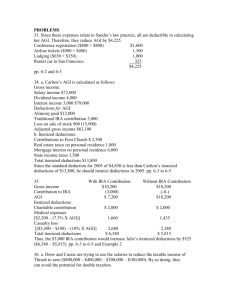

12. Adjustments to income (deductible part of Self

advertisement

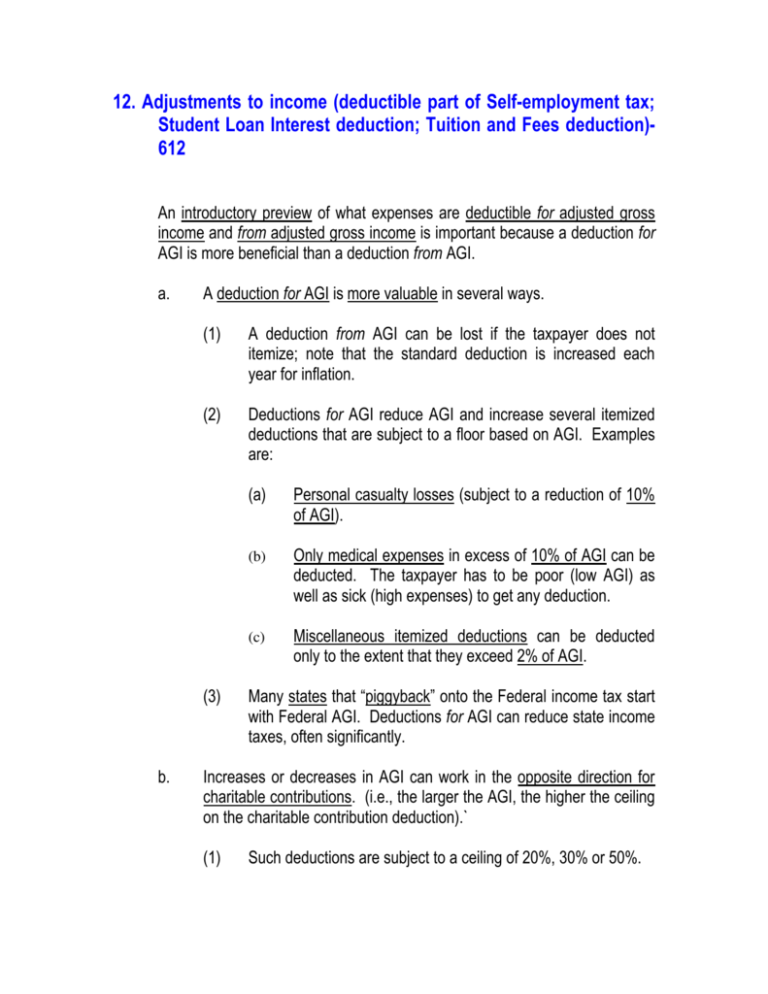

12. Adjustments to income (deductible part of Self-employment tax; Student Loan Interest deduction; Tuition and Fees deduction)612 An introductory preview of what expenses are deductible for adjusted gross income and from adjusted gross income is important because a deduction for AGI is more beneficial than a deduction from AGI. a. A deduction for AGI is more valuable in several ways. (1) A deduction from AGI can be lost if the taxpayer does not itemize; note that the standard deduction is increased each year for inflation. (2) Deductions for AGI reduce AGI and increase several itemized deductions that are subject to a floor based on AGI. Examples are: (3) b. (a) Personal casualty losses (subject to a reduction of 10% of AGI). (b) Only medical expenses in excess of 10% of AGI can be deducted. The taxpayer has to be poor (low AGI) as well as sick (high expenses) to get any deduction. (c) Miscellaneous itemized deductions can be deducted only to the extent that they exceed 2% of AGI. Many states that “piggyback” onto the Federal income tax start with Federal AGI. Deductions for AGI can reduce state income taxes, often significantly. Increases or decreases in AGI can work in the opposite direction for charitable contributions. (i.e., the larger the AGI, the higher the ceiling on the charitable contribution deduction).` (1) Such deductions are subject to a ceiling of 20%, 30% or 50%. DEDUCTIONS FOR ADJUSTED GROSS INCOME The various allowable deductions for adjusted gross income are categorized as follows: a. Trade and business deductions available to all taxpayers, including individuals, corporations, etc. b. Reimbursed employee business expenses. An employee is considered to be in the trade or business of being an employee for purposes of reimbursed employment related expenses. c. The capital loss deduction, and other losses on the sale or exchange of property other than personal use property (e.g., casualty losses on business property). d. Section 212 deductions are allowed for adjusted gross income only if attributable to rent and royalty income; (1) All other § 212 deductions are deducted from adjusted gross income. (1) Section 212 allows deductions for expenses related to the production of income, for the management of assets held for the production of income, or in connection with the determination, collection, or refund of any tax. e. Alimony payments. f. Certain contributions to pension, profit-sharing, and annuity plans of self-employed individuals (e.g., Keogh plan). g. Deduction for certain retirement savings such as traditional IRA’s. h. Penalty imposed on premature withdrawal of funds from time savings accounts or deposits. i. Moving expenses. j. Deduction for certain interest on education loans. k. Deduction for one-half of the self-employment tax paid by a selfemployed taxpayer. k. n. o. Deduction for 100 percent of the medical insurance premiums paid by a self-employed taxpayer for coverage of the taxpayer, spouse, and any dependents. Deduction for qualified tuition and related expenses under § 222. Deduction for contribution to health savings accounts (HSAs) under § 223. p. Deduction for jury pay remitted by an employee to an employer. q. Deduction for certain expenses of elementary and secondary school teachers (limited to $250). Deduction for attorneys’ fees and court costs incurred in civil rights r. suits. (1) Applies to judgments and settlements paid after the enactment of the American Jobs Creation Act of 2004 [i.e., October 22, 2004]. (2) Covers causes of action deemed to involve “unlawful discrimination” as defined in Code § 62(e)(19). (3) Prior to AJCA of 2004, these expenses were miscellaneous itemized deductions—subject to the 2%-of-AGI limitation and not deductible for AMT purposes. (4) Now these expenses are “above the line” deductions and can be claimed for AMT purposes. .