File

INDIAN UNION BUDGET

2011-2012

Highlights

Powered By

-

Dearer

-Legal Services

-Healthcare in top – end Pvt. hospitals.

-Branded

Cloths

-Gold

-A/c restaurants serving Liquor

-Hotel Services

-Printers

-Paper

-Soap

-Steel

-Diapers &

Sanitary napkins

-Homoeopathic

Medicines

-Yarn/raw silk

-Mobile Phones

-Agarbatti

-Solar Lantern,

LED Lights

-Battery Driven-

Vehicles

-Agriculture machinery

Cheaper

DIRECT TAXES

Corporate tax

The Direct Taxes Code is likely to be effective from 1 April 2012

The Corporate tax,Firms,Local authority, Co operative Societies rate remains unchanged

The basic rate of MAT increased to 18.5% from 18 %

The surcharge for domestic companies reduced to 5% from 7.5 %

The surcharge Non domestic companies reduced to 2 % from 2.5 %

NEW INCOME-TAX return form called Sugam to be introduced for small business.

Salary earners having an income of less than ` 5 lakh is exempted for filing income tax return from this year.

Provision for tax-free infrastructure bonds extended by 1more year

TAX HOLIDAY for IT companies finally ends Levy MAT on developers of

SEZ and units operating in them.

Levy Alternative Minimum Tax (AMT) in the case of Limited Liability partnerships at 18.5%

Money market and debt funds will pay a higher dividend Distribution tax

(DDT) for investment made by firms.

DDT will rise to 30% from 25% but stay unchanged at 12% for individual investors.

The TDS structure & rates remains unchanged

Above rules are made effective from 01.04.2011

Personal Taxation

For MEN

Current Slabs (`) Proposed Slabs (`) Basic rate of tax

Upto160,000

160,001to500,000

Upto180,000

180,001to500,000

500,001to800,000 500,001to800,000

Above800,001 Above800,001

Nil

10%

20%

30%

For WOMEN

No change in tax Structure

Upto190,000

190,001to500,000

Upto190,000

190,001to500,000

500,001to800,000 500,001to 800,000

Above800,000 Above800,000

Nil

10%

20%

30%

For Senior Citizen (60-80years)

Age for eligibility reduced from 65 years to 60 Years

Upto 240,000 Upto 250,000

240,001to500,000 250,001to500,000

500,001to800,000 500,001to800,000

Above800,001 Above 800,001

For Senior Citizen (80years & above)

Hike in exemption limit to ` 5 lakh will result on big gains

Nil

10%

20%

30%

Upto 240,000 Upto 500,000

240,001to500,000 -

500,001to800,000 500,001to800,000

Above 800,001 Above 800,001

Nil

10%

20%

30%

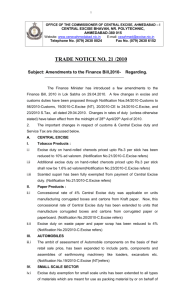

INDIRECT TAXES

Central excise

Central Excise Duty to be maintained as 10% only (un changed)

Nominal Central Excise Duty of 1 % without Cenvat credit facility is being imposed on 130 items entering in the tax net.

Lower rate of Central Excise Duty enhanced from 4 % to 5 %

Optional levy on branded garments or made up proposed to be converted into a mandatory levy at unified rate of 10 per cent.

Labelled jewellery and Precious metals attract 1% excise duty.

Excise duty on sanitary napkin, baby & clinical diapers and adult diapers is being reduced from 10% to 1% with no cenvat credit.

Concessional rate of excise duty for Hydrogen / hybrid vehicle.

Exemption withdrawn on HD drive, CD/DVD drive,& writers, Flash memory,

Combo drives meant for fit inside of CPU or Laptop will attract 5% of concessional excise duty .

Changes come into effect immediately unless otherwise specified.

Service tax

Service tax rate remains unchanged at 10 percent as a pre-cursor to GST

Legal Cases will also become a costly affair to cover all legal consultations, except individual to individual ,under service tax net.

Hotel accommodation in excess of ` 1,000 per day will come under the ambit of tax ,although there will be an abatement of 50%

service provided by air conditioned restaurants that have license to serve liquor added as new services for levying Service Tax at 3- 5%. After an abatement of 70%

Tax on all services provided by hospitals with 25 or more beds with facility of central air conditioning at the rate of 5%

Service Tax on air travel raised from ` 100 to ` 150 in the case of domestic air travel and ` 500 to ` 750 on international journeys by economy class.

The domestic air travel on higher classes will be taxed at the standard rate of 10%

Services provided by life insurance companies in the area of investment and some more legal services proposed to be brought into tax net.

Above rules are made effective from 01.04.2011

Customs duty

Basic customs duty on agricultural machinery reduced to 4.5 per cent from

5 per cent

Basic customs duty on raw silk reduced from 30 to 5 per cent.

Basic customs duty on solar lantern or lamps reduced from 10 to 5%

CVD exempted fully on LEDs used for manf of LEDs light & fixtures.

Fully exemption from basic custom duty is being extended battery charger, hands free, head phones and PC connectivity cable of mobile handset including cellular phones.

Basic customs duty on bamboo used for manf of agarbattis is being reduced from 30% to 10%

The government has added a fixed excise duty of ` 160 per tonne on cement and reduced custom duty on petcoke and gypsum, key inputs for the sector.

Changes come into effect immediately unless otherwise specified.

Goods and service tax

GST proposed to be rolled out from April 2012

Several proposals under the existing tax regime should facilitate a move to wards GST:

Focus on building robust IT infrastructure

Further rationalization of rates under Excise and Customs

No Changes in CST act 1956