DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH

advertisement

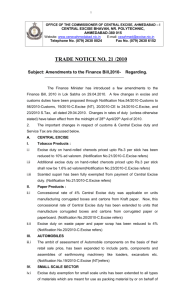

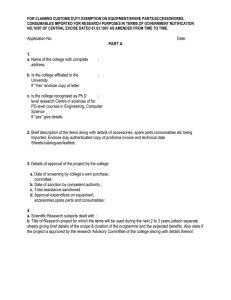

DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH MINISTRY OF SCIENCE AND TECHNOLOGY GOVERNMENT OF INDIA PRESS NOTE Sub: Customs Duty/Central Excise Duty Exemption on Goods imported/indigenously procured by public funded research institutions or IITs or Indian Institute of Science, Bangalore or Regional Engineering Colleges or universities, other than a hospital The Union Budget 1996-97 has notified rationalisation of the exemption from customs duty for import of equipment and consumables, etc. for R&D institutions, as per Notification No. 51/96-Customs dated 23 July 1996. As per the notification, customs duty exemption on scientific & technical instruments, apparatus and equipment (including computers), as also accessories & spare parts thereof, consumables and computer software, Compact Disc Read-Only Memory (CD-ROM), recorded magnetic tapes, micro-films and micro-fiches, is available to : "public funded research institutions or IITs or Indian Institute of Science, Bangalore, or Regional Engineering Colleges or universities other than a hospital" (without any ceiling on the aggregate value of imports except prototypes in which case the limit is Rs. 50,000/- in a financial year) (hereinafter called INSTITUTIONS). The Union Budget 1997-98 has extended the above provision to allow purchase of indigenous equipment and consumables by the above institutions free of central excise duty in terms of Government Notification No. 10/97-Central Excise dt. 1 March 1997. As per the Notification, central excise duty exemption on scientific and technical instruments, apparatus and equipment (including computers), as also accessories & spare parts thereof and consumables, computer software, Compact Disc Read-Only Memory (CD-ROM), recorded magnetic tapes, micro-films, micro-fiches and prototypes is available to : "public funded research institutions or IITs or Indian Institute of Science, Bangalore, or Regional Engineering Colleges or universities other than a hospital" (without any ceiling on the aggregate value of indigenous purchases for all items except prototypes in which case the limit is Rs. 50,000/- in a financial year) (hereinafter called INSTITUTIONS). To be eligible for such customs/central excise duty exemption, the INSTITUTION should have a valid registration with the Department of Scientific & Industrial Research (DSIR) for availing of the customs/central excise duty exemption facility. Such DSIR-registered institutions can import/procure indigenously customs/central excise duty-free goods for R&D based on a certificate from the Head of Institution concerned in each case, certifying that the said goods are required for research purposes only. All INSTITUTIONS should, for this purpose, also submit to DSIR half-yearly statements of all duty-free imports/indigenous purchases made by them under this provision. INSTITUTIONS other than hospitals, desirous of seeking registration with DSIR for purposes of availing of such customs duty exemption under Notification No. 51/96-Customs dated 23 July 1996 and Central Excise Duty Exemption under Notification No. 10/97-Central Excise dated 1 March 1997, may apply to Scientist-G & Head (RDI), Department of Scientific & Industrial Research, in the prescribed proforma for making registration application and then submit the completed proforma to the same authority. Request for application proformae for seeking registration of an INSTITUTION other than a hospital, and any other information relating to this matter may be addressed to: Scientist-G & Head (RDI), Department of Scientific & Industrial Research, Technology Bhavan, New Mehrauli Road, New Delhi –110 016. Tel: 6960171, 6567373 (EPABX); Fax: 011-6960629, 6868607. The application should be submitted in the enclosed proforma, signed by the Director/ Registrar/ Head of the institution/university, to DSIR along with all relevant enclosures, like: (i) Latest annual report of the institution, (ii) A note on the R&D activities of the institution, highlighting the on-going & proposed research activities, details of past achievements/ completed research projects, (iii) Details of scientific personnel working in the institution and details of infrastructure available for research, (iv) Details of composition of Research Advisory Committee (RAC) for guiding & monitoring the research activities of the institution, (v) A copy of the Pass-Book for imports issued to your institution earlier, (vi) A copy of the Act./Gazette notification establishing the institution/university, (vii) A copy of notification issued by UGC under section 3 of UGC Act, 1956, (viii) A notification of approval under section 2-F of UGC Act. (ix) Audited statement of accounts, (x) A letter from the Government Department concerned regarding the commitment to meet at least 50% of the recurring expenses of your institution and (xi) Statement of receipts & recurring expenditure of the institution to establish that it is a public funded research institution and copies of few sanction orders issued by the concerned Government Department for release of grants for recurring expenditure of the institution. DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH MINISTRY OF SCIENCE AND TECHNOLOGY GOVERNMENT OF INDIA PROFORMA OF APPLICATION FOR REGISTRATION OF A PUBLIC FUNDED RESEARCH INSTITUTION OR A UNIVERSITY OR AN INDIAN INSTITUTE OF TECHNOLOGY OR INDIAN INSTITUTE OF SCIENCE, BANGALORE OR A REGIONAL ENGINEERING COLLEGE, OTHER THAN A HOSPITAL, FOR PURPOSES OF AVAILING CUSTOMS DUTY EXEMPTION IN TERMS OF GOVERNMENT NOTIFICATION NO. 51/96-CUSTOMS DATED 23 JULY 1996 AND CENTRAL EXCISE DUTY EXEMPTION IN TERMS OF GOVERNMENT NOTIFICATION NO. 10/97-CENTRAL EXCISE DATED 1 MARCH 1997, AS AMENDED FROM TIME TO TIME. 1. Name of the Institution 2. Address along with Phone/Fax/Telex/Grams/E-mail address 3. a) Legal status of the Institution (In case of new institution, please submit a copy of the Memorandum of Association/Act, future R&D programmes for 5 years, copy of the order issued by the Government department concerned for creation of the institution. In case of Government colleges enclose a letter from the Registrar of the University to which it is affiliated, stating so) b) Date of establishment 4. Name & designation of the Head of the Institution 5. Broad areas of research & major research programmes (Enclose a copy of the latest annual report.) 6. Composition of Research Advisory Committee (RAC) for guiding the research activities of the institution 7. Details of R&D activities (Enclose a note on the R&D activities giving details of past achievements, ongoing programmes & future programmes) 8. Details of staff (Enclose a list of scientific personnel working in the institution engaged in research activities along with their qualifications) 9. Details of infrastructure available for research (Enclose a list of equipment and facilities available with the institution for undertaking research activities) 10. Did the institution have the facility of Pass-Book for imports earlier (If so, enclose a copy of Pass-Book for imports issued by DST/MHRD) -211. Sources of funding to the Institution: Share of Central/State/UT Government and others (Enclose the statement of receipts & recurring expenditure of the institution along with copies of few sanction orders issued by the concerned Government Department for release of grants for non-plan recurring expenditure of the institution and a letter from the concerned central/state/UT Govt. Department regarding the commitment to meet atleast 50% of the recurring expenses of the institution.) 12. Annual budget for research (for last two years) Year 1 2 Capital: Revenue: whether the budget includes staff salaries: Yes/No 13. Average yearly import of goods for R&D (for the past two years) 14. Number of papers published during last two years (Enclose list of publications, their authors, journals/journal pages and the year in which they were published) 15. Number of patents filed during last two years : (a) Indian (b) Foreign (give details) 16. Computer Software Developed: (Details of nature of Software & end-use to which put.) 17. Awards and any other recognitions won by the institution: 18. Any other information you may like to provide: (i) (ii) I certify that the information given above is correct. I also undertake To utilise the facility of customs and central excise duty exemption for research purposes only. To submit half-yearly returns of goods imported duty- free under the provisions of Notification No. 51/96-Customs dt. 23 July 1996 and goods procured indigenously availing excise duty exemption under provisions of Notification No.10/97-Central Excise dt. 1 March 1997, to the Department of Scientific & Industrial Research every year (by December 31 and June 30) and to provide all such information and documentation to DSIR as requested by the Department, as also access of DSIR officials / teams sent by DSIR to my institution, in order to have continuity of and maintain the registration. Place: Date : Signature with Designation of the Head of the Institution UNDERTAKING I, _________________________________________________ (Name & Designation) of _______________________________________________________ hereby undertake to utilise the customs/ central excise duty exemption facility in terms of notification Nos. 51/96Customs dt. 23.7.1996 and 10/97-Central Excise dt. 1.3.1997 for research purposes only. I also undertake to provide separate budget for research activities, which will be spent according to the approvals by the Research Advisory Committee (RAC) and imports as well as domestic purchases will be made out of budgets for research. Signature of Head of the institution -3APPENDIX-1 DETAILS OF R&D PROGRAMMES/PROJECTS IN PROGRESS Sl. No. Title & Scope of The R&D project Year in which started Budgeted Project Cost Remarks* (Status: Completed/Not Completed) Capital Recurring Total * Enclose a small write-up on each project indicating important aspects of the project, progress made so far and balance R&D work remaining to be done in the project. -4APPENDIX-2 DETAILS OF PROPOSED R&D WORK (FOR THE NEXT THREE YEARS) Sl. No. Title & Scope of the project proposed Duration of the Project Total estimated project cost Capital Recurring Total List of specialised equipment required to be purchased and indicate their cost Remarks (indicate specific reasons, if any, for proposing the R&D project) (Use separate sheet if necessary)