Presentation of Workshop on Taxation

advertisement

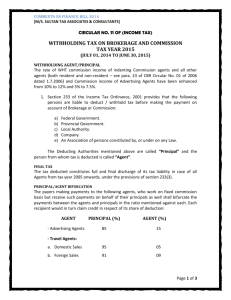

. 1 Amendments in Income Tax ordinance, 2001 vide Finance Act, 2008 (Insurance Sector) Payment to non-resident 152 (1AA) Every person making a payment of insurance premium or re-insurance premium to a non-resident person shall deduct tax from the gross amount paid. Payment to Non-Resident The rate of tax to be deducted from payments referred to in sub-section (1AA) of section 152 shall be 5% of the gross amount paid. Payment to Non-Resident 152(1BB) Tax deducted under sub-section (1AA) shall be a final tax on the income of the non-resident person arising out of such payment. Certificate of collection or deduction of tax 164 Every person collecting tax shall, at the time of collection or deduction of the tax, furnish to the person from whom the tax has been collected or to whom the payment from which tax has been deducted has been made, a certificate setting out the amount of tax collected or deducted Section 107 of Income Tax Ordinance, 2001 • The Provisions of Double Taxation treaties override the provisions of Income Tax Ordinance 2001. Section 152 (IAA) of Income tax Ordinance, 2001 • Not applicable to the non-resident companies having residence in the countries with which Pakistan has entered into Double Taxation Treaties. Agreements on Avoidance of Double Taxation between Pakistan and following countries 1) 4) 7) 10) 13) 16) 19) 22) 25) 28) 31) 34) 37) 40) 43) 46) 49) 52) Austria Belgium Denmark France Holland Indonesia Italy Kazakhstan Kuwait Malaysia Netherland Oman Qatar Singapore Sweden Thailand Turkmenistan USA 2) Azerbaijan 5) Canada 8) Egypt 11) Germany 14) Hungary 17) Iran 20) Japan 23) Kenya 26) Lebanon 29) Malta 32) Nigeria 35) Philippines 38) Romania 41) South Africa 44) Switzerland 47) Tunisia 50) UAE 53) Uzbekistan 3) Bangladesh 6) China 9) Finland 12) Greece 15) India 18) Ireland 21) Jordan 24) Korea 27) Libya 30) Mauritius 33) Norway 36) Poland 39) Saudi Arabia 42) Srilanka 45) Syrian 48) Turkey 51) United Kingdom Exemption Certificates Exemption Certificate for non deduction of Income Tax Under Section 152(1AA) not required. WITHOLDING PROVISONS APPLICABLE TO INSURANCE BUSINESS 11 APPLICABLE WITHOLDING SECTIONS AT A GLANCE Salaries u/s 149 Dividends u/s 150 Non Residents (General) u/s 152 Non Residents (Premiums) u/s 152 Non Residents (Advertisements) u/s153A Local Contracts & Services u/s 153 Rent of properties u/s 155 Prizes & Winnings u/s 156 Commission u/s 233 12 OBLIGATIONS Deduct Tax at prescribed rates. Deposit Tax within 7 days of the end of fortnight Issue Prescribed Deduction Certificate to payee Salary within 45 days of the end of F.Y. Others within 15 days of the end of F.Y. On request of Payee within 7 days of request. Submit Monthly Statement by 20th of following month Submit Annual Statement by 31st August Furnish Reconciliation of Statements,if required 13 SALARIES Payment through cross cheque or transfer except upto Rs. 15,000 p.m. which may be paid in cash. Deductions to be made on average basis Rates of Deductions as per First Schedule Adjustments may be made for credits and other deductions as per section 149 (1) Deductions also to be made from payment out of Pension Fund.(Sec 156B) 14 SALARIES No deductions upto Rs. 180,000 In case of woman, no deductions upto Rs. 240,000 Minimum rate of deduction 0.5 % Maximum rate of deduction 20 % 15 DIVIDENDS Deduction of Tax at the time of Payment Tax to be deducted at 10 % by Resident companies ( Division III Part I 1st Schedule ) Dividend to include after tax profit of a branch of a foreign company ( Section 2 (19) (f) ) 16 INSURANCE OR RE-INSURANCE PREMIUM PAYMENT TO NON RESIDENT PERSON (SECTION 152(1AA) Inserted through Finance Act 2008. Rate of Tax Deduction 5% ( Div II Part III 1st Schedule) Full & Final Tax as Pakistan source income (Section 152(1BB)) 17 PAYMENT OF LOCAL COMMISSION Tax to be deducted / collected at 10 % ( Part IV of First Schedule ) Rate in case of Advertising Agents at 5 % (Clause 26 Part II 2nd Schedule ) Tax is full & Final in case of Recipients ( Section 233 (2) ) 18 PAYMENT TO NON RESIDENT MEDIA PERSONS Payment for advertisement services attract this deduction ( Section 153A) Rate of Tax Deduction 10 % (Division IIIA, Part III ,First Schedule ) Full & Final tax as Pakistan source income (Section 169 (1)(b)) 19 RENT OF IMMOVEABLE PROPERTY Rent to include advance rent , rent of furniture / fixtures and amount for services relating to such property. 20 RATES OF TAX DEDUCTION ON RENT ( Div V Part III 1st Schedule / Clause 28 Part II 2nd Schedule ) PAYMENT TO INDIVIDUAL From 150,000 to 400,000 5 % of amount exceeding 150,000 From 400,000 to 1000,000 12500 + 7.5 of amount exceeding 400,000 Exceeding 1,000,000 57,500 +10 of amount exceeding 1,000,000 PAYMENT TO COMPANY Upto 400,000 5% From 400,000 to 1,000,000 20,000 + 7.5 % of amount exceeding 400,000 Exceeding 1,000,000 65,000 + 10 % of amount exceeding 1,000,000 21 EXPOSURES ON DEFAULT 1. In case of non deduction of tax at source, following expenditures are inadmissible ; . Salary . Services and Fee . Rent . Commission . Contractual Payment . Payment to Non Residents 2. Defaulted amount will be recoverable with additional tax @ 12 %. 3. Prosecution proceedings may be initiated. 22 FORMAT OF STATEMENTS Monthly Statement ( Consolidated for salary & other payments ) Annual Statement for Salary Annual Statement for Other payment . Formats may be downloaded from http:// fbr.gov.pk / 23 EFILING ON FBR PORTAL Get enrolled at https://e.fbr.gov.pk Obtain Digital certificate from NIFT (www.nift.com.pk) Submit Returns, Statements , application on line Make the payments on line 24 BENEFITS OF EFILING Filing of Income Tax Returns and Statements electronically Tax Payment by Taxpayers and Withholding Agents Payment Collection by Banks Online Payments from bank accounts electronically (ePayments) In order to facilitate the taxpayers and users of these services; FAQs and help is available online, however in case of any further assistance , please contact at following: Helpline : (051) 111-772-772 ... 24 hrs 25 FEDERAL EXCISE DUTY (F.E.D) Services provided or rendered in respect of insurance to a policy holder by an insurer, including a re-insurer “[in case where direct insurance service has been provided] i) Goods insurance RATE OF DUTY “[Ten] per cent of the gross premium paid. ii) Fire insurance do iii) Theft insurance do iv) Marine insurance do v) Other insurance do FEDERAL EXCISE DUTY (F.E.D) - Exclusion: Life Insurance Rule 40 : Special procedure for insurance companies Monthly return in the form STR-7 (Sales Tax Rules 2006) Return to be filed by 15th day of the following month. - In case of default Default surcharge @ 1.5% per month - Penalty provision - Non-filing of return: Rs.5000/-. - Non or short payment of duty ; Rs.10,000/- or 5% of the duty involved whichever is greater - If return filed within 15 days of due date; Penalty of Rs.100/- for each day of default. 28