess of unreimbursed

expenses over 10% of AGI as an itemized

deduction

• 10% decreased to 7.5% for taxpayer age 65 or older

• Qualifying medical expenses include:

•

•

•

•

•

Clinics, hospitals, long-term care facilities

Medical aids (e.g., hearing aids, crutches)

Prescription drugs

Medical insurance premiums

Doctors, dentists, chiropractors

17-11

Medical Expenses Example

• Sam, age 42, incurred the following unreimbursed expenses

•

•

•

•

•

•

Health insurance premiums

Prescription drugs

Hospital bills

Doctor bills

Wheelchair

Diet food and pills, non Rx

$2,200

600

2,000

900

100

250

• If Sam’s AGI is $55,000, compute his medical expense

deduction

• $5,800 – ($55,000 x 10%) = $300

17-12

Personal Expenses - Taxes

• Individuals are allowed an itemized deduction for:

• Real or personal property taxes paid on nonbusiness

assets

• Either state and local sales taxes or state and local

income taxes

• Costs of tax compliance (e.g. tax preparation fees)

are miscellaneous itemized deductions

17-13

Personal Expenses – Charitable Contributions

• General limit – Itemized deduction limited to 50% of

AGI for cash donation (less for capital assets)

• Carryover excess as an itemized deduction for 5 years

• Deduction amount

• LT capital assets = FMV of property

• Other property = lesser of FMV or basis

17-14

Charitable Contribution Example

• Mrs. Bain gave the following to charity this year

• Antiques (owned 15 years; cost $50,000; FMV $125,000)

• Painting (owned 9 months; cost $25,000; FMV $27,000)

• Compute Mrs. Bain’s itemized deduction for

charitable contributions before AGI limitation

• $125,000 (FMV of antiques) + $25,000 (basis of painting)

= $150,000 deduction

17-15

Tax Subsidies for Education

• EE Savings Bonds

• Deduction for qualified tuition and fees

• Deduction for interest on qualified education loans

• American Opportunity Credit

• Lifetime Learning Credit

• Qualified tuition programs

• Coverdell education savings accounts

17-16

Casualty Losses

• Casualty and theft losses

• Loss equals lesser of adjusted basis or

decline in FMV of property resulting

from casualty or theft

• Loss reduced by insurance

reimbursement

• Loss in excess of $100 floor per

casualty is deductible

• Deduction limited to excess of

aggregate losses over 10% AGI

17-17

Hobby and Gambling Losses

• Activity not entered into for profit (hobby)

• Revenue included in gross income

• Expenses are miscellaneous itemized deductions

limited to revenue from hobby

• If the activity generates a profit in 3 of 5 years, IRS

presumes it is a business and losses are deductible

• Gambling losses

• Itemized deduction but not miscellaneous

• Limited to gambling winnings

17-18

Home Mortgage Interest

• Qualified residence interest is itemized deduction

• Interest on acquisition debt up to $1 million

• Interest on home equity debt up to $100,000

• Deduction for mortgage on principal residence and

one other personal residence

17-19

Vacation Home Rental

• Residence is subject to vacation home rules if

owner’s days of personal use exceed greater of 14

days or 10% of rental days

• Expenses attributable to rental days are deductible

to extent of rental revenues

• Vacation home rental can’t generate a net loss deductible

against other income

• Nondeductible loss carries forward

17-20

Gain on Sale of Principal Residence

• $250,000 exclusion of gain on sale of home

• Owner must have used the home as a principal residence

for two years out of five years ending on date of sale

• Exclusion doubled to $500,000 for MFJ

• Exclusion applies to only one sale in a two-year period

• Owners who sell a home but don’t satisfy above

requirements may be eligible for reduced exclusion

if sale was necessitated by:

• Change of employment

• Health reasons

• Unforeseen circumstances

17-21

Itemized Deductions as AMT Adjustments

• Medical deductions are allowed only to the extent

they exceed 10% AGI

• Deductions for state and local taxes are disallowed

• Miscellaneous itemized deductions are disallowed

• Interest on home equity debt is disallowed

17-22