141002 Asia Watch Hong Kong

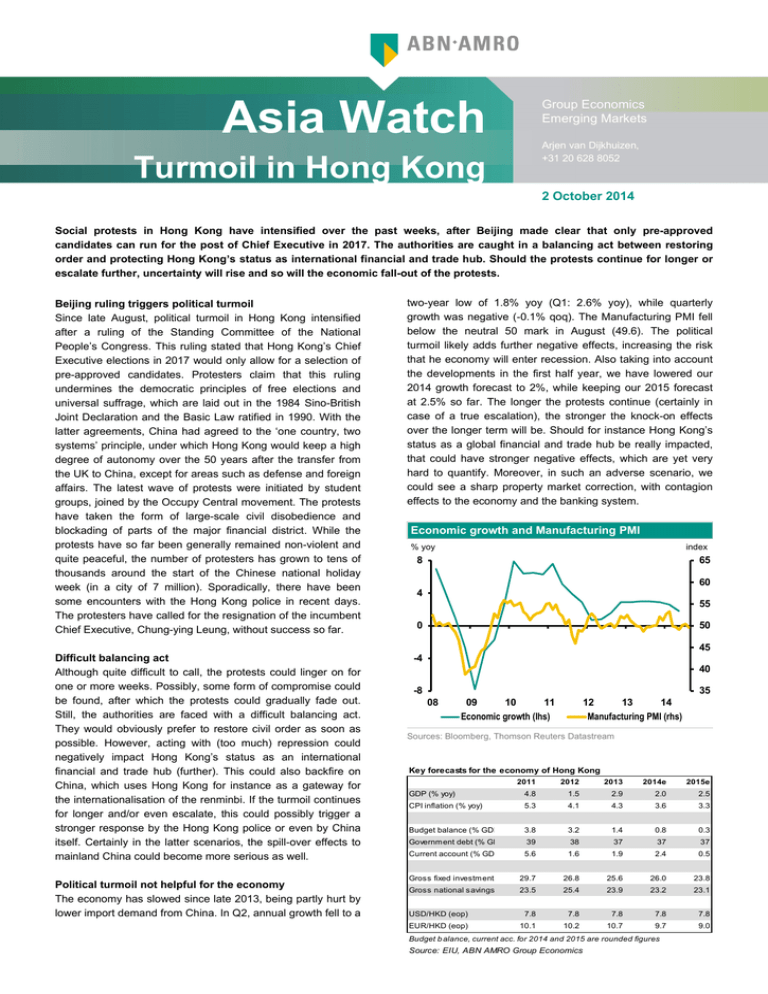

advertisement

Group Economics Emerging Markets Asia Watch Arjen van Dijkhuizen, +31 20 628 8052 Turmoil in Hong Kong 2 October 2014 Social protests in Hong Kong have intensified over the past weeks, after Beijing made clear that only pre-approved candidates can run for the post of Chief Executive in 2017. The authorities are caught in a balancing act between restoring order and protecting Hong Kong’s status as international financial and trade hub. Should the protests continue for longer or escalate further, uncertainty will rise and so will the economic fall-out of the protests. Beijing ruling triggers political turmoil Since late August, political turmoil in Hong Kong intensified after a ruling of the Standing Committee of the National People’s Congress. This ruling stated that Hong Kong’s Chief Executive elections in 2017 would only allow for a selection of pre-approved candidates. Protesters claim that this ruling undermines the democratic principles of free elections and universal suffrage, which are laid out in the 1984 Sino-British Joint Declaration and the Basic Law ratified in 1990. With the latter agreements, China had agreed to the ‘one country, two systems’ principle, under which Hong Kong would keep a high degree of autonomy over the 50 years after the transfer from the UK to China, except for areas such as defense and foreign affairs. The latest wave of protests were initiated by student groups, joined by the Occupy Central movement. The protests have taken the form of large-scale civil disobedience and blockading of parts of the major financial district. While the protests have so far been generally remained non-violent and quite peaceful, the number of protesters has grown to tens of thousands around the start of the Chinese national holiday week (in a city of 7 million). Sporadically, there have been some encounters with the Hong Kong police in recent days. The protesters have called for the resignation of the incumbent Chief Executive, Chung-ying Leung, without success so far. two-year low of 1.8% yoy (Q1: 2.6% yoy), while quarterly growth was negative (-0.1% qoq). The Manufacturing PMI fell below the neutral 50 mark in August (49.6). The political turmoil likely adds further negative effects, increasing the risk that he economy will enter recession. Also taking into account the developments in the first half year, we have lowered our 2014 growth forecast to 2%, while keeping our 2015 forecast at 2.5% so far. The longer the protests continue (certainly in case of a true escalation), the stronger the knock-on effects over the longer term will be. Should for instance Hong Kong’s status as a global financial and trade hub be really impacted, that could have stronger negative effects, which are yet very hard to quantify. Moreover, in such an adverse scenario, we could see a sharp property market correction, with contagion effects to the economy and the banking system. Economic growth and Manufacturing PMI % yoy index 8 65 60 4 55 0 50 45 Difficult balancing act Although quite difficult to call, the protests could linger on for one or more weeks. Possibly, some form of compromise could be found, after which the protests could gradually fade out. Still, the authorities are faced with a difficult balancing act. They would obviously prefer to restore civil order as soon as possible. However, acting with (too much) repression could negatively impact Hong Kong’s status as an international financial and trade hub (further). This could also backfire on China, which uses Hong Kong for instance as a gateway for the internationalisation of the renminbi. If the turmoil continues for longer and/or even escalate, this could possibly trigger a stronger response by the Hong Kong police or even by China itself. Certainly in the latter scenarios, the spill-over effects to mainland China could become more serious as well. Political turmoil not helpful for the economy The economy has slowed since late 2013, being partly hurt by lower import demand from China. In Q2, annual growth fell to a -4 40 -8 35 08 09 10 11 12 Economic growth (lhs) 13 14 Manufacturing PMI (rhs) Sources: Bloomberg, Thomson Reuters Datastream Key forecasts for the economy of Hong Kong 2011 2012 2013 2014e 2015e GDP (% yoy) 4.8 1.5 2.9 2.0 2.5 CPI inflation (% yoy) 5.3 4.1 4.3 3.6 3.3 Budget balance (% GDP) 3.8 3.2 1.4 0.8 0.3 Government debt (% GDP) 39 38 37 37 37 Current account (% GDP) 5.6 1.6 1.9 2.4 0.5 Gross fixed investment (% GDP) 29.7 26.8 25.6 26.0 23.8 Gross national savings (% GDP) 23.5 25.4 23.9 23.2 23.1 USD/HKD (eop) 7.8 7.8 7.8 7.8 7.8 EUR/HKD (eop) 10.1 10.2 10.7 9.7 9.0 Budget b alance, current acc. for 2014 and 2015 are rounded figures Source: EIU, ABN AMRO Group Economics 2 South Korea Watch, Turmoil in Hong Kong – 11 September 2014 Find out more about Group Economics at: httips://insights.abnamro.nl/en This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics.The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personaladvisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").