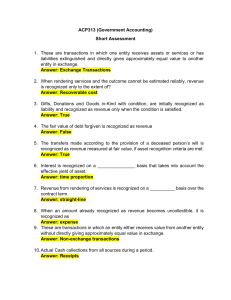

ACP313 (Government Accounting) Short Assessment 1. These are transactions in which one entity receives assets or services or has liabilities extinguished and directly gives approximately equal value to another entity in exchange. Answer: Exchange Transactions 2. When rendering services and the outcome cannot be estimated reliably, revenue is recognized only to the extent of? Answer: Recoverable cost 3. Gifts, Donations and Goods in-Kind with condition, are initially recognized as liability and recognized as revenue only when the condition is satisfied. Answer: True 4. The fair value of debt forgiven is recognized as revenue Answer: False 5. The transfers made according to the provision of a deceased person’s will is recognized as revenue measured at fair value, if asset recognition criteria are met. Answer: True 6. Interest is recognized on a _______________ basis that takes into account the effective yield of asset. Answer: time proportion 7. Revenue from rendering of services is recognized on a __________ basis over the contract term. Answer: straight-line 8. When an amount already recognized as revenue becomes uncollectible, it is recognized as Answer: expense 9. These are transactions in which an entity either receives value from another entity without directly giving approximately equal value in exchange. Answer: Non-exchange transactions 10. Actual Cash collections from all sources during a period. Answer: Receipts 11. Revenue includes all funds received by the government from taxes, grants, aids and borrowings; Answer: False 12. No payment of any nature shall be received by a collecting officer without immediately issuing an official receipt in acknowledgment thereof. Answer: True 13. The Treasurer of the Philippines and all AGDB shall acknowledge receipt of all funds received by them, the acknowledgement bearing the date of actual remittance or deposit and indicating from whom and on what account it was received. Answer: True 14. Revenue is recognized by reference to the stage of completion if the outcome of the transaction can be estimated reliably Answer: True 15. Royalties is recognized as revenue immediately without regards to the substance of the relevant agreement. Answer: False 16. Dividends are recognized when the entity’s right to receive payment is established. Answer: True 17. When cash flows are deferred, the fair value of the consideration is the present value of the consideration receivable. Answer: True 18. Revenue from non exchange transactions are measured at fair value of the consideration received or receivable. Answer: False 19. Revenue is recognized when exchanging similar goods and services. Answer: False 20. Revenue from exchange transactions are derived mostly from taxes, fines and penalties, gifts, donations and goods in kind. Answer: False Google form link: https://forms.gle/NNdd9Hwqr1PFKwku6