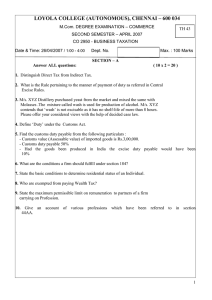

Presentation

advertisement

CENTRAL EXCISE, CUSTOMS, & SERVICE TAX PROPOSALS by COMMISSIONER, SERVICE TAX, MUMBAI BUDGET THEME Move towards GST - ST rate increase, removing exemptions to sync with State VAT levy. Improve Ease of doing business Remove ambiguity by changes in law & clarifications Boost to domestic manufacturing by reducing tax burden 2 CENTRAL EXCISE & CUSTOMS CHANGES Central Excise duty rate increased from 12.36% to 12.5% with abolition of education cesses. Issue of balance credit of Education Cess as on 1st March under consideration of Govt. Reduction of Customs duty on raw-materials, intermediate and components (22 items) to promote domestic manufacturing and minimise duty inversion on items used by polymers, Telecom, IT and Power Sector. 3 CENTRAL EXCISE & CUSTOMS CHANGES Reduction in SAD to minimise CENVAT Credit accumulation and liquidity issues. IT Sector items, Polymers, metals and LED light goods benefited. Tablet Computers and their parts manufacturing given boost by reduction of import duties Excise duty increased on Cigarettes by 15 -25%. Excise duty structure on Pan Masala and Gutka also modified. Clean Energy Cess increased from Rs 100 to 200 per MT to fund Swatcha Bharat Mission 4 EASE OF DOING BUSINESS. On-line Central Excise & Service Tax registration within 2 working days. Tax payers allowed to use digitally signed invoices. Time limit for taking CENVAT Credit increased from 6 months to 1 year from date of invoice. Facility of direct dispatch of goods to the customer of a dealer or job worker of manufacturer allowed. Time limit for return of capital goods from job worker increased from 6 months to 2 years. 5 EASE OF DOING BUSINESS. Clarification also issued for garnishing provision and providing instalments for recovery of arrears. Withdrawal of prosecution cases permitted if the adjudication proceedings are dropped on merit. Exporters allowed credit of services used between factory and port – clarification Advance ruling facility extended to Indian firms also. Valuation provisions amended to add reimbursement 6 MODIFIED PENAL PROVISIONS - Encouraging Voluntary Compliance (All 3 taxes) Non-suppression cases can be closed on payment of Tax and interest, if paid within 30 days of issue of SCN 25% of penalty if paid within 30 days of OIO Max Penalty 10% of Tax amt SUPPRESSION Cases Only 15% penalty, if tax and interest is paid within 30 days of SCN. Only 25% penalty if tax n interest is paid within 30 days of issue of order. For existing cases also benefit available after enactment of Finance Bill 7 SERVICE TAX CHANGES Service Tax rate increased from 12.36% to 14%. Levy of Swatch Bharat Cess at the rate of 2%. New Levy on Tickets of amusement park, Theme Park, Water parks etc. New levy on entry ticket to concerts, award functions, non-recognised sport events if the ticket charge is more than Rs.500/-. However, Cinema, Circus, dance, drama tickets remain exempted. 8 SERVICE TAX CHANGES Service Tax on contract manufacturing/job work for alcoholic liquor liable to Service Tax. Services provided by Govt. or local authority to business entities charged Service Tax Construction/repair services provided to Govt. would be taxable except like canals, dam, irrigation, water supply. (wef 1/4/15) Construction of Airport and port also made taxable. 9 SERVICE TAX CHANGES Services provided by Mutual fund or Lottery agents or chit fund selling agent made taxable on reverse charge basis. Services provided by the Banks on behalf of RBI or similar services also taxable. In case of foreign aggregator model (like UBER taxi) the aggregator is liable to pay tax in India. For transport of goods by Road and vessel uniform abatement of 30% allowed. 10 SERVICE TAX CHANGES In the case of executive air travel abatement reduced from 60% to 40%. Partial reverse charge on manpower supply and security services made to full reverse charges. CENVAT Credit allowed under partial reverse charge without linking it to the payment to service provider. Section 73 being amended to provide that if the short payment has been declared, for recovery purpose no need to issue any SCN. 11 THANK YOU