TRO-K

advertisement

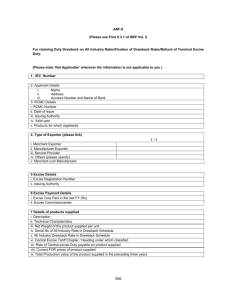

Form TRO-K REQUEST FOR A REFUND OF EXCISE DUTY PURSUANT TO ARTICLE 54. Č OF THE EXCISE DUTY ACT FOR GAS OIL USED AS PROPELLANT FOR COMMERCIAL PURPOSES Stamp upon receipt (to be completed by the Customs Authority) information of the claimant: Title/Name: District /road and house number: Postal number, town and country: VAT number: INFORMATION OF THE AGENT: INFORMATION OF THE ACCOUNT: Title/Name Account holder: VAT number SWIFT/BIC code District /road and house number Account number (IBAN) Postal number, town and country Bank name and country 1 The refund of the excise duty is claimed for : claimant agent month: year: quarter: year: year: goods The gas oil was used for the transport of: passengers QUANTITY OF FUEL USED FOR WHICH THE REFUND IS BEING REQUESTED (in litres): 2 3 1 January February March 2 April May June 3 July August September 4 October November December NUMBER OF INVOICES FOR THE PURCHASE OF FUEL ON THE BASIS OF WHICH THE REFUND IS CLAIMED * REGISTRATION NUMBERS OF VEHICLES Registration number 4 / NUMBER OF MOTOR VEHICLES: Quantity of gas oil used (in litres) Registration number 1 11 2 12 3 13 4 14 5 15 6 16 7 17 8 18 9 19 10 20 Quantity of gas oil used (in litres) We hereby undertake to return any undue amount received. Place and date:_____________ Name, last name and signature of authorised person of the claimant: ______________ By signing I am certifying that the above information is true *Invoices for fuel used which read on the claimant need to be enclosed to the request. FOR OFFICIAL USE Number Date Customs office Pursuant to Article 54. č of the Excise Duty Act the (Official Journal of the Republic of Slovenia No 97/10, 48/12 and 109/12) Applicant is for the period of ______________ entitled to a refund of the excise duty for ________________ litres of fuel in the amount of ___________________ EUR. In accordance with point 4 of Article 28 of the Administrative Fees Act (Official Journal of the Republic of Slovenia No 106/10) this Request is exempt from the payment of an administrative fee. Signature of the official:_________________________ Instructions for completing Form TRO-K Title/Name Enter the title of the legal entity or the name of sole trader. Tax number Enter tax number. District/Road and house number Enter full address. Postal number, place and country Enter postal code, place and country. Current account number (IBAN) Enter current account number for refund of excise duty in IBAN form. SWIFT/BIC code Enter SWIFT or BIC bank code. Bank name and country Enter bank name and bank country. Account holder Mark if account holder is claimant or agent on the basis of authorization. The refund of the excise duty is claimed for Mark and enter (month, year) or circle (quarter) the calendar period for which the request is submitted. The gas oil was used for the transport of Mark the purpose of use of gas oil. 3 Quantity of fuel used (in litres) For single month, regarding marked calendar period, enter the quantity of fuel used that can be proven with receipts for which the refund is being claimed. Enter the quantity of fuel used for single month in case of request for calendar quarter or calendar year as well. 4 Number of invoices Enter the total number of invoices for the purchase of fuel in Slovenia on the basis of which the refund is claimed. 1 2