Small Business Tax Saving Strategies for the 2012 Filing

advertisement

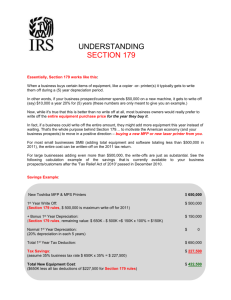

Small Business Tax Saving Strategies for the 2012 Filing Season Updated December 12, 2011 Advice for Small Businesses from CPAs • Tax incentive opportunities for small businesses in 2011 and 2012: - Expense-related provisions - Employee-related provisions - Reporting-related provisions - Planning opportunities • Year-round tax management 2 Expenses: Section 179 Deduction • Expensing provision for certain business property • Maximum $500,000 first-year write-off in 2011; $139,000 in 2012 • Most tangible personal property eligible • Includes qualified restaurant, leasehold and retail properties in 2011 • Phaseout begins at $2 million in 2011; $560,000 in 2012 • Limits and exceptions 3 Expenses: Bonus Depreciation • First-year bonus depreciation allowance for eligible property • 100% deduction for property placed in service in 2011; 50% in 2012 • Property eligibility requirements • Benefits of using bonus depreciation: - Immediate tax relief - Improved cash flow - Additional reinvestment capital 4 Expenses: Start-up and Organizational Costs • Start-up Costs - Deduction in year business starts/succeeding years - Can include full range of business investigatory costs - First $5,000 in expenses deducted; the remaining is amortized over 180 months - The deduction requires an election - $50,000+ dollar-for-dollar phaseout • Organizational Costs - Deduction for certain costs in creating C or S corporation or partnership - $5,000 maximum - $50,000+ dollar-for-dollar phaseout - Same rules as business start-up costs - Certain legal and accounting fees 5 Employee Related: Federal Unemployment Tax (FUTA) • Employers pay FUTA tax on first $7,000 of each employee’s wages • 6.2% tax rate through June 30, 2011 • Reduced to 6.0% tax rate starting July 1, 2011 • Credit against state unemployment taxes 6 Employment Related: Deduction for Health Insurance • Self-employment tax rate reduced by 2% to 13.3% in 2011 • If you are self-employed, you may continue to deduct health insurance costs from your business income when determining your income tax liability • Deduction for business owner, spouse and dependents (and children under age 27 in certain circumstances) 7 Employee Related: Worker Retention Credit • Worker retention tax credit for each formerly unemployed worker - Hired after 3/18/2010 and before 1/1/2011 - Minimum one-year employment period - Claim credit on 2011 tax return - $1,000 or percentage of wages paid 8 Employee Related: Credit for Hiring Unemployed Veterans • Special credit for hiring unemployed veterans - Component of work opportunity credit - Hired after 11/11/2011 and before 1/1/2013 - Up to $5,600 for hiring a long-term unemployed veteran - Up to $2,400 for hiring a short-term unemployed veteran - Up to $9,600 for hiring an unemployed veteran with a service related disability 9 Reporting: Certain 1099-MISC Reporting Repealed • As in previous years, Form 1099-MISC is used to report payments for business services totaling $600 or more. • Payments to corporations for business services do not require a 1099 – Congress repealed. • All other reporting requirements remain 10 Reporting: Credit Card Transactions • New reporting requirement for merchants accepting credit cards, debit cards, or gift cards • Businesses will need to report income from credit card transactions separately and reconcile credits and returns • Designed to make sure merchants are properly reporting income • Businesses must provide card processing company with your TIN on a Form W-9 • Merchants will receive Form 1099-K by January 31 of each year, beginning 1/31/2012 11 Reporting: Information Return Penalties • Failure to file a correct and timely information return • Penalties significantly increased by Congress - $30 per return if less than 30 days late - $60 per return more than 30 days late, but filed by Aug. 1st - $100 per return, otherwise • Penalties may be waived for reasonable cause • Increase penalty for intentional disregard 12 Important Tax Rule: Corporation Built-in Gains • No net built-in gains tax on certain property • If sold more than 5 years after conversion from C corporation to S corporation • Special rule for 2011 – normally 10 years • Reduced taxes and additional investment capital 13 Planning for 2012 and Beyond • Additional 0.9% Medicare tax on certain wages beginning January 1, 2013 • New Medicare tax (3.8%) on certain investment income beginning January 1, 2013 • If Bush-era tax cuts allowed to expire December 31, 2012: - Tax rates increase on regular income, capital gains, dividends - Number of taxpayers subject to Alternative Minimum Tax (AMT) rises - Certain tax credits expire 14 Planning for Net Operating Losses • NOL deduction available when current year’s income is less than current year’s deductions • NOLs can be carried back 2 years and forward 20 • Planning required to maximize deduction • NOL versus Section 179 deduction • NOL versus bonus depreciation • Many businesses have large NOLs generated during economic downturn. Proper planning will insure best tax result so that NOL benefits are not allowed to expire. 15 Planning for Retirement • Variety of options, designed to fit your needs - 401(k) allows flexibility; salary deferrals and/or employer contributions - SIMPLE IRA and SIMPLE 401(k) are available only to small businesses; for SIMPLE 401(k), employer is required to contribute - SEP is simple, inexpensive 16 Planning for Business Succession • Critical to start now – need to have plan for unexpected events • Significant impact if a principal owner/ partner suddenly leaves or dies • Several strategies available to finance a smooth transition • Sources of financing can include: - Life insurance - Buy-sell agreement - Grantor trust • Best plan should fit structure of company, personal preferences & needs 17 Key Takeaways • CPA-small business owner partnership • CPA advice • Year-round tax planning 18 Copyright © 2011 American Institute of CPAs Copyright © 2011 American Institute of CPAs