Chapter 26

advertisement

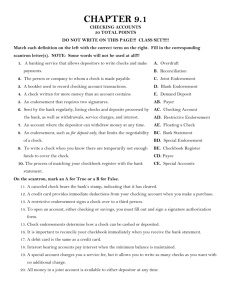

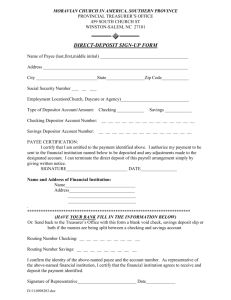

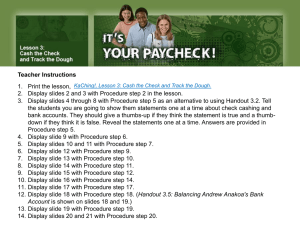

Chapter 26 Opening a Checking Account Advantages of Checking Account Convenience – spend money through paper (checks) or the EFT systems. Safety – from physically being damaged, or from careless spending Proof of Payment – once the check is cashed, it is a legal proof of payment Record of Finances – the bank will provide a record of finances, demonstrating how necessary it is to keep track of all deposits and credits Types of Checking Accounts Regular Checking Accounts – best when planning on writing a lot of checks. There is not a service charge on most regular checking accounts. Minimum balance – stated amount that the account must not fall below. Average monthly balance – the sum of the daily balance divided by the number of days in the month. This average needs to stay above a certain point, in order to avoid a service charge. Additional Charge Service Charge – a fee a bank charges for handling a checking account. Types of Checking Accounts Interest Checking Accounts – These accounts make it possible for a checking account to earn interest on the amount kept in the bank. However, if this is the account that you want, there is normally a minimum balance or minimum average monthly balance of at least $500. Money Market Rate The interest rate that big users of money, such as governments and large corporations, pay when they borrow money. As this rate changes, so does the rate the banks pay holders of certain accounts. Other Types of Checking Accounts Credit Union – provide checking accounts for its members. Members are called Shareholders when they have money on deposit. Their checks are called Sharedrafts. With these accounts, interest rates may vary and the number of sharedrafts per month may be limited. Opening a Checking Account Signature Card – The official card which the depositor signs, and the bank keeps, in order to use it as an official signature. Joint Account – when two people and more have an account together. Deposit Slip – a form on which you list all items you are depositing currency, coins, and checks. Endorsing Checks for Making Deposits Endorsement – is written evidence that you received payment or that you transferred your right of receiving payment to someone else. Purposes of Endorsements 1 – Endorsements allow the recipient of the check to cash, deposit, or transfer it to someone else. 2 – Endorsements serve as legal evidence that the receiver cashed or transferred the check to someone else. Purposes of Endorsements 3 – Endorsements mean that the endorser will pay the check in case the next owner of the check cannot collect the money. Placement of Endorsement The bank has a stamp that they must put on the back of the check The signature of the endorser must sign in the designated area of the check If the check is not signed in the right spot, it is not legible, or incomplete, the check may be returned. Types of Endorsements Blank Endorsement consists of only the endorsers name. makes a check payable to anyone who has the check. Special Endorsement includes the name of the person to whom the check has been transferred. More types of Endorsements Restrictive Endorsements limits the use of the check to the purpose given in the endorsement. For deposit only – the check may only be deposited in your account. Recording the Deposit Deposits can be made… At the bank At an ATM Or sent through the mail Recording the Deposit Checkbooks contain forms on which a depositor writes a record of deposits made and checks written. Check Stub • Attached to each check Check Register • Booklet designed to record and keep track of funds in a checking account.