File

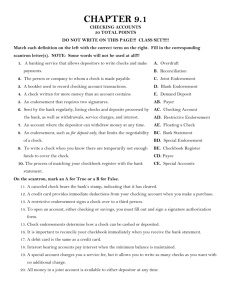

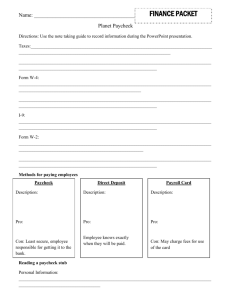

advertisement

Unit 1: Introduction to Personal Finance Examine the charts, graphics, and reading excerpts in Chapter 3: Budgeting. o Make a list of questions you would like to have answered as we go through the chapter. WB: Before You Begin, pgs. 50-51 o Review the Learning Outcome objectives and Key Terms o Complete the “Before” column on the “Measure Your Progress” chart Journal: On average, how much money do you spend per week? 2. What are your top three expenses? 1. Section 1 Video 1.1 (10 minutes): Cash Flow Planning Journal: 1. Describe in your own words what it means to have a budget. Read: 1. 10 Things Millionaires Do NOT Do (p. 52) In what way is money active? o Money can easily be spent without accurate accounting of where it all went. Why is it important to have a cash flow plan? o It allows you to be intentional with your spending and saving. Video 1.2 (6 minutes): Four reasons people avoid budgets Journal: 1. What do you think is most challenging when it comes to keeping a monthly budget? Read: What’s the difference between a cash flow statement and a budget? (p. 53) 2. Real Wealth Building Begins with Your Behavior (p. 54) 1. Why do some people avoid writing or following budgets? o If budgeting is not done correctly, people view budgets as restrictive or ineffective. All checks are eventually taken to a financial institution. o This is why you must add your signature to the back of the check, telling the institution what to do with your money. An endorsement is your signed approval for a check to be: o Cashed o Deposited o Assigned to someone else Blank Endorsement: o Just your signature o Anyone can cash your check if it is lost or stolen. Restrictive Endorsement: o For deposit only, our signature, and your account number. o This type of endorsement can only be deposited into your account. Special Endorsement: o Write “Pay to the order of,” the person’s name, followed by your signature. o This type of endorsement is used if you are signing your check over to another person. Activity: o Endorse a Check WS o How to Manage Your Checking Account WS Section 2 Video 2.1 (8 minutes): Responsible Banking Journal: 1. Explain why Dave describes overdrafts as a sign of “crisis living.” Read: Balancing Your Checking Account (p. 56) 2. Are multiple accounts a good idea? (p. 58) 3. Banking tools (p. 59-60) 1. • Vary from month to month • Electricity • Gas • Groceries • Clothing • Occur at various times throughout the year and tend to be large lump sums. • Tuition payments • Athletic/Club dues • Car repairs Variable Fixed Intermittent Discretionary (NonEssential) • Expenses that remain relatively the same from month to month • Rent/Mortgage • Insurance premiums • Cable Bill • Expenses for things we don’t NEED. • Restaurants • Gifts • Candy • Etc. 1. What is the First Foundation? 2. Why is it important to maintain an accurate balance of your checking account? 3. Should a checking account be used as a saving or spending account? 4. What are three things you’ll need to balance your checking account each month? 5. Which record is the most accurate reflection of your current balance? 6. What transactions will you need to include on your account register? 7. Why is it important to keep your own financial records? 8. What does it mean to reconcile your account? How often should you do this? 9. Why is it a good idea to select “credit” instead of “debit” when using your debit card for purchases? 10. Have you ever written a budget? 11. You have heard Dave say that personal finance is 20% head knowledge and 80% behavior. How does this relate to budgeting? 12. Some Americans believe that a credit card is safer for purchases than a debit card. Explain why that is a money myth. Activity: 1. Balance Your Checking Account 2. BB&T Activity 3. Calculating Your Net Worth Section 3 Video 3.1 (8 minutes): Cash Flow Plans Don’t Work When… Journal: 1. Why do you think it is so common in America to spend more than you make? Explain how budgeting helps you save money. o Managed money goes farther because you intentionally cut out unnecessary spending. Describe the ways in which having an agreed upon budget can improve a relationship. o A written plan, if lived and agreed on, removes guilt, shame, fear and fights regarding how money is spent and saved. Have you ever witnessed money affecting a relationship close to you? Activity: o M&M Budget Activity Quiz o Write checks o Check register o Deposit slips o Check endorsement o Bank reconciliation Video 3.2 (13 minutes): The Zero-Based Budget Journal: Explain in your own words what a zero-based budget is. 2. Why is it important to write a zero-based budget every month? 1. What is a zero-based budget? o A budget where every dollar has a name on paper, on purpose. What is the envelope system and how does it work? o A system for managing spending on things that don’t normally have a fixed monthly expense. Your budget will only work if you follow it. What are some things you can do to make sure you stick to your budget? o Use the envelope system, direct transfer from checking to savings each week, etc. In a zero-based budget, income minus expenses/ purchases should equal _________. o Zero Look at the student budget form. In what categories might it be a god idea to use the envelope system? o Where you see the envelope icon. You have a friend who has not taken a personal finance course. How would you describe the benefits of budgeting to him/her? Fixed Income: Receiving the same amount of money each paycheck. o Salary Irregular income: Receiving a different amount of money each paycheck. o Hourly paychecks Discretionary income: Money left over after all of your expenses have been paid that you can use however you would like. Fixed expense: stays relatively the same each month. o Mortgage or rent Variable expense: changes each month o Groceries, electric bill, etc. Discretionary expense: You have a choice on whether or not to spend money on these items. o Dining out Intermittent expense: Expenses that happen periodically o Vehicle or house repairs Impulse purchase: an item that is bought without previous planning or consideration of the long-term effects. Activity: 1. The Student Budget (35 minutes) 2. Family Reality Check (25 minutes) Budget Builder – foundationsU.com/3 Take Action Challenge, pg. 69 Study Guide: Money in Review, pgs. 70-71 Complete the “After” column on the “Measure Your Progress” chart, pg. 51.