021/2010 - Central Excise, Ahmedabad

advertisement

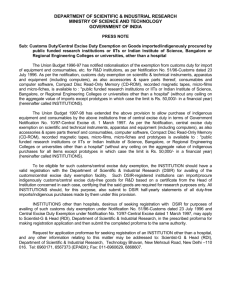

1 OFFICE OF THE COMMISSIONER OF CENTRAL EXCISE, AHMEDABAD – I CENTRAL EXCISE BHAVAN, NR. POLYTECHNIC, AHMEDABAD-380 015 Website: www.cenexahmedabad.nic.in E-mail: cexahmed@excise.nic.in Telephone No. (079) 2630 0024 Fax No. (079) 2630 6152 TRADE NOTICE NO. 21 /2010 Subject: Amendments to the Finance Bill,2010- Regarding. ________________________________________________ The Finance Minister has introduced a few amendments to the Finance Bill, 2010 in Lok Sabha on 29.04.2010. A few changes in excise and customs duties have been proposed through Notification Nos.54/2010-Customs to 56/2010-Customs, 19/2010-C.Excise (NT), 20/2010-CE to 24/2010-C.Excise, and 23/2010 S.Tax, all dated 29.04.2010. Changes in rates of duty (unless otherwise stated) have taken effect from the midnight of 28th April/29th April of 2010. 2. The important changes in respect of customs & Central Excise duty and Service Tax are discussed below. A. CENTRAL EXCISE I. Tobacco Products : i.i Excise duty on hand-rolled cheroots priced upto Rs.3 per stick has been reduced to 10% ad valorem. (Notification No.21/2010-C.Excise refers) i.ii Additional excise duty on hand-rolled cheroots priced upto Rs.3 per stick shall now be 1.6% ad valorem(Notification No.23/2010-C.Excise refers) i.iii Scented supari has been fully exempted from payment of Central Excise duty. (Notification No.21/2010-C.Excise refers) II. Paper Products : ii.i Concessional rate of 4% Central Excise duty was applicable on units manufacturing corrugated boxes and cartons from Kraft paper. Now, this concessional rate of Central Excise duty has been extended to units that manufacture corrugated boxes and cartons from corrugated paper or paperboard. (Notification No.20/2010-C.Excise refers) ii.ii Excise duty on waste paper and paper scrap has been reduced to 4% (Notification No.20/2010-C.Excise refers) III. AUTOMOBILES iii.i The ambit of assessment of Automobile components on the basis of their retail sale price, has been expanded to include parts, components and assemblies of earthmoving machinery like loaders, excavators etc. (Notification No.19/2010-C.Excise (NT)refers) IV. SMALL SCALE SECTOR iv.i Excise duty exemption for small scale units has been extended to all types of materials which are meant for use as packing material by or on behalf of 2 the person whose brand name they bear. (Notification No.24/2010-C.Excise refers) B. CUSTOMS : I. MACHINERY : i.i Parts and components of tunnel boring machines for use in the assembly of Tunnel boring machines have been fully exempted from Basic Customs Duty (S.No.598 of Notification No.54/2010-Customs refers) II. HEALTH : ii.i Basic Customs Duty on Ostomy products (Appliances), their Accessories and parts has been reduced to 5% (S.No.363A of Notification No.54/2010Customs refers) ii.ii Basic Customs Duty on 11 specified drugs including two anti-cancer and one for the treatment of AIDS has been reduced to 5%. (List 3 of annexure to Notification No.54/2010-Customs refers) III. METALS & ORES : iii.i Basic Customs duty on stainless steel melting scrap has been reduced to 2.5% (S.No.202 of Notification No.54/2010-Customs refers) iii.ii Export duty on Iron ore (Lumps) has been increased to 15% Ad Valorem. (Notification No.56/2010-Customs refers) IV. INFORMATION TECHNOLOGY : iv.i Specified parts or components required for the manufacture of Optical Disc Drives (ODD) have been exempted from basic customs duty. (S.No.604 of Notification No.54/2010-Customs refers) V. MISCELLANEOUS : v.i Acetate rayon tow required for the manufacture of cigarette filter rods has been fully exempted from payment of special CVD of 4%. (Notification No.55/2010-Customs refers) v.ii Flax fibre has been fully exempted from payment of Basic Customs duty. (S.No.436 of Notification No.54/2010-Customs refers) v.iii. Statutory rate of export duty for raw cotton is being enhanced to Rs.10,000 PMT. However, the effective rate of export duty is being maintained at current levels of Rs.2,500/- PMT. For this purpose ; an official amendment to the Finance Bill, 2010 has been moved by the Finance Minister and the new statutory rate will be applicable when Finance Act, 2010 is signed by the President of India. C. SERVICE TAX I. Modular Employable Skill courses , approved by the National Council of Vocational Training, by a Vocational Training Provider registered under the Skill Development Initiative Scheme with the Directorate General of Employment and Training, Ministry of Labour and Employent, Government of India, have been exempted from the whole of the service tax. (Service as per Section 65 (105) (zzc) of Finance Act, 1994) (Notification 3 No.23/2010-Service Tax refers). However, other courses conducted by such vocational training providers would continue to attract Service Tax. 3/- All the Trade Associations / Chambers of Commerce and the members of the RAC/PGRC are requested to bring/publicize the contents of this Trade Notice amongst their Members/Constituents for their information and necessary action. 4/- Authority for issue of this Trade Notice : Ministry of Finance ‘s D.O.Letter F.No.B-1/22/2010-TRU dated 29.04.2010. [M. RAHMAN] JOINT COMMISSIONER (Technical) F.No.IV/16-01/MP/2010 Encl. As above. Copy to:As per mailing list of Trade & Deptt. Dated :10.05.2010