chapter 9 - Cherry Creek School District

advertisement

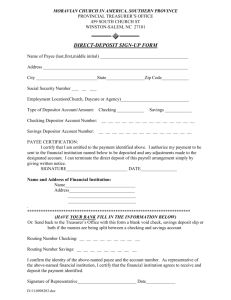

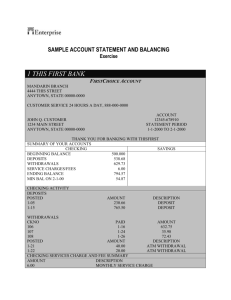

CHAPTER 9.1 CHECKING ACCOUNTS 50 TOTAL POINTS DO NOT WRITE ON THIS PAGE!!! CLASS SET!!!!! Match each definition on the left with the correct term on the right. Fill in the corresponding scantron letter(s). NOTE: Some words will not be used at all!!! 1. A banking service that allows depositors to write checks and make payments. A. Overdraft B. Reconciliation 2. The person or company to whom a check is made payable. C. Joint Endorsement 3. A booklet used to record checking account transactions. D. Blank Endorsement 4. A check written for more money than an account contains. E. Demand Deposit 5. An endorsement that requires two signatures. AB. Payer 6. Sent by the bank regularly, listing checks and deposits processed by AC. Checking Account the bank, as well as withdrawals, service charges, and interest. AD. Restrictive Endorsement 7. An account where the depositor can withdraw money at any time. AE. Floating a Check 8. An endorsement, such as for deposit only, that limits the negotiability BC. Bank Statement of a check. 9. To write a check when you know there are temporarily not enough funds to cover the check. 10. The process of matching your checkbook register with the bank BD. Special Endorsement BE. Checkbook Register CD. Payee CE. Special Accounts statement. On the scantron, mark an A for True or a B for False. 11. A canceled check bears the bank’s stamp, indicating that it has cleared. 12. A credit card provides immediate deductions from your checking account when you make a purchase. 13. A restrictive endorsement signs a check over to a third person. 14. To open an account, either checking or savings, you must fill out and sign a signature authorization form. 15. Check endorsements determine how a check can be cashed or deposited. 16. It is important to reconcile your checkbook immediately when you receive the bank statement. 17. A debit card is the same as a credit card. 18. Interest bearing accounts pay interest when the minimum balance is maintained. 19. A special account charges you a service fee, but it allows you to write as many checks as you want with no additional charge. 20. All money in a joint account is available to either depositor at any time. 21. The top half of the fraction of the American Bankers Association number identifies the specific bank on which the check is drawn. 22. You don’t have to have an initial deposit when opening a checking account. 23. Check endorsements protect you in the event a check is lost or stolen. 24. Writing a check is safer than carrying cash. 25. The second half of the account number, routes your check to your specific bank. PLEASE WRITE YOUR ANSWER TO THE EXTRA CREDIT, ON THE CHECKING ACCOUNT EXAMPLE, IN THE UPPER RIGHT HAND CORNER ON THE FIRST PAGE!!!!!!! According to the Financial Peace video, in the new millennium, the personal savings rate in America fell to ______________ , compared to Japan who saves _____________ of their after taxed income. According to the Identity Theft Lesson from the Junior Achievement program, there are ________ people per year in the USA that are victims, which is ________ people per SECOND!!!!